Get the free Customs and Excise

Show details

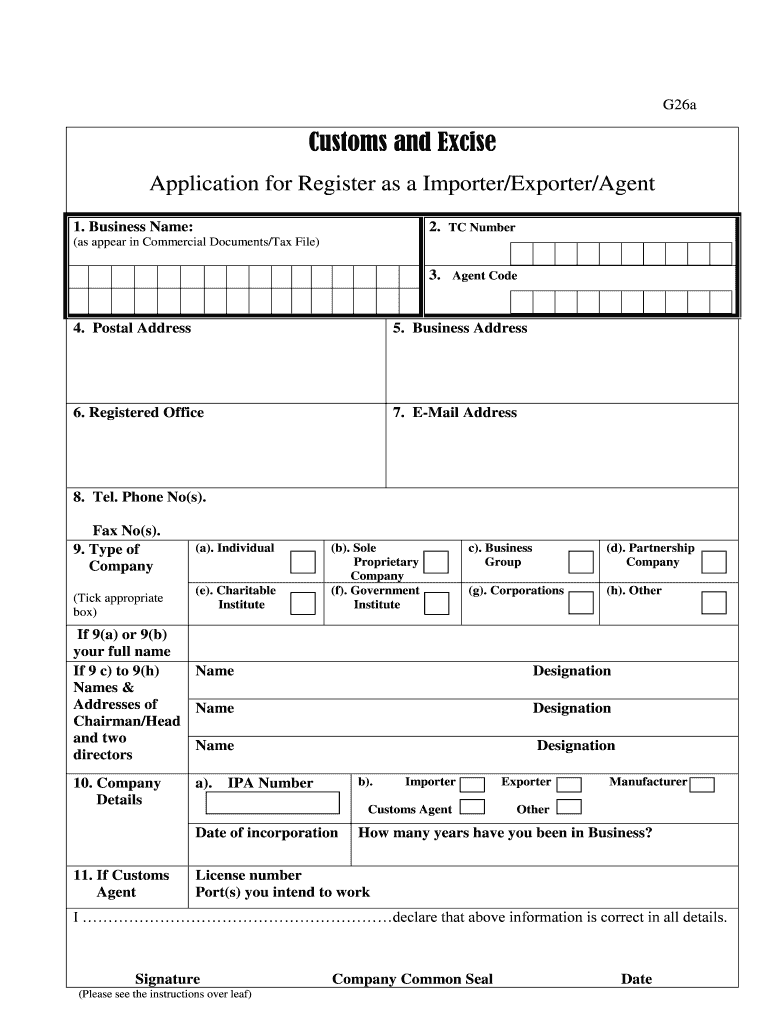

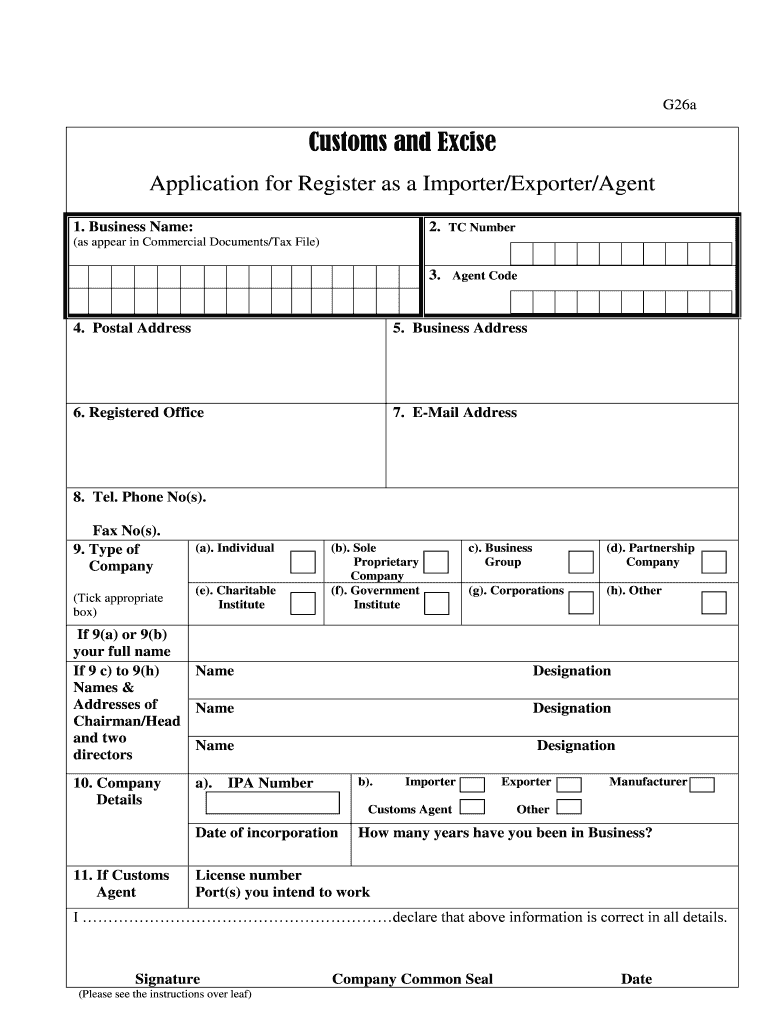

G26a Customs and Excise Application for Register as an Importer/Exporter/Agent 1. Business Name: 2. TC Number (as appear in Commercial Documents/Tax File) 3. Agent Code 4. Postal Address 5. Business

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign customs and excise

Edit your customs and excise form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your customs and excise form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing customs and excise online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit customs and excise. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out customs and excise

How to fill out customs and excise?

01

Start by gathering all the necessary documents and information required for customs and excise. This typically includes the commercial invoice, packing list, bill of lading or airway bill, and any relevant permits or licenses.

02

Ensure that you accurately declare the value of the goods being imported or exported. This is crucial for determining duties and taxes.

03

Familiarize yourself with the customs regulations and procedures of the specific country or region you are dealing with. Each jurisdiction has its own set of rules and requirements that must be followed.

04

Complete the customs declaration form accurately and thoroughly. Provide all the requested information, including details about the goods being transported, their quantities, descriptions, and the country of origin.

05

Pay attention to any special requirements or restrictions pertaining to certain types of goods. Some items may require additional permits, certificates, or inspections.

06

Submit the completed customs declaration form along with the supporting documents to the appropriate customs authorities. This can usually be done electronically or in person at the designated customs office.

07

Be prepared for potential inspections or audits by customs officials. It is important to keep accurate records and make sure that all the information provided is truthful and compliant with the customs regulations.

Who needs customs and excise?

01

Importers and exporters: Individuals or businesses involved in international trade are generally required to comply with customs and excise procedures. Whether you are importing goods into a country or exporting goods to another destination, customs and excise regulations are necessary to ensure compliance with trade laws and to protect the economy, national security, and public health.

02

Customs authorities: Customs and excise play a vital role in any country's revenue collection, border security, and trade facilitation efforts. Governments establish customs departments or agencies to regulate and monitor the movement of goods across borders, collect duties and taxes, and enforce trade regulations.

03

Consumers and general public: Customs and excise measures help safeguard consumers by ensuring that imported goods meet certain quality and safety standards. They also help prevent the illegal import or export of restricted or prohibited items, including drugs, weapons, counterfeit products, and endangered species.

In conclusion, filling out customs and excise involves following specific steps and providing accurate information. It is a necessary process for individuals and businesses involved in international trade, as well as for customs authorities and the general public. Compliance with customs and excise regulations helps maintain the integrity of international trade and protect various interests, ranging from national security to consumer safety.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my customs and excise directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your customs and excise and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I edit customs and excise on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign customs and excise on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I edit customs and excise on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute customs and excise from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is customs and excise?

Customs and excise refers to the taxes levied on imported and exported goods by a country.

Who is required to file customs and excise?

Any individual or business importing or exporting goods is required to file customs and excise.

How to fill out customs and excise?

Customs and excise forms can be filled out online or submitted in person at the customs office.

What is the purpose of customs and excise?

The purpose of customs and excise is to regulate the flow of goods in and out of a country and to collect taxes on imports and exports.

What information must be reported on customs and excise?

Information such as the type of goods, their value, country of origin, and intended use must be reported on customs and excise forms.

Fill out your customs and excise online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Customs And Excise is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.