Get the free No of Sales Tax Forms Forms Entry Sl No State - spoton co

Show details

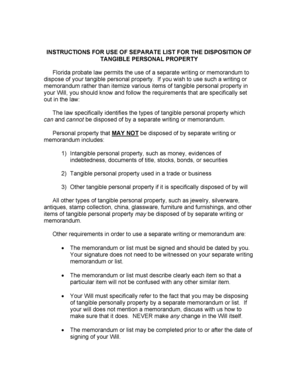

SL. No. 1 State Andaman & Nicobar Sales Tax Forms No of Copies 4 Inbound NA Outbound NA Forms Issued By NA Outro Entry Tax NA No NA Remarks 2 Andhra Pradesh 4 Form X or 600 Form 602 Shipper No Yes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign no of sales tax

Edit your no of sales tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your no of sales tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing no of sales tax online

Follow the steps below to take advantage of the professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit no of sales tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out no of sales tax

How to fill out the number of sales tax:

01

Gather all sales receipts and records: Start by collecting all your sales receipts and records that document the transactions for which you need to calculate the sales tax. This may include invoices, receipts, or any other documentation that outlines your sales.

02

Determine the applicable sales tax rate: Research and identify the sales tax rate that applies to your specific jurisdiction. Sales tax rates can vary by state, county, and even city. Visit the official website of your local tax authority or consult with a tax professional to find the accurate rate.

03

Calculate the sales tax amount: Once you determine the tax rate, multiply it by the total taxable sales amount. Remember to exclude any non-taxable items and exempt transactions. The result will give you the total sales tax amount to be collected.

04

Fill out the appropriate forms: Depending on your location, you may need to fill out specific forms to report and remit the sales tax. This could include state-specific forms, such as a sales tax return, or federal forms if applicable. Consult your local tax authority's website or seek guidance from a tax professional to ensure you are using the correct forms.

05

Enter the sales tax amount: On the designated field of the form, enter the calculated sales tax amount for each reporting period. This could be on a monthly, quarterly, or annual basis, depending on your jurisdiction's requirements. Double-check the accuracy of the entered amount to avoid any discrepancies.

Who needs the number of sales tax:

01

Business owners: Business owners are primarily responsible for calculating and remitting sales tax. They need the number of sales tax to accurately assess the tax liability and ensure compliance with the law. Failing to report or submit the correct amount could result in penalties or legal consequences.

02

Tax professionals: Tax professionals, such as accountants or tax consultants, may need the sales tax information to assist their clients in fulfilling their tax obligations. They rely on the number of sales tax to provide accurate financial advice, prepare tax returns, and ensure compliance.

03

Government tax authorities: Tax authorities at various levels, such as state, county, or city, require the number of sales tax to monitor tax collection, enforce compliance, and assess revenue. They use this data to analyze economic trends, identify potential tax fraud or evasion, and determine funding for public services.

Remember, it is crucial to consult with a tax professional or the appropriate tax authority to ensure you are following the correct procedures and meeting all the legal requirements related to filing sales tax.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit no of sales tax in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing no of sales tax and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit no of sales tax straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing no of sales tax.

How do I complete no of sales tax on an Android device?

On an Android device, use the pdfFiller mobile app to finish your no of sales tax. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is no of sales tax?

Sales tax is a consumption tax imposed by the government on the sale of goods and services.

Who is required to file no of sales tax?

Businesses that sell taxable goods or services are required to file sales tax.

How to fill out no of sales tax?

Sales tax can be filled out online through the government's online portal or through paper forms.

What is the purpose of no of sales tax?

The purpose of sales tax is to generate revenue for the government and to regulate consumption.

What information must be reported on no of sales tax?

Information such as total sales, taxable sales, and tax collected must be reported on sales tax.

Fill out your no of sales tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

No Of Sales Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.