Get the free Financial binformation statementb - Guadalupe County

Show details

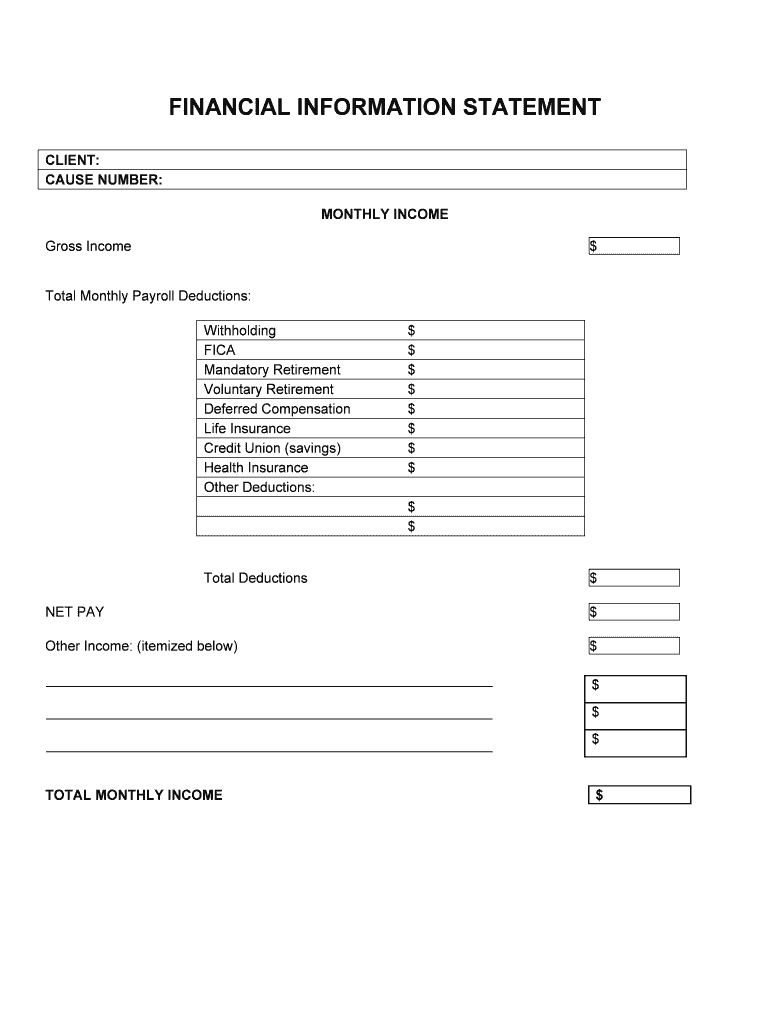

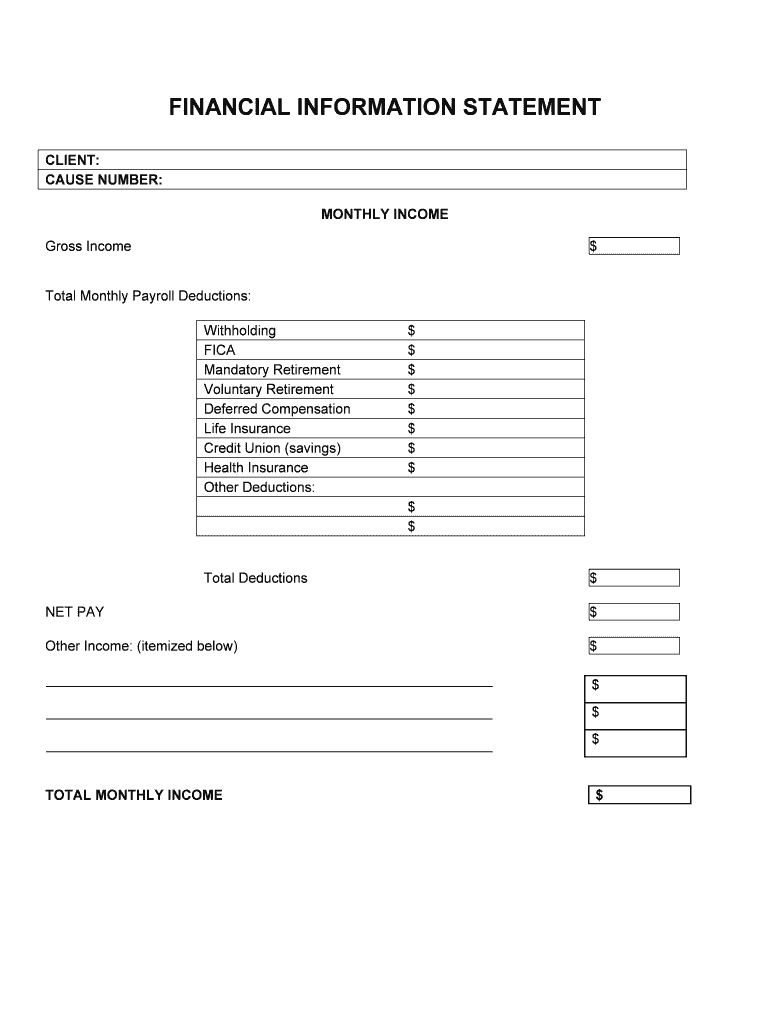

FINANCIAL INFORMATION STATEMENT CLIENT: CAUSE NUMBER: MONTHLY INCOME Gross Income $ Total Monthly Payroll Deductions: Withholding FICA Mandatory Retirement Voluntary Retirement Deferred Compensation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial binformation statementb

Edit your financial binformation statementb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial binformation statementb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial binformation statementb online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit financial binformation statementb. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial binformation statementb

How to fill out a financial information statement?

01

Gather all necessary documents: Before starting to fill out the financial information statement, gather all relevant financial documents. This may include bank statements, tax returns, pay stubs, investment account statements, and any other documents that reflect your financial situation.

02

Begin with personal information: The first step is to provide your personal information, such as your full name, address, contact details, and social security number. Make sure to double-check the accuracy of this information before proceeding.

03

List your assets: Provide a comprehensive list of your assets, including real estate, vehicles, investment accounts, retirement savings, and any other valuable possessions. Be as specific as possible and include estimated values for each asset.

04

Detail your liabilities: In this section, list all your outstanding debts. This can include mortgage loans, credit card debts, student loans, car loans, and any other loans or debts you may have. Include the current balance owed, monthly payment amounts, and the name of the lender.

05

Provide income information: Offer details of your income sources. This typically includes employment wages, self-employment income, rental income, spousal or child support, or any other sources of income you may have. Specify the amounts, frequency, and sources of your income.

06

Include your expenses: Document your monthly expenses, including housing costs, utilities, transportation, groceries, healthcare, education, and any other regular expenses you have. It is important to be accurate and realistic while listing your expenses.

07

Describe additional financial information: In this section, provide any other relevant financial information, such as investments, assets held jointly with another person, outstanding legal judgments, or any other financial matters that could impact your financial situation.

08

Review and double-check: Once you have filled out all the necessary information, review the financial information statement thoroughly. Check for any errors or inconsistencies and make corrections as needed. It is crucial to ensure the accuracy of the statement.

Who needs a financial information statement?

01

Individuals involved in divorce proceedings: When going through a divorce, both parties may be required to fill out a financial information statement. This helps to assess each person's financial situation and determine matters related to alimony, child support, or property division.

02

Loan applicants: When applying for a loan, such as a mortgage or business loan, financial institutions often require applicants to complete a financial information statement. This allows the lender to evaluate the borrower's creditworthiness and ability to repay the loan.

03

Debtors in bankruptcy: People filing for bankruptcy are commonly required to provide a financial information statement as part of the bankruptcy process. This statement helps assess the debtor's financial situation and determine the appropriate bankruptcy proceedings.

04

Estate planning and probate: In estate planning or probate cases, individuals may need to fill out a financial information statement to provide an overview of their assets and liabilities. This aids in determining inheritance distribution, tax obligations, and settling the estate.

05

Court proceedings: Financial information statements are often required during court proceedings, such as personal injury cases or disputes involving financial matters. They assist in evaluating the financial impact of the case and determining appropriate settlements or judgments.

It is essential to consult with legal professionals or relevant authorities to determine the specific circumstances or situations where a financial information statement may be required. Always ensure the accuracy and honesty of the information provided in the statement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit financial binformation statementb online?

With pdfFiller, it's easy to make changes. Open your financial binformation statementb in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an eSignature for the financial binformation statementb in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your financial binformation statementb right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit financial binformation statementb on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share financial binformation statementb from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your financial binformation statementb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Binformation Statementb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.