Get the free MAR - APR - University of Cincinnati College of Medicine - med uc

Show details

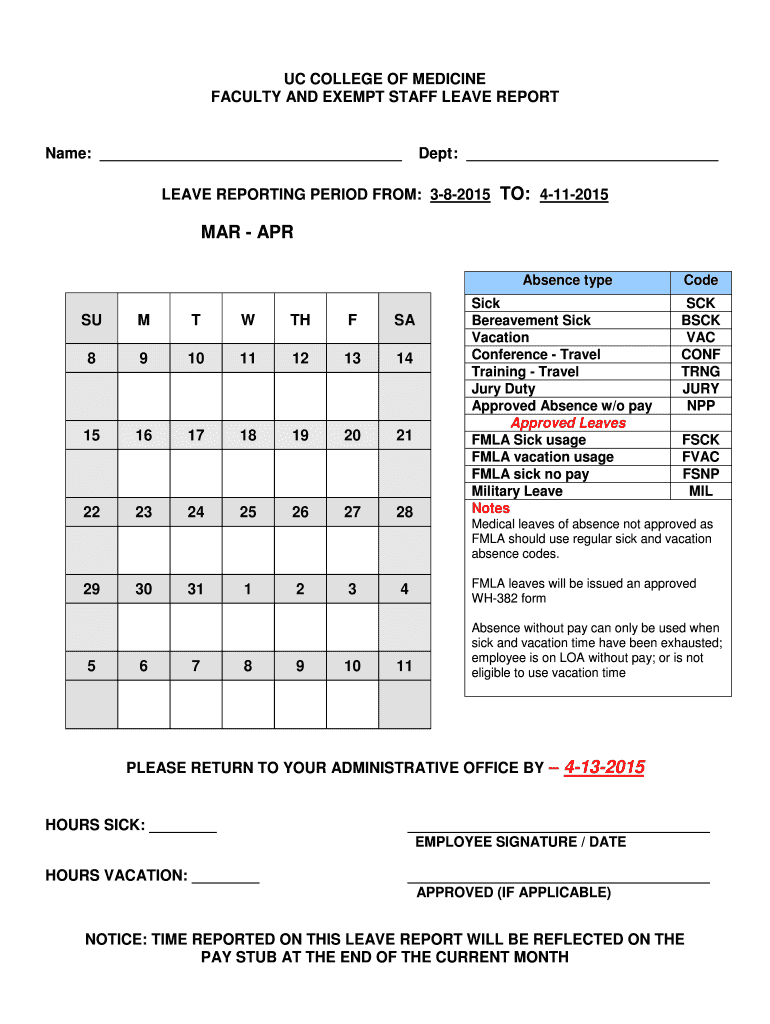

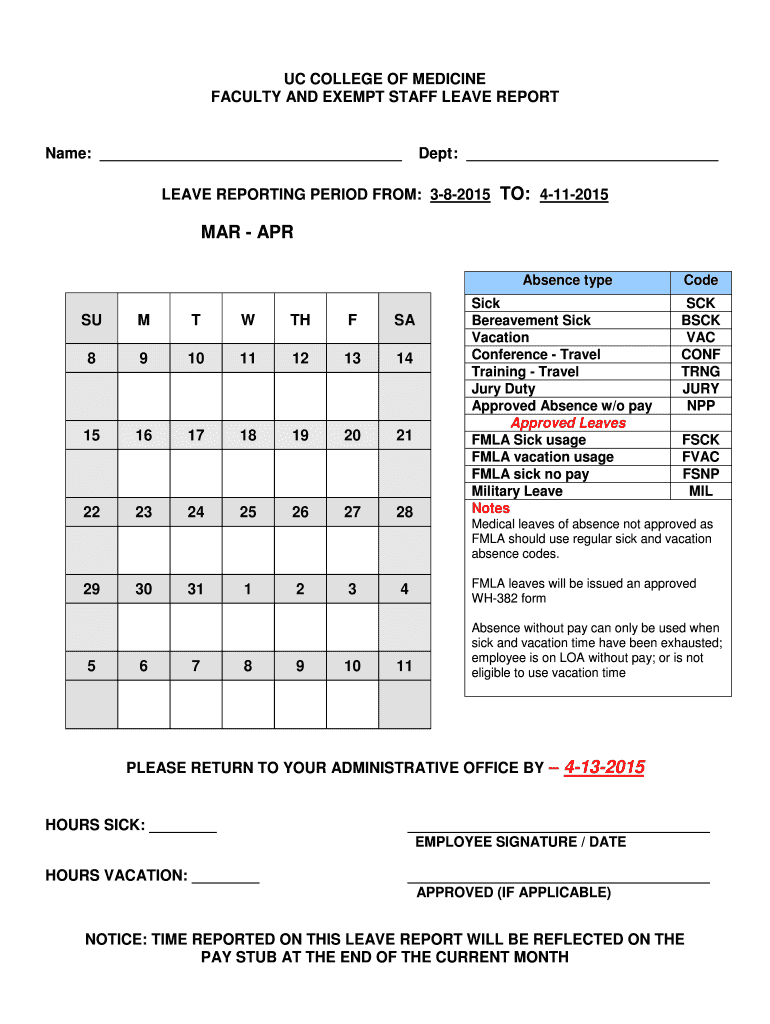

UC COLLEGE OF MEDICINE FACULTY AND EXEMPT STAFF LEAVE REPORT Name: Dept : LEAVE REPORTING PERIOD FROM: 382015 TO: 4112015 MAR APR Absence type SU M T W TH F SA 8 9 10 11 12 13 14 15 16 17 18 19 20

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mar - apr

Edit your mar - apr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mar - apr form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mar - apr online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mar - apr. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mar - apr

How to fill out mar - apr?

01

Start by gathering all the necessary documents and information related to the time period from March to April. This may include invoices, receipts, bank statements, and any other relevant financial records.

02

Review the records and ensure that all transactions and expenses for the specified period are accounted for. Check for any discrepancies or missing information that may need to be clarified or obtained.

03

Organize the documents in a systematic manner, such as by date or category, to make it easier to input the information into the desired format or software.

04

Determine the specific form or template to be used for filling out the records for March to April. This could be an accounting software, a spreadsheet program, or any other document designed for financial record keeping.

05

Enter the appropriate data for each transaction or expense during the specified period. Be diligent in accurately labeling and categorizing each entry to ensure proper financial analysis and reporting.

06

Double-check all the entered information to ensure accuracy and completeness. Review any calculations or formulas used in the record-keeping process to avoid errors.

07

Save a backup copy of the filled-out records for reference and future auditing purposes. Consider maintaining both digital and physical copies to ensure the information is securely stored.

Who needs mar - apr?

01

Small Business Owners: Business owners need to fill out mar - apr to maintain accurate financial records for their ventures. This helps in tracking income, identifying expenses, and monitoring overall profitability during the specified time period.

02

Accountants: Professionals in the accounting field require mar - apr to accurately assess and analyze a company's financial performance. This information is essential for preparing financial statements, calculating taxes, and providing valuable financial insights to business owners and stakeholders.

03

Individuals for Personal Finances: Individuals may need to fill out mar - apr for personal financial management. By keeping track of income and expenses, individuals can better understand their spending habits, save money, and plan for future financial goals.

In conclusion, filling out mar - apr requires organization, attention to detail, and accurate data entry. It is necessary for small business owners, accountants, and individuals aiming to maintain proper financial records and make informed financial decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mar - apr from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your mar - apr into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I complete mar - apr online?

pdfFiller makes it easy to finish and sign mar - apr online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit mar - apr in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your mar - apr, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is mar - apr?

Mar - Apr stands for March to April, typically referring to a two-month period.

Who is required to file mar - apr?

Mar - Apr filing may be required by individuals or businesses depending on the specific requirements set by the governing tax authority.

How to fill out mar - apr?

Mar - Apr can be filled out by providing accurate financial information related to the specific time period.

What is the purpose of mar - apr?

The purpose of Mar - Apr filing is to report financial information for the specified time period and comply with tax regulations.

What information must be reported on mar - apr?

Information to be reported on Mar - Apr may include income, expenses, deductions, and other relevant financial details for the specific time period.

Fill out your mar - apr online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mar - Apr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.