Get the free Insurance Agents Professional Liability Application

Show details

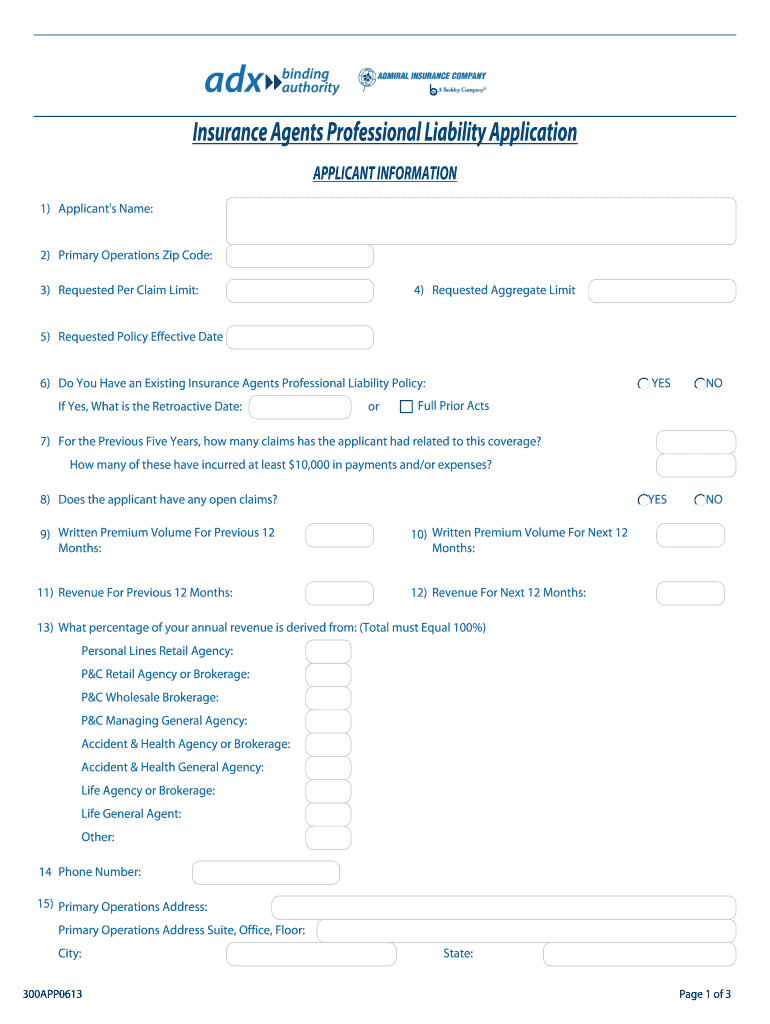

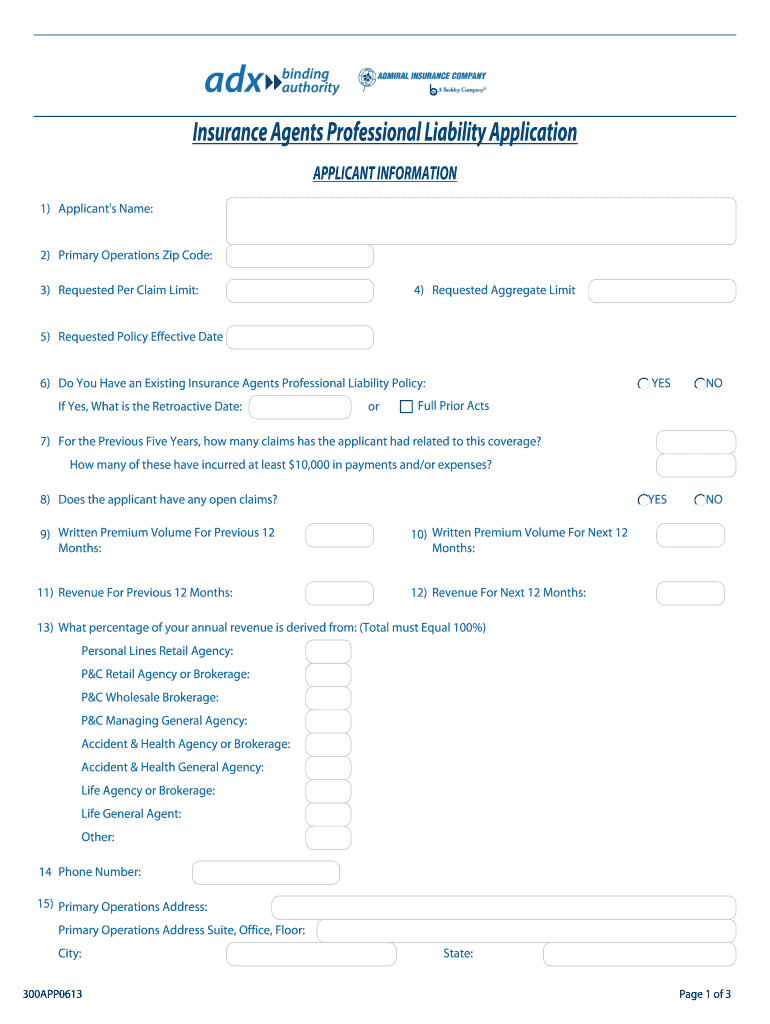

Insurance Agents Professional Liability Application APPLICANT INFORMATION 1) Applicant's Name: 2) Primary Operations Zip Code: 3) Requested Per Claim Limit: 4) Requested Aggregate Limit 5) Requested

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance agents professional liability

Edit your insurance agents professional liability form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance agents professional liability form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit insurance agents professional liability online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit insurance agents professional liability. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance agents professional liability

How to fill out insurance agents professional liability:

01

Gather necessary information: Start by collecting all the relevant information related to your insurance agency. This may include your agency's name, address, contact information, type of insurance products offered, and any professional certifications or licenses.

02

Understand coverage requirements: Familiarize yourself with the specific coverage requirements for insurance agents professional liability. These requirements may vary depending on your location and the specific insurance industry you are part of. Take the time to research and understand the coverage limits, exclusions, and endorsements that need to be included in your policy.

03

Evaluate your risks: Assess the potential risks associated with your insurance agency's operations. Consider factors such as the types of insurance policies you sell, the nature of client interactions, and the potential for errors or omissions. This evaluation will help you determine the appropriate level of coverage you need to protect yourself and your clients.

04

Compare insurance providers: Shop around and obtain quotes from different insurance providers specialized in professional liability coverage for insurance agents. Compare the coverage options, pricing, and reputation of each provider to make an informed decision.

05

Complete the application: Once you have selected an insurance provider, fill out the application form accurately and thoroughly. This may involve providing details about your agency's operations, past claims history, and any additional risk management practices implemented.

06

Review and sign the policy: Carefully review the terms and conditions of the insurance policy before signing it. Ensure that all the coverage details discussed in the application are accurately reflected in the policy. Seek clarification from the insurance provider if any parts are unclear or if you require further information.

Who needs insurance agents professional liability:

01

Insurance agents and brokers: Professionals working in the insurance industry, including independent agents, brokers, and agencies, may require insurance agents professional liability coverage. This coverage helps protect them against potential claims resulting from errors, omissions, negligence, or wrongful acts committed in the course of their professional duties.

02

Insurance agencies: Insurance agencies that manage a team of agents or offer specialized insurance products may choose to obtain insurance agents professional liability coverage. It provides an additional layer of protection for the agency in case of claims arising from the actions of their agents.

03

Insurance industry consultants: Individuals or firms providing consulting services to insurance agencies may also benefit from insurance agents professional liability coverage. This coverage protects them in case of claims alleging errors or negligence in their consulting advice or services.

It is important to note that the need for insurance agents professional liability coverage may vary depending on individual circumstances. It is advisable to consult with an insurance professional or broker to assess your specific needs and determine the appropriate coverage for your insurance agency.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get insurance agents professional liability?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the insurance agents professional liability in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I execute insurance agents professional liability online?

Easy online insurance agents professional liability completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I fill out insurance agents professional liability using my mobile device?

Use the pdfFiller mobile app to fill out and sign insurance agents professional liability. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is insurance agents professional liability?

Insurance agents professional liability provides coverage for claims related to errors and omissions in the performance of their duties.

Who is required to file insurance agents professional liability?

Insurance agents and agencies are required to file insurance agents professional liability.

How to fill out insurance agents professional liability?

Insurance agents can fill out professional liability forms provided by insurance carriers or through online platforms.

What is the purpose of insurance agents professional liability?

The purpose of insurance agents professional liability is to protect agents and agencies from financial losses due to claims of negligence or errors.

What information must be reported on insurance agents professional liability?

Information such as policy details, client information, claims history, and coverage limits must be reported on insurance agents professional liability forms.

Fill out your insurance agents professional liability online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Agents Professional Liability is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.