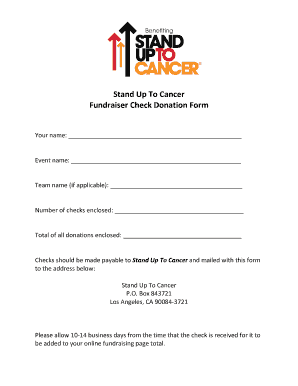

Charitable Donation Request Form free printable template

Show details

Charitable Donation Request Form The mission of the Alliance Bank Charitable Giving Committee will be to identify nonprofit organizations that contribute to the enrichment and growth in the very communities

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 252693349 form

Edit your Charitable Donation Request Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Charitable Donation Request Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Charitable Donation Request Form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Charitable Donation Request Form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Charitable Donation Request Form

How to fill out Charitable Donation Request Form

01

Begin by downloading or obtaining the Charitable Donation Request Form from the organization's website or office.

02

Fill in the date at the top of the form.

03

Provide your organization's name, address, and contact information.

04

Clearly state the purpose of the donation request and the specific project or event it will support.

05

Indicate the type of donation you are requesting (monetary, goods, services, etc.).

06

If applicable, describe how the donation will be recognized or acknowledged.

07

Include information about your organization's tax-exempt status, if relevant.

08

Sign and date the form, and provide a contact person for any questions.

09

Submit the completed form according to the instructions provided by the organization.

Who needs Charitable Donation Request Form?

01

Nonprofit organizations seeking financial or material support for their programs or initiatives.

02

Community groups organizing events that require contributions from local businesses or philanthropists.

03

Schools and educational institutions looking for funding for specific projects or activities.

04

Religious organizations requesting donations for outreach or charitable activities.

Fill

form

: Try Risk Free

People Also Ask about

What IRS form do I use for charitable donations?

Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500.

How do you politely ask for charitable donations?

Our tips on how to ask for donations Remember to tell your story. Not everyone who you ask will know what your situation is. Tailor your message to the moment. Explain what will happen if they don't donate. Keep a positive attitude and expect people to donate. Start the relationship and strengthen it.

What IRS form do I use for donations over $5000?

Form 8283. For noncash donations over $5,000, the donor must attach Form 8283 to the tax return to support the charitable deduction. The donee must sign Part IV of Section B, Form 8283 unless publicly traded securities are donated.

How do I write a donation request form?

How to write a donation request letter Know exactly what you are requesting. Make sure you know your audience. Include the date and the recipient's full address. Personalize the letter - donors will appreciate a personal touch. Keep the letter specific and professional.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute Charitable Donation Request Form online?

With pdfFiller, you may easily complete and sign Charitable Donation Request Form online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How can I edit Charitable Donation Request Form on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing Charitable Donation Request Form right away.

How do I fill out the Charitable Donation Request Form form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign Charitable Donation Request Form and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is Charitable Donation Request Form?

The Charitable Donation Request Form is a document used by individuals or organizations to formally request donations or contributions from potential donors or charitable organizations.

Who is required to file Charitable Donation Request Form?

Typically, nonprofit organizations, charities, or individuals seeking support for a specific cause or project are required to file a Charitable Donation Request Form.

How to fill out Charitable Donation Request Form?

To fill out a Charitable Donation Request Form, applicants should provide details about their organization, the purpose of the request, a description of how donations will be used, and any specific needs or goals related to the fundraising effort.

What is the purpose of Charitable Donation Request Form?

The purpose of the Charitable Donation Request Form is to facilitate the process of obtaining donations by clearly communicating the needs and intentions of the requester to potential donors.

What information must be reported on Charitable Donation Request Form?

The information that must be reported on the Charitable Donation Request Form typically includes the organization's name and contact information, the amount of the requested donation, the intended use of the funds, and any relevant tax ID numbers or documentation.

Fill out your Charitable Donation Request Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Donation Request Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.