Get the free Transfer of Property When a Per pfp1190821775 Transfer of Property When a Per pfp119...

Show details

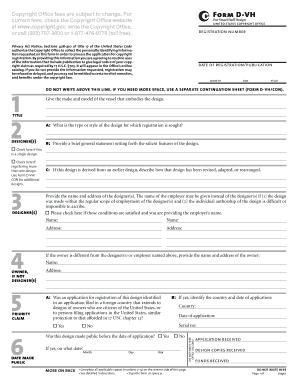

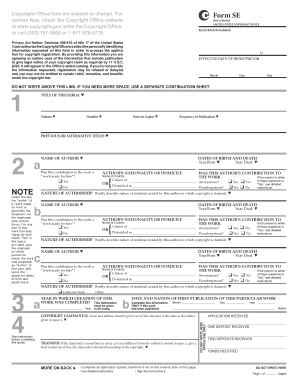

PROBATE Transfer of Property When a Person has Died Small Estate Affidavit for Transfer Superior Court of Arizona in Maricopa County Packet Last Revised August 2005 ALL RIGHTS RESERVED PBSE1c 5280

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transfer of property when

Edit your transfer of property when form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transfer of property when form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit transfer of property when online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit transfer of property when. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transfer of property when

How to fill out transfer of property when:

01

Gather all necessary documents: Start by collecting all the required documents related to the property transfer. This may include the deed, title, purchase agreement, and any other relevant paperwork.

02

Verify legal requirements: Ensure that you understand the legal requirements for transferring the property. This may involve researching the local laws and regulations governing property transfers.

03

Seek professional assistance: Consider seeking assistance from a real estate attorney or a qualified professional to guide you through the process. They can help you ensure that all the necessary steps are completed correctly.

04

Prepare a transfer of property form: Use a standardized transfer of property form or consult a legal professional to draft a customized form. Fill out all the relevant details accurately, including the names of the parties involved, property address, and terms of the transfer.

05

Sign the transfer form: Once the transfer form is completed, all parties involved should sign it. This may include the current property owner, the buyer, and any witnesses required by local laws.

06

Complete any additional paperwork: Depending on the specific circumstances, there may be additional paperwork that needs to be completed, such as a mortgage release or a transfer tax affidavit. Ensure that all necessary forms are filled out correctly and submitted to the appropriate authorities.

07

File the transfer form: Submit the transfer form to the relevant county recorder's office or any other appropriate government agency. Pay any required fees and ensure that you obtain a copy of the recorded transfer for your records.

Who needs transfer of property when:

01

Homeowners: Individuals who own residential or commercial properties and wish to transfer ownership to another person or entity may need a transfer of property form.

02

Real estate investors: Investors who buy or sell properties as part of their business operations often require transfer of property forms to legally transfer ownership.

03

Inheritors: Individuals who inherit property through a will or trust may need to complete a transfer of property form to officially transfer the ownership rights to their name.

04

Divorcees: In cases of divorce or separation, one party may need to transfer their ownership rights in a property to the other party as part of a settlement agreement.

05

Trustees or executors: Individuals acting as trustees or executors of a deceased person's estate may need to complete transfer of property forms to transfer ownership to the beneficiaries or other designated parties.

Remember, it's always advisable to consult with a legal professional or seek expert advice to ensure that the transfer of property is done correctly and in compliance with applicable laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify transfer of property when without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including transfer of property when, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send transfer of property when to be eSigned by others?

When you're ready to share your transfer of property when, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I fill out transfer of property when using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign transfer of property when and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is transfer of property when?

Transfer of property occurs when ownership of real estate or personal property is passed from one party to another.

Who is required to file transfer of property when?

The party responsible for filing a transfer of property typically depends on the laws and regulations of the specific jurisdiction where the property is located. However, in many cases, the buyer or the new owner is responsible for filling out the necessary paperwork.

How to fill out transfer of property when?

To fill out a transfer of property form, typically the parties involved will need to provide information such as the details of the property, the purchase price, the names of the parties involved, and any other relevant information required by the jurisdiction.

What is the purpose of transfer of property when?

The purpose of a transfer of property form is to legally document the change in ownership of a property. This is important for maintaining an accurate record of property ownership and to ensure that the appropriate taxes are paid.

What information must be reported on transfer of property when?

The information that must be reported on a transfer of property form typically includes the details of the property, the names of the parties involved, the purchase price, and any other relevant information required by the jurisdiction.

Fill out your transfer of property when online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transfer Of Property When is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.