Get the free Charitable Trust Deed Hui E

Show details

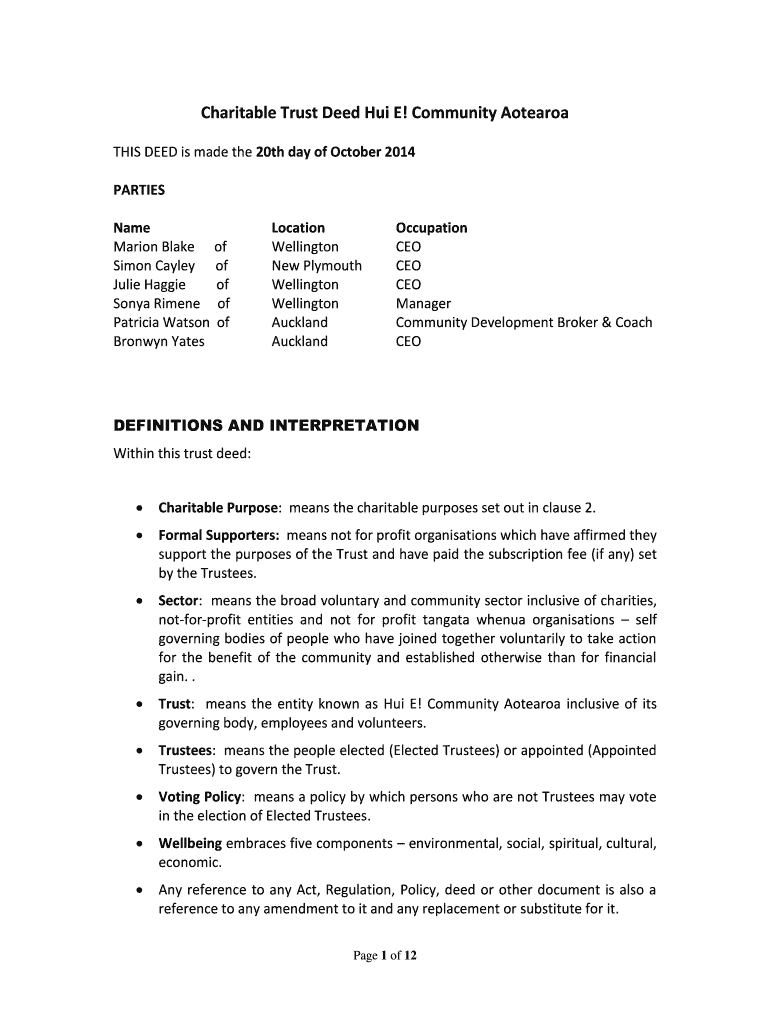

Charitable Trust Deed Hui E! Community Altered THIS DEED is made the 20th day of October 2014 PARTIES Name Marion Blake of Simon Cayley of Julie Haggai of Sonya Rime né of Patricia Watson of Brown

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable trust deed hui

Edit your charitable trust deed hui form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable trust deed hui form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing charitable trust deed hui online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit charitable trust deed hui. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable trust deed hui

How to fill out charitable trust deed hui:

01

Research the requirements: Before starting the process, it is important to conduct thorough research and understand the specific requirements and regulations for creating a charitable trust deed hui. This may vary depending on your jurisdiction, so ensure you are familiar with the legal guidelines.

02

Identify the purpose: Determine the purpose of the charitable trust deed hui. Clearly define the goals, objectives, and activities that the trust intends to undertake. This could include supporting charitable causes, providing grants, or funding educational initiatives.

03

Choose trustees: Select trustees who will be responsible for managing the charitable trust. Look for individuals who have a strong understanding of the mission and values of the trust, as well as experience in financial management and governance.

04

Draft the deed: With the assistance of legal professionals, draft the charitable trust deed hui. This document should outline the purpose of the trust, the responsibilities of the trustees, and any specific terms and conditions that need to be met.

05

Seek professional advice: It is recommended to seek advice from legal and financial professionals to ensure that the charitable trust deed hui complies with all legal requirements and is structured appropriately. They can provide valuable guidance throughout the process and ensure everything is in order.

Who needs charitable trust deed hui:

01

Individuals or organizations wishing to establish a trust: Any person or entity interested in establishing a charitable trust can benefit from a charitable trust deed hui. This includes individuals, families, groups, or businesses who want to create a legacy that supports charitable causes.

02

Philanthropists: Philanthropists who wish to create a long-lasting impact on society often utilize a charitable trust. By establishing a charitable trust deed hui, they ensure their charitable goals will be carried out in a systematic and organized manner.

03

Charitable organizations: Existing charitable organizations that want to incorporate a trust structure into their operations may also require a charitable trust deed hui. This allows them to manage and distribute funds for further charitable initiatives in a structured and accountable manner.

In conclusion, anyone interested in establishing a charitable trust deed hui should follow specific steps to ensure compliance with legal requirements and to outline the purpose and responsibilities of the trust. This can be beneficial for individuals, philanthropists, and charitable organizations looking to make a difference in the community.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the charitable trust deed hui in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your charitable trust deed hui in minutes.

How do I fill out charitable trust deed hui using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign charitable trust deed hui and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit charitable trust deed hui on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute charitable trust deed hui from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is charitable trust deed hui?

A charitable trust deed hui is a legal document that establishes a trust for charitable purposes.

Who is required to file charitable trust deed hui?

Any individual or organization looking to establish a charitable trust for the purpose of carrying out charitable activities is required to file a charitable trust deed hui.

How to fill out charitable trust deed hui?

To fill out a charitable trust deed hui, one must provide information on the intended charitable purposes, trustees, beneficiaries, and other key details as required by law.

What is the purpose of charitable trust deed hui?

The purpose of a charitable trust deed hui is to establish a legally binding trust that will carry out charitable activities for the benefit of society.

What information must be reported on charitable trust deed hui?

Information such as the name of the trust, details of trustees, charitable purposes, beneficiaries, and any other relevant information must be reported on a charitable trust deed hui.

Fill out your charitable trust deed hui online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Trust Deed Hui is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.