Get the free DonorAdvised Fund Account

Show details

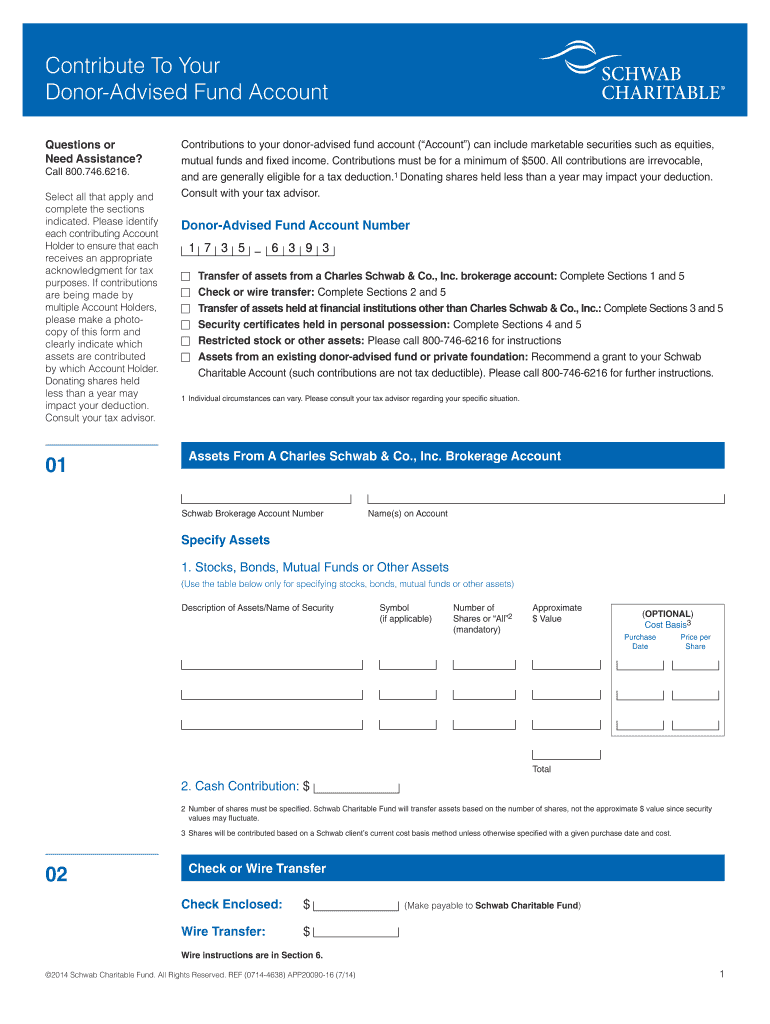

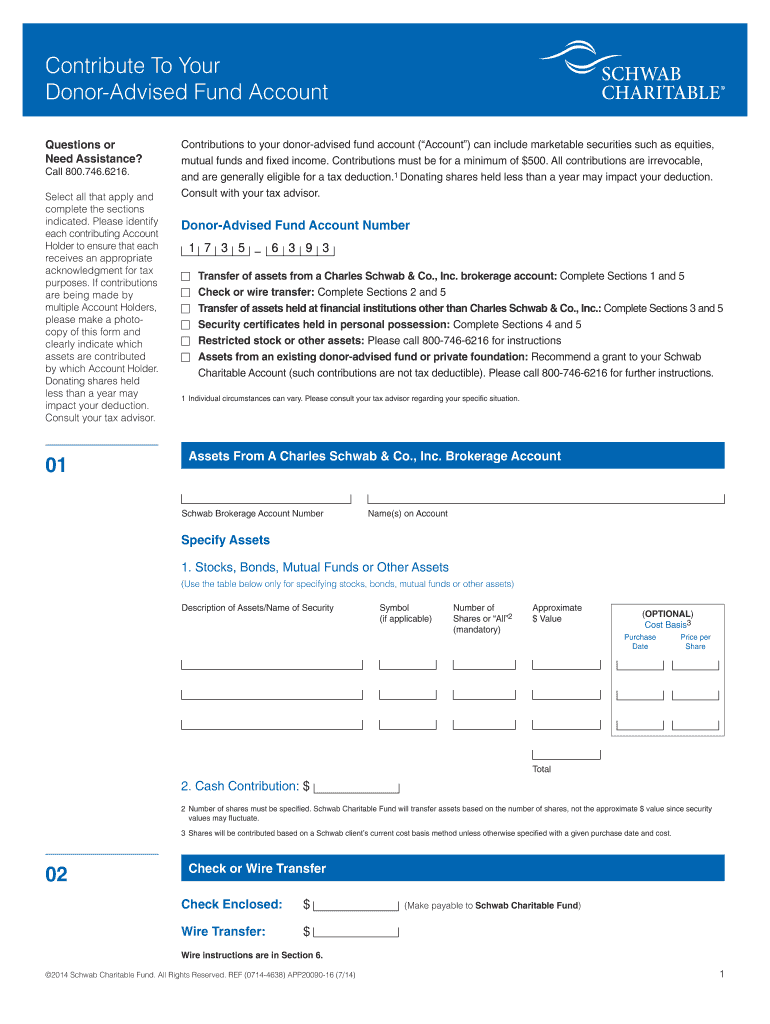

Contribute To Your Donor-Advised Fund Account Questions or Need Assistance? Call 800.746.6216. Select all that apply and complete the sections indicated. Please identify each contributing Account

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donoradvised fund account

Edit your donoradvised fund account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donoradvised fund account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing donoradvised fund account online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit donoradvised fund account. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donoradvised fund account

How to fill out a donor-advised fund account:

01

Research the donor-advised fund provider: Start by researching and comparing different donor-advised fund providers to find the one that best fits your needs. Look for reputable organizations with low fees, a user-friendly online platform, and a wide range of investment options.

02

Open an account: Once you've decided on a donor-advised fund provider, you'll need to open an account. This typically involves filling out an application form with your personal information, including your name, address, and social security number or tax identification number.

03

Contribute funds: After opening the account, you can contribute funds to your donor-advised fund. Decide how much you would like to donate, and then transfer the funds from your bank account or other assets to the donor-advised fund account. Most providers offer online transfer options for convenience.

04

Choose an investment strategy: Many donor-advised fund providers offer various investment options, ranging from conservative to aggressive. Evaluate your risk tolerance and investment goals, and select an investment strategy that aligns with your preferences. Remember that the investments will grow tax-free, allowing for larger charitable contributions in the future.

05

Recommend grants: Once your funds are deposited into the donor-advised fund account, you can start recommending grants to your favorite charitable organizations. Research the nonprofits you wish to support, and then submit grant recommendations through the online platform provided by your donor-advised fund provider. They will handle the administrative processes involved in distributing the funds to the designated organizations.

Who needs a donor-advised fund account:

01

High-net-worth individuals: Donor-advised funds are commonly used by high-net-worth individuals who want to maximize their charitable giving impact while receiving tax benefits. By donating appreciated assets to a donor-advised fund, they can avoid capital gains taxes and receive an immediate tax deduction.

02

Philanthropically-minded individuals or families: If you have a strong desire to give back to society and want to organize your charitable contributions in a strategic manner, a donor-advised fund account can be an excellent tool. It allows you to manage your charitable giving in one centralized account and easily distribute funds to the causes you care about.

03

Individuals seeking tax advantages: Donor-advised funds offer several tax advantages, including immediate tax deductions for contributions made to the account. Additionally, contributions to a donor-advised fund may be eligible for itemized deductions, helping individuals reduce their taxable income. This makes donor-advised funds appealing for those looking to optimize their tax planning while supporting charitable causes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit donoradvised fund account from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your donoradvised fund account into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an eSignature for the donoradvised fund account in Gmail?

Create your eSignature using pdfFiller and then eSign your donoradvised fund account immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I edit donoradvised fund account on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing donoradvised fund account, you need to install and log in to the app.

What is donor-advised fund account?

A donor-advised fund account is a charitable giving vehicle that allows donors to make charitable contributions, receive immediate tax benefits, and recommend grants from the fund over time.

Who is required to file donor-advised fund account?

Organizations that operate donor-advised fund accounts are required to file Form 990, the annual information return with the IRS.

How to fill out donor-advised fund account?

Donor-advised fund accounts can be filled out by following the instructions provided by the sponsoring organization or financial institution that administers the account.

What is the purpose of donor-advised fund account?

The purpose of a donor-advised fund account is to enable individuals and organizations to make charitable contributions, receive immediate tax benefits, and have the flexibility to recommend grants to qualified charities over time.

What information must be reported on donor-advised fund account?

The donor-advised fund account must report the total contributions, grants made, investment income, and other relevant financial information.

Fill out your donoradvised fund account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donoradvised Fund Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.