Get the free Backup WithholdingEstimated Tax PaymentsWage WithholdingFinancial Institution Record...

Show details

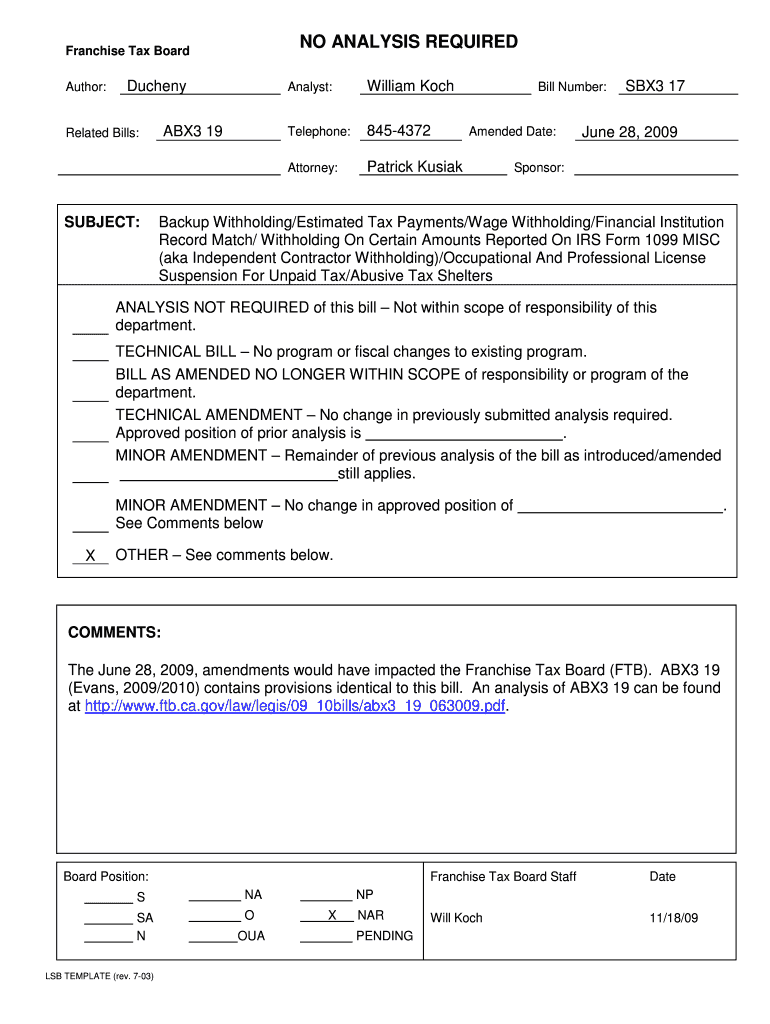

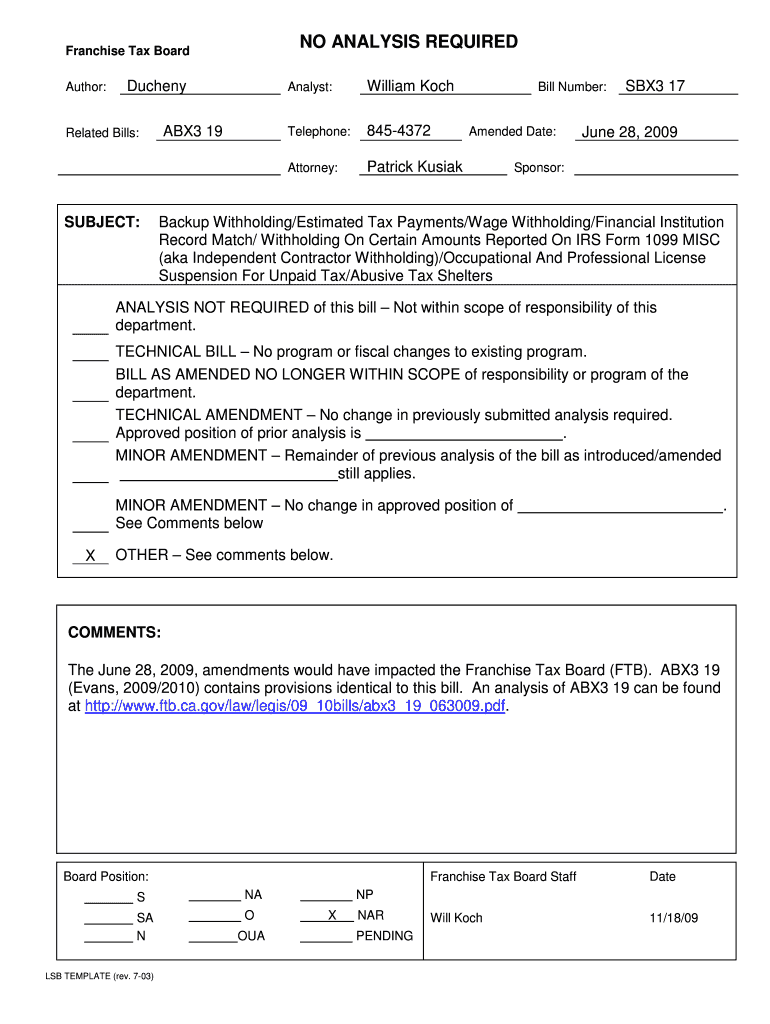

NO ANALYSIS REQUIRED Franchise Tax Board Duchy William Koch Telephone: ABX3 19 Related Bills: SUBJECT: Analyst: 8454372 Attorney: Author: Patrick Kodiak Bill Number: Amended Date: SBX3 17 June 28,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign backup withholdingestimated tax paymentswage

Edit your backup withholdingestimated tax paymentswage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your backup withholdingestimated tax paymentswage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit backup withholdingestimated tax paymentswage online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit backup withholdingestimated tax paymentswage. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out backup withholdingestimated tax paymentswage

How to fill out backup withholdingestimated tax paymentswage:

01

Obtain the necessary forms: To fill out backup withholdingestimated tax paymentswage, you will need to acquire the appropriate forms from the Internal Revenue Service (IRS). This typically includes Form W-4, Employee's Withholding Certificate, and Form 1040-ES, Estimated Tax for Individuals.

02

Review your paycheck and tax information: Before filling out the forms, gather information regarding your wages and income, including any additional sources of income. Take note of any previous tax withholding amounts as well.

03

Complete Form W-4: Begin by providing your personal information, such as your name, address, and Social Security number. Then, follow the instructions on the form to indicate your filing status, number of allowances, and any additional withholding desired. If you are subject to backup withholding, check the appropriate box on the form.

04

Calculate estimated tax payments: If your income exceeds certain thresholds or you have income from sources not subject to withholding, you may need to make estimated tax payments. Use Form 1040-ES to calculate the necessary estimated tax payments for the upcoming tax year. Consider factors such as your expected income, deductions, and credits to accurately determine the amount owed.

05

Submit forms and payments: Send Form W-4 with backup withholding information to your employer, ensuring they are aware of the need for backup withholdingestimated tax paymentswage. Follow the instructions on Form 1040-ES to make estimated tax payments to the IRS. This can typically be done electronically or by mail, depending on your preference.

Who needs backup withholdingestimated tax paymentswage:

01

Individuals with delinquent tax debts: If you owe a significant amount of taxes in the past and have failed to pay, the IRS may require your employer to withhold a portion of your wages as backup withholdingestimated tax paymentswage. This helps ensure that your tax liability is being addressed.

02

Individuals who failed to provide a valid Social Security number: If you fail to furnish a valid Social Security number or provide an incorrect one, backup withholdingestimated tax paymentswage may be enforced by your employer. This ensures that accurate tax information is reported to the IRS.

03

Self-employed individuals: Self-employed individuals often need to make estimated tax payments since they do not have taxes withheld from their income throughout the year. Backup withholdingestimated tax paymentswage may apply if they fail to make these estimated payments or if they have outstanding tax debts.

Note: It is important to consult a tax professional or refer to the official IRS guidelines for specific circumstances and to ensure accurate compliance with tax laws.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in backup withholdingestimated tax paymentswage?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your backup withholdingestimated tax paymentswage to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I sign the backup withholdingestimated tax paymentswage electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your backup withholdingestimated tax paymentswage in seconds.

How do I complete backup withholdingestimated tax paymentswage on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your backup withholdingestimated tax paymentswage, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is backup withholdingestimated tax paymentswage?

Backup withholding is a tax withholding on certain income payments, wage is the money earned from working.

Who is required to file backup withholdingestimated tax paymentswage?

Employers are required to withhold taxes from employees' wages and make estimated tax payments to the IRS.

How to fill out backup withholdingestimated tax paymentswage?

Employers need to accurately report employees' wages, withhold the appropriate amount of taxes, and make estimated tax payments to the IRS.

What is the purpose of backup withholdingestimated tax paymentswage?

The purpose is to ensure that taxes are paid on income earned and to help individuals and businesses meet their tax obligations.

What information must be reported on backup withholdingestimated tax paymentswage?

Employers need to report wages paid to employees, the amount of taxes withheld, and make timely estimated tax payments to the IRS.

Fill out your backup withholdingestimated tax paymentswage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Backup Withholdingestimated Tax Paymentswage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.