Get the free Nebraska Tax Bond for Nonresident Contractor's and Subcontractor's Construction Proj...

Show details

This document serves as a bond for nonresident contractors and subcontractors in Nebraska for construction projects, requiring registration and security for contracts of $10,000 or greater.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nebraska tax bond for

Edit your nebraska tax bond for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nebraska tax bond for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nebraska tax bond for online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit nebraska tax bond for. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

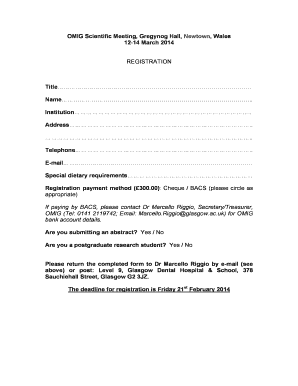

How to fill out nebraska tax bond for

How to fill out Nebraska Tax Bond for Nonresident Contractor's and Subcontractor's Construction Projects

01

Obtain the Nebraska Tax Bond form from the Nebraska Department of Revenue website or relevant authority.

02

Fill out the contractor's information, including name, address, and contact details.

03

Clearly indicate the type of work or projects for which the bond is being issued.

04

Specify the total bond amount required for the construction project.

05

Gather required documentation, such as proof of liability insurance and any necessary licenses.

06

Complete the bonding company's portion of the form, if applicable.

07

Sign and date the bond form where indicated.

08

Submit the completed bond form along with any required documentation to the appropriate state authority.

Who needs Nebraska Tax Bond for Nonresident Contractor's and Subcontractor's Construction Projects?

01

Nonresident contractors and subcontractors who wish to perform construction projects in Nebraska are required to obtain a Nebraska Tax Bond.

Fill

form

: Try Risk Free

People Also Ask about

What states charge sales tax on construction labor?

Do contractors charge sales tax on labor? Many states exempt most services, including construction labor. Only Hawaii, New Mexico, South Dakota, and West Virginia tax services by default; in those four states, all services are taxable unless a specific exception or exemption applies.

Are installation services taxable in Nebraska?

Charges for production and assembly labor are taxable. Charges for repair and installation labor are taxable when the property being repaired, replaced, or installed is taxable. See Sales and Use Tax Regulation 1-082, Labor Charges.

What is the contractor registration act in Nebraska?

The Nebraska Contractor Registration Act requires contractors and subcontractors doing business in Nebraska to register with the Nebraska Department of Labor. While the registration is a requirement, it does not ensure quality of work or protect against fraud.

Are construction services taxable in Nebraska?

Generally, contractor labor for new construction, reconstruction, alteration, or improvement of real property is not taxable in Nebraska. However, certain services related to construction, such as pest control services performed at a construction site, are subject to tax.

What is the income tax withholding for nonresident individuals performing personal services in Nebraska?

Instead, withholding on nonresident personal services is calculated using the Nebraska Form W-4NA and the following rates: If the net payments (payments minus expenses) are less than $28,000, the withholding rate is 4% of the net payments. If the net payments are $28,000 or more, the rate is 6% of the net payments.

How much does it cost to register a contractor in Nebraska?

Contractor Registration Act There is a $25.00 annual registration fee.

Is construction labor taxable in Nebraska?

Do I need to collect tax on any of my charges to the general contractor? Yes. You are required to collect sales tax on the total amount charged for the building materials. The charge for your contractor labor is not taxable, provided it is separately stated.

Do you charge tax on services in Nebraska?

Services are generally not taxable in Nebraska, with the following exceptions: Admissions to a location for purposes of amusement, entertainment or recreation. Pest control services. Building cleaning and maintenance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Nebraska Tax Bond for Nonresident Contractor's and Subcontractor's Construction Projects?

The Nebraska Tax Bond for Nonresident Contractor's and Subcontractor's Construction Projects is a financial guarantee required by the state for nonresident contractors and subcontractors working on construction projects in Nebraska. It ensures compliance with state tax obligations and protects the state from financial loss due to unpaid taxes.

Who is required to file Nebraska Tax Bond for Nonresident Contractor's and Subcontractor's Construction Projects?

Nonresident contractors and subcontractors who engage in construction projects in Nebraska are required to file the Nebraska Tax Bond. This applies to those who do not have a physical presence or business location in the state but are working on projects within its boundaries.

How to fill out Nebraska Tax Bond for Nonresident Contractor's and Subcontractor's Construction Projects?

To fill out the Nebraska Tax Bond, nonresident contractors and subcontractors must complete the required bond form, include their business information, the specific project details, and the amount of the bond. They must also have the bond signed by an authorized surety company and submitted to the appropriate Nebraska state agency.

What is the purpose of Nebraska Tax Bond for Nonresident Contractor's and Subcontractor's Construction Projects?

The purpose of the Nebraska Tax Bond is to ensure that nonresident contractors and subcontractors fulfill their tax obligations while working in the state. It serves as a safeguard for the state in case the contractors fail to pay taxes related to their construction activities.

What information must be reported on Nebraska Tax Bond for Nonresident Contractor's and Subcontractor's Construction Projects?

The information that must be reported on the Nebraska Tax Bond includes the contractor's or subcontractor's name, address, the surety company's details, the bond amount, the project location, and the specific tax identification numbers. Additionally, any relevant contractual obligations should be included.

Fill out your nebraska tax bond for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nebraska Tax Bond For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.