Get the free Closing Disclosure Final Executed Clsoing Disclosure

Show details

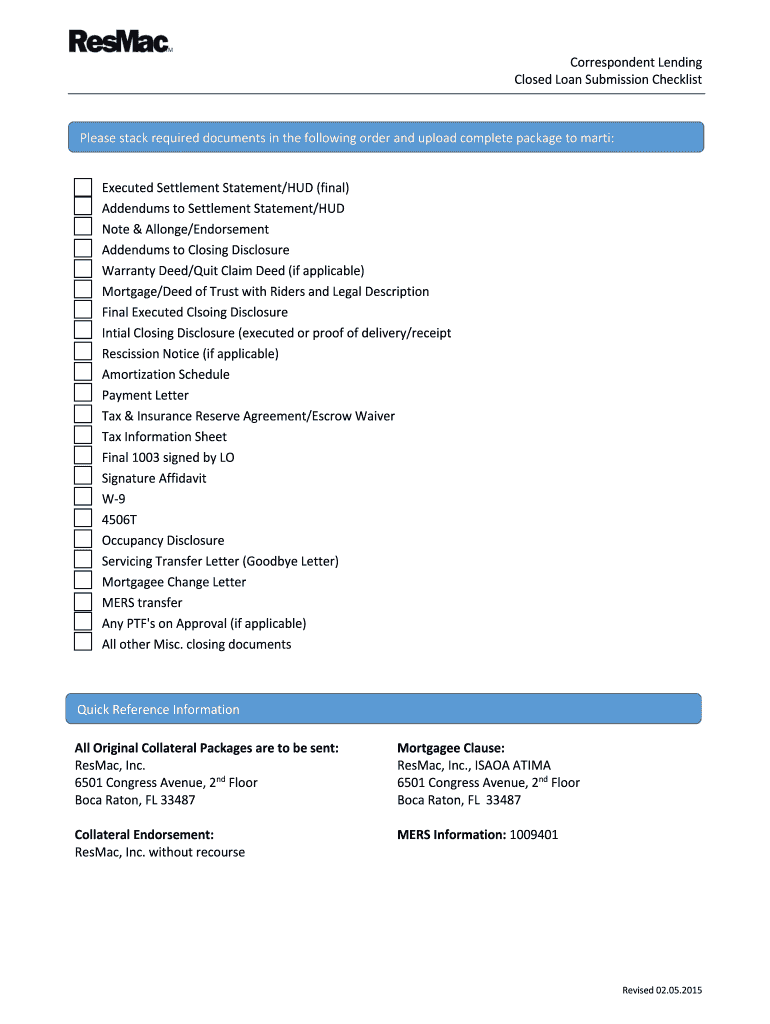

Correspondent Lending Closed Loan Submission Checklist Please stack required documents in the following order and upload complete package to Martí: Executed Settlement Statement/HUD (final) Addendums

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign closing disclosure final executed

Edit your closing disclosure final executed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your closing disclosure final executed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit closing disclosure final executed online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit closing disclosure final executed. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out closing disclosure final executed

How to fill out closing disclosure final executed:

01

Start by carefully reviewing the closing disclosure form provided by your lender or settlement agent. Familiarize yourself with the layout and the various sections of the form.

02

Verify that all the information provided on the form is accurate and matches the terms and conditions of your loan agreement. Pay close attention to details such as the loan amount, interest rate, closing costs, and any additional fees.

03

Calculate and enter the total amount you will need to bring to the closing table. This includes any closing costs, prepaid items, and the down payment, if applicable. Make sure these figures align with the information provided by your lender.

04

Check the loan terms section to ensure that the loan type, loan term, and payment schedule are correct. Additionally, verify if there are any prepayment penalties or balloon payments associated with your loan.

05

Review the escrow account details, which will include items such as property taxes, homeowner's insurance, and mortgage insurance. Ensure that the estimated amounts for these expenses are accurate.

06

Move on to the loan calculations section, where you will find details about the total amount financed, the finance charge, the annual percentage rate (APR), and your monthly payment. Double-check these figures to ensure they align with your loan agreement.

07

Look for any additional provisions or disclosures that may be relevant to your loan. These could include information about adjustable interest rates, late payment penalties, or any special conditions that apply to your mortgage.

08

Make sure to carefully read the borrower's and seller's closing statements, as these provide a breakdown of the costs and credits associated with the purchase or refinance transaction.

09

If you have any questions or concerns about the closing disclosure form, don't hesitate to reach out to your lender or settlement agent for clarification. It's important to have a clear understanding of the information presented in the form before proceeding.

Who needs closing disclosure final executed:

01

Homebuyers who are obtaining a mortgage loan for the purchase of a property.

02

Homeowners refinancing their existing mortgage.

03

Lenders and settlement agents involved in the loan closing process.

04

Real estate agents or brokers who need to review the closing disclosure for accuracy and completeness.

05

Regulatory bodies and government agencies that oversee mortgage lending practices.

Remember, the closing disclosure final executed is a critical document that provides detailed information about your mortgage loan. It is essential to fill it out accurately and thoroughly to ensure a smooth and transparent closing process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out closing disclosure final executed using my mobile device?

Use the pdfFiller mobile app to fill out and sign closing disclosure final executed. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit closing disclosure final executed on an Android device?

You can edit, sign, and distribute closing disclosure final executed on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I complete closing disclosure final executed on an Android device?

Complete closing disclosure final executed and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is closing disclosure final executed?

Closing disclosure final executed is the final document that outlines all the costs and details of a mortgage loan, which is signed by both the buyer and the seller at the closing.

Who is required to file closing disclosure final executed?

The buyer and seller, as well as the lender or closing agent, are required to file the closing disclosure final executed.

How to fill out closing disclosure final executed?

Closing disclosure final executed is filled out by the lender or closing agent, who includes all the final figures and details of the mortgage loan.

What is the purpose of closing disclosure final executed?

The purpose of closing disclosure final executed is to ensure transparency and provide borrowers with a final breakdown of all costs associated with their mortgage loan.

What information must be reported on closing disclosure final executed?

Closing disclosure final executed must report details such as loan terms, closing costs, interest rate, and any other fees associated with the mortgage loan.

Fill out your closing disclosure final executed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Closing Disclosure Final Executed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.