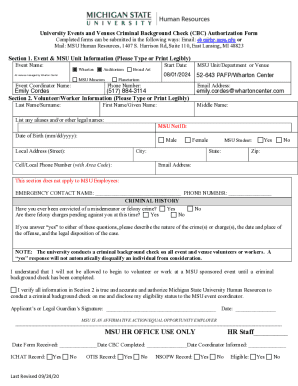

Get the free SUSPICIOUS TRANSACTIONS AND ANTI-MONEY LAUNDERING GUIDELINES FOR THE SECURITIES INDU...

Show details

This document provides guidelines issued by the Financial Intelligence Unit of The Bahamas regarding suspicious transactions and anti-money laundering practices for financial institutions within the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign suspicious transactions and anti-money

Edit your suspicious transactions and anti-money form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your suspicious transactions and anti-money form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit suspicious transactions and anti-money online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit suspicious transactions and anti-money. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out suspicious transactions and anti-money

How to fill out SUSPICIOUS TRANSACTIONS AND ANTI-MONEY LAUNDERING GUIDELINES FOR THE SECURITIES INDUSTRY IN THE BAHAMAS

01

Read the SUSPICIOUS TRANSACTIONS AND ANTI-MONEY LAUNDERING GUIDELINES document thoroughly to understand its structure.

02

Gather necessary information about the transaction, including the parties involved, the amounts, and the purpose of the transaction.

03

Identify any red flags or suspicious indicators that deviate from normal business operations.

04

Document the findings in a clear and organized manner, following the format outlined in the guidelines.

05

Submit the completed report to the relevant authorities as specified in the guidelines, ensuring compliance with submission deadlines.

Who needs SUSPICIOUS TRANSACTIONS AND ANTI-MONEY LAUNDERING GUIDELINES FOR THE SECURITIES INDUSTRY IN THE BAHAMAS?

01

Financial institutions operating in the securities industry in the Bahamas.

02

Compliance officers and personnel responsible for anti-money laundering (AML) efforts.

03

Employees handling transactions and customer interactions that might involve suspicious activity.

04

Regulatory bodies overseeing financial activities and ensuring compliance with AML laws.

Fill

form

: Try Risk Free

People Also Ask about

Is Bahamas FATF?

FATF removes The Bahamas from the list of Jurisdictions under Increased Monitoring The Bahamas is no longer subject to the FATF's increased monitoring process. The Bahamas will continue to work with CFATF to improve further its AML/CFT regime.

What is a suspicious transaction in anti-money laundering?

According to Article 27 (1) of the Regulation on Measures regarding Prevention of Laundering Proceeds of Crime and Financing of Terrorism, suspicious transaction is the case where there is any information, suspicion or reasonable grounds to suspect that the asset, which is subject to the transactions carried out or

What are the key AML regulations?

AML regulations require firms to retain records such as transaction details, client identities and due diligence documentation for a period of five to seven years. These records help maintain transparency, support investigations and identify patterns that uncover financial crime.

Are the Bahamas known for money laundering?

Drug traffickers and other criminal organizations take advantage of the large number of IBCs and offshore banks registered in The Bahamas to launder significant sums of money, despite strict know-your-customer and transaction reporting requirements.

What is the AML regulation Act?

Firms must comply with the Bank Secrecy Act and its implementing regulations ("AML rules"). The purpose of the AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing, such as securities fraud and market manipulation.

What type of transactions may be reported as suspicious?

Suspicious activities in banking are any event within a financial institution that could be possibly related to fraud, money laundering, terrorist financing, or other illegal activities.

What is the AML regulation in the Bahamas?

The Bahamas' AML framework is governed by various laws and regulatory bodies to ensure transparency and prevent illicit financial activities. The key legislation includes the Proceeds of Crime Act (POCA), the Financial Transactions Reporting Act (FTRA), and the Anti-Terrorism Act.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SUSPICIOUS TRANSACTIONS AND ANTI-MONEY LAUNDERING GUIDELINES FOR THE SECURITIES INDUSTRY IN THE BAHAMAS?

The Suspicious Transactions and Anti-Money Laundering Guidelines for the Securities Industry in the Bahamas are regulations designed to identify and report suspicious activities that may indicate money laundering or other financial crimes within the securities sector.

Who is required to file SUSPICIOUS TRANSACTIONS AND ANTI-MONEY LAUNDERING GUIDELINES FOR THE SECURITIES INDUSTRY IN THE BAHAMAS?

All licensed securities dealers, investment advisors, and other financial institutions operating within the securities industry in the Bahamas are required to file reports on suspicious transactions.

How to fill out SUSPICIOUS TRANSACTIONS AND ANTI-MONEY LAUNDERING GUIDELINES FOR THE SECURITIES INDUSTRY IN THE BAHAMAS?

To fill out the guidelines, institutions must complete a prescribed reporting form that includes details such as the nature of the suspicious activity, parties involved, transaction amounts, and any relevant supporting documentation.

What is the purpose of SUSPICIOUS TRANSACTIONS AND ANTI-MONEY LAUNDERING GUIDELINES FOR THE SECURITIES INDUSTRY IN THE BAHAMAS?

The purpose is to prevent and detect money laundering activities, safeguard the integrity of the financial system, and comply with international anti-money laundering standards.

What information must be reported on SUSPICIOUS TRANSACTIONS AND ANTI-MONEY LAUNDERING GUIDELINES FOR THE SECURITIES INDUSTRY IN THE BAHAMAS?

The required information includes the details of the transaction, descriptions of the suspicious behavior, identities of the parties involved, date and time of the transaction, and any other pertinent information that could aid in the investigation.

Fill out your suspicious transactions and anti-money online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Suspicious Transactions And Anti-Money is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.