Get the free Income Tax Investment Proofs Form

Show details

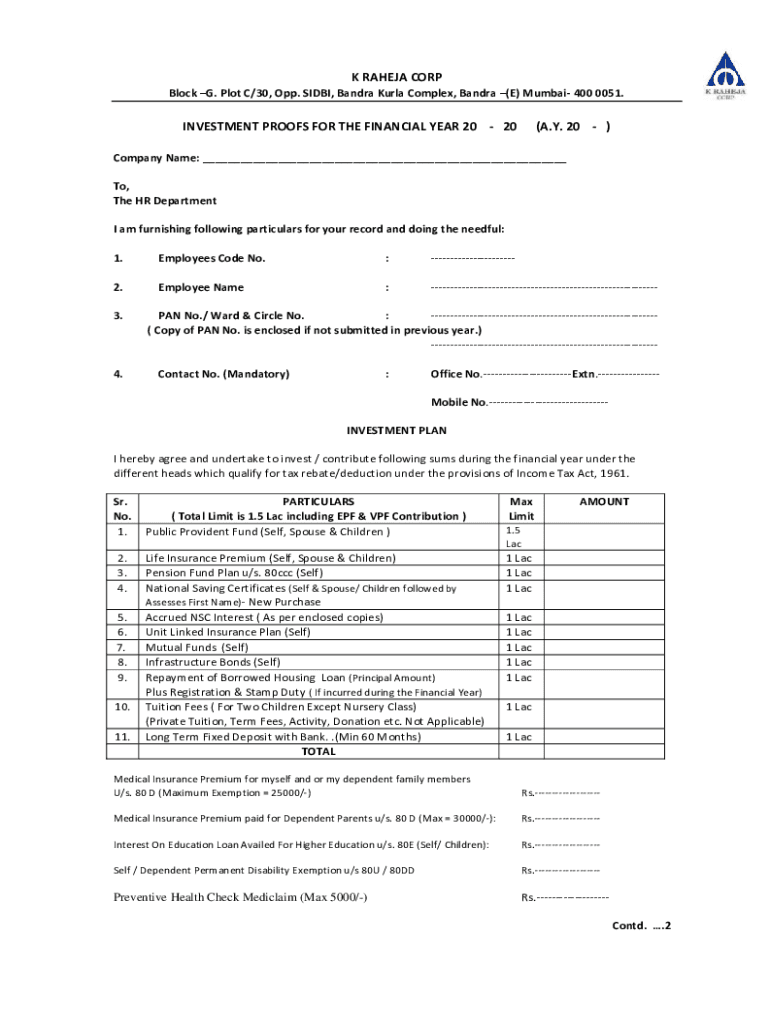

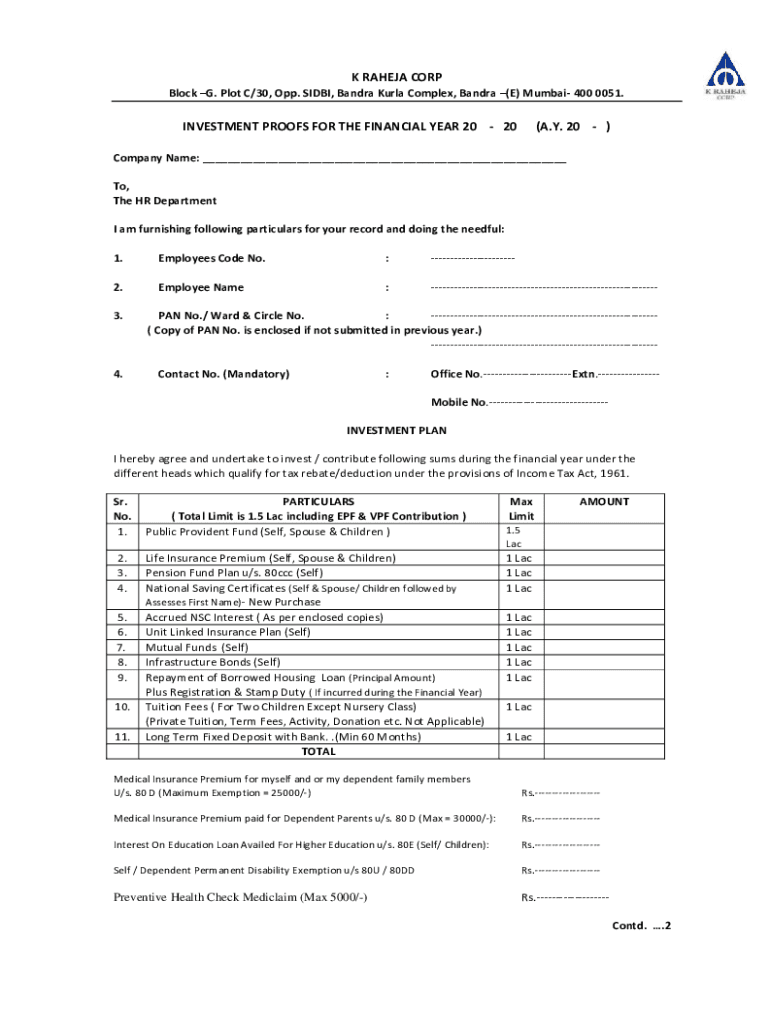

K RHEA CORP Block G. Plot C/30, Opp. SIDE, Sandra Karla Complex, Sandra (E) Mumbai 400 0051.INVESTMENT PROOFS FOR THE FINANCIAL YEAR 20 20(A.Y. 20)Company Name: ___ To, The HR Department I am furnishing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income tax investment proofs

Edit your income tax investment proofs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income tax investment proofs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing income tax investment proofs online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit income tax investment proofs. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out income tax investment proofs

How to fill out income tax investment proofs:

01

Gather all relevant documents: Before filling out income tax investment proofs, make sure you have all the necessary documents such as Form 16, salary slips, bank statements, and investment proofs like receipts or statements.

02

Identify eligible investments: Determine which investments qualify for tax deductions under the Income Tax Act. These can include investments in tax-saving instruments like Public Provident Fund (PPF), National Savings Certificates (NSC), or Equity Linked Saving Scheme (ELSS).

03

Calculate investment amounts: Based on your income and tax slab, calculate the maximum amount you can invest in each eligible investment to avail of the maximum tax benefits.

04

Fill out the investment details: Take a copy of the investment proof form provided by your employer or tax consultant and fill in the necessary details for each investment. This usually includes the investment amount, date of investment, name of the investment instrument, and any related reference numbers.

05

Attach supporting documents: Remember to attach supporting documents such as investment receipts, account statements, or certificates for each investment mentioned in the form. Keep copies of these documents for your reference.

06

Review and verify: Double-check all the filled-out details and ensure accuracy. This will help you avoid any discrepancies or errors that may lead to complications during tax assessment.

07

Submit the investment proofs: Submit the completed investment proof form along with the supporting documents to your employer or tax consultant within the stipulated deadline. Make sure to follow any specific submission guidelines provided by your employer or relevant tax authority.

Who needs income tax investment proofs?

01

Employees: Individuals who are salaried and receive taxable income need to provide investment proofs to their employers. This is necessary for employers to calculate and deduct accurate tax amounts from their employees' salaries.

02

Taxpayers: Individuals who fall under the tax bracket and file their income tax returns independently also need to maintain investment proofs. These proofs help in availing deductions and reducing tax liability while filing tax returns.

03

Auditors and Tax Consultants: Auditors and tax consultants require investment proofs from their clients to review and verify the tax-saving investments made by them. This is necessary for accurate tax planning and compliance with the Income Tax Act.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is income tax investment proofs?

Income tax investment proofs are documents that provide evidence of investments made by a taxpayer in order to claim deductions and exemptions on their income tax return.

Who is required to file income tax investment proofs?

Taxpayers who have made investments and wish to claim deductions and exemptions on their income tax return are required to file income tax investment proofs.

How to fill out income tax investment proofs?

Income tax investment proofs can be filled out by providing details of the investments made, the amount invested, and any supporting documents required by the tax authorities.

What is the purpose of income tax investment proofs?

The purpose of income tax investment proofs is to support the claims made by taxpayers for deductions and exemptions on their income tax return, thereby reducing their taxable income.

What information must be reported on income tax investment proofs?

Income tax investment proofs must include details such as the type of investment, the amount invested, the date of investment, and any supporting documentation required by the tax authorities.

How can I send income tax investment proofs for eSignature?

Once your income tax investment proofs is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I execute income tax investment proofs online?

pdfFiller has made it easy to fill out and sign income tax investment proofs. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I edit income tax investment proofs on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute income tax investment proofs from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your income tax investment proofs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Tax Investment Proofs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.