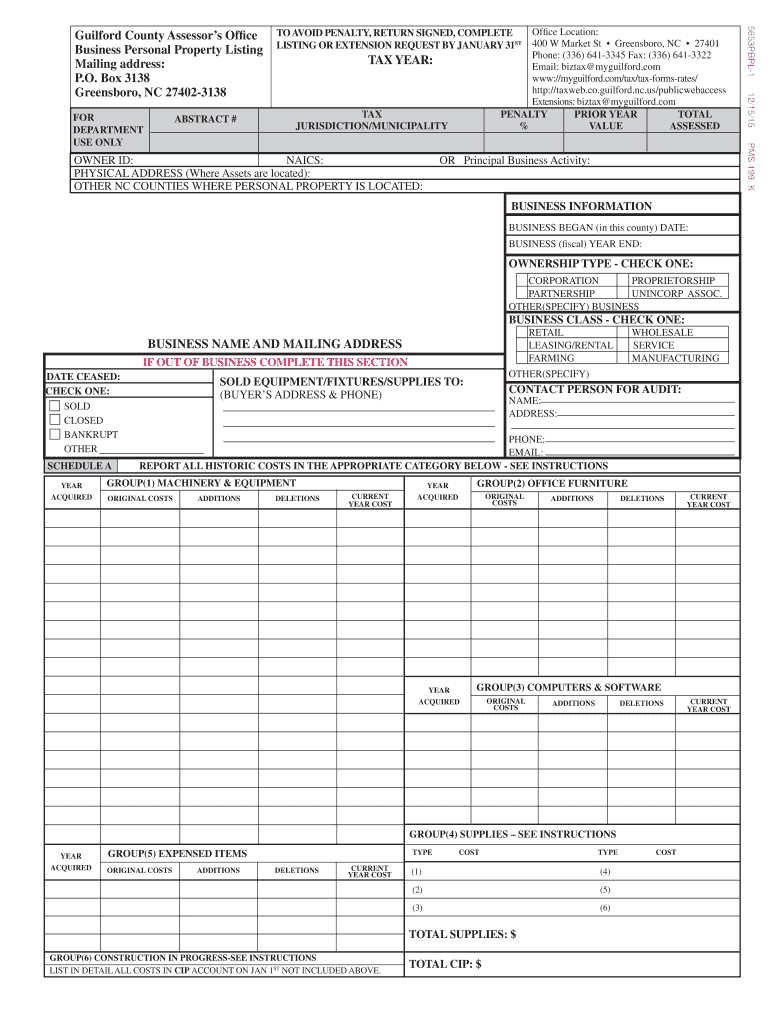

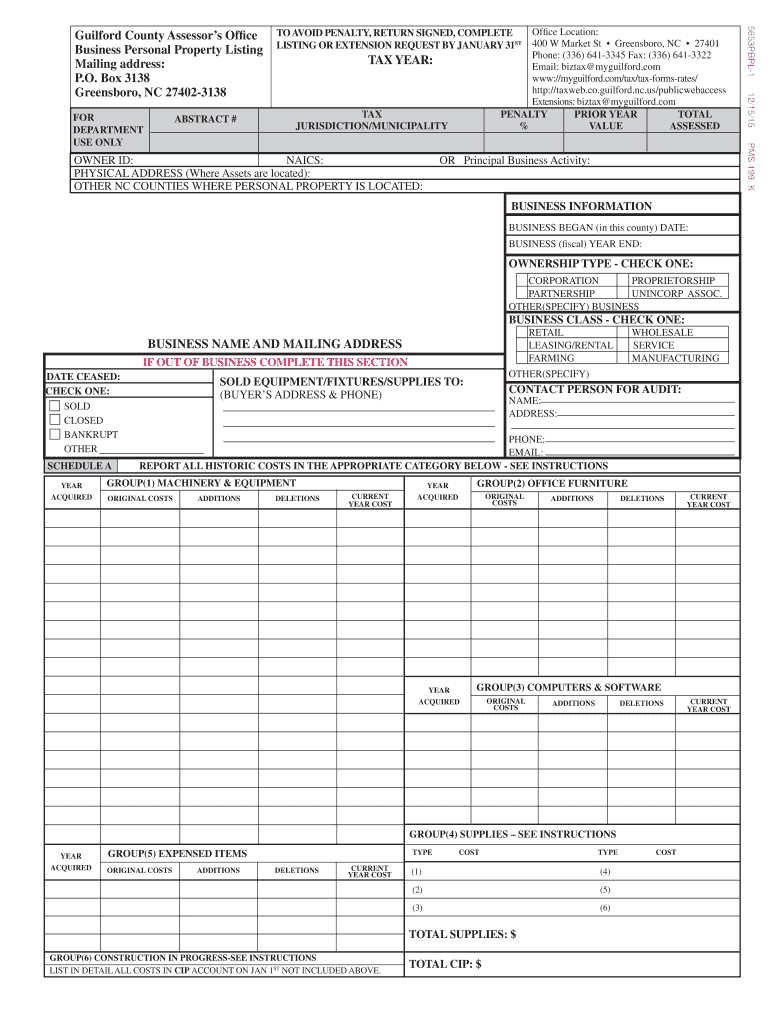

NC 5653PBPL 2015 free printable template

Show details

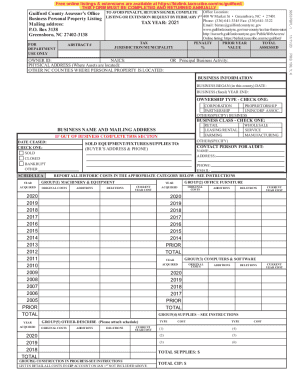

ABSTRACT # TAX YEAR: TAX JURISDICTION/MUNICIPALITY PMS 199, K OWNER ID: NAILS: PHYSICAL ADDRESS (Where Assets are located): OTHER NC COUNTIES WHERE PERSONAL PROPERTY IS LOCATED: OR Principal Business

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NC 5653PBPL

Edit your NC 5653PBPL form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC 5653PBPL form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NC 5653PBPL online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NC 5653PBPL. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC 5653PBPL Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC 5653PBPL

How to fill out NC 5653PBPL

01

Obtain the NC 5653PBPL form from the appropriate agency or website.

02

Read the instructions provided with the form carefully.

03

Fill out your personal information in the designated sections, including your name and address.

04

Provide any required identification numbers or codes as indicated on the form.

05

Complete any specific sections related to the reason for filling out the NC 5653PBPL.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where required.

08

Submit the form as instructed, either by mail or electronically.

Who needs NC 5653PBPL?

01

Individuals applying for certain benefits or services in North Carolina.

02

Residents who need to report specific information related to their eligibility for programs.

03

Anyone involved in a legal process requiring documentation in relation to the state’s regulations.

Fill

form

: Try Risk Free

People Also Ask about

How do I get property tax exemption in South Carolina?

Most property tax exemptions are found in South Carolina Code Section 12-37-220. For any real property exemptions taxation is a year in arrears, meaning to be exempt for the current year, you must be the owner of record and your effective date of disability must be on or before December 31 of the previous year.

At what age do you stop paying property taxes in South Carolina?

The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

How do I get a property tax exemption in North Carolina?

A qualifying owner must either be at least 65 years of age or be totally and permanently disabled. The owner cannot have an income amount for the previous year that exceeds the income eligibility limit for the current year, which for the 2021 tax year is $31,500. See G.S. 105-277.1 for the full text of the statute.

What is the senior property tax exemption in Guilford County?

Reduce the taxable value of your home: Homeowners who are 65 and older or 100% totally and permanently disabled can get $25,000 or up to 50% off their primary residence value, whichever is greater, if they meet certain income and ownership requirements.

How to apply for property tax exemption in South Carolina?

Where do I apply? You must apply for the Homestead Exemption at your County Auditor's office. If you are unable to go to the Auditor's office, you may authorize someone to apply for you. Contact the County Auditor's Office for details.

At what age do seniors stop paying property taxes in NC?

North Carolina defers a portion of the property taxes on the appraised value of a permanent residence owned and occupied by a North Carolina resident who has owned and occupied the property at least five years, is at least 65 years of age or is totally and permanently disabled, and whose income does not exceed $50,700.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete NC 5653PBPL online?

pdfFiller has made it easy to fill out and sign NC 5653PBPL. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How can I edit NC 5653PBPL on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing NC 5653PBPL right away.

How can I fill out NC 5653PBPL on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your NC 5653PBPL. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is NC 5653PBPL?

NC 5653PBPL is a specific tax form used in North Carolina for reporting certain business income and expenses.

Who is required to file NC 5653PBPL?

Individuals or entities that earn income from pass-through entities and need to report this income for state tax purposes are required to file NC 5653PBPL.

How to fill out NC 5653PBPL?

To fill out NC 5653PBPL, taxpayers should gather all necessary financial information, follow the provided instructions on the form, fill in their income and expense details accurately, and submit it to the state by the required deadline.

What is the purpose of NC 5653PBPL?

The purpose of NC 5653PBPL is to ensure that income earned from pass-through entities is reported and taxed appropriately in North Carolina.

What information must be reported on NC 5653PBPL?

NC 5653PBPL requires reporting information such as income received from partnerships, S corporations, and other pass-through entities, as well as related expenses and deductions.

Fill out your NC 5653PBPL online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC 5653pbpl is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.