NC 5653PBPL 2013 free printable template

Show details

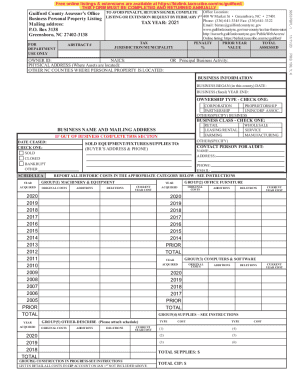

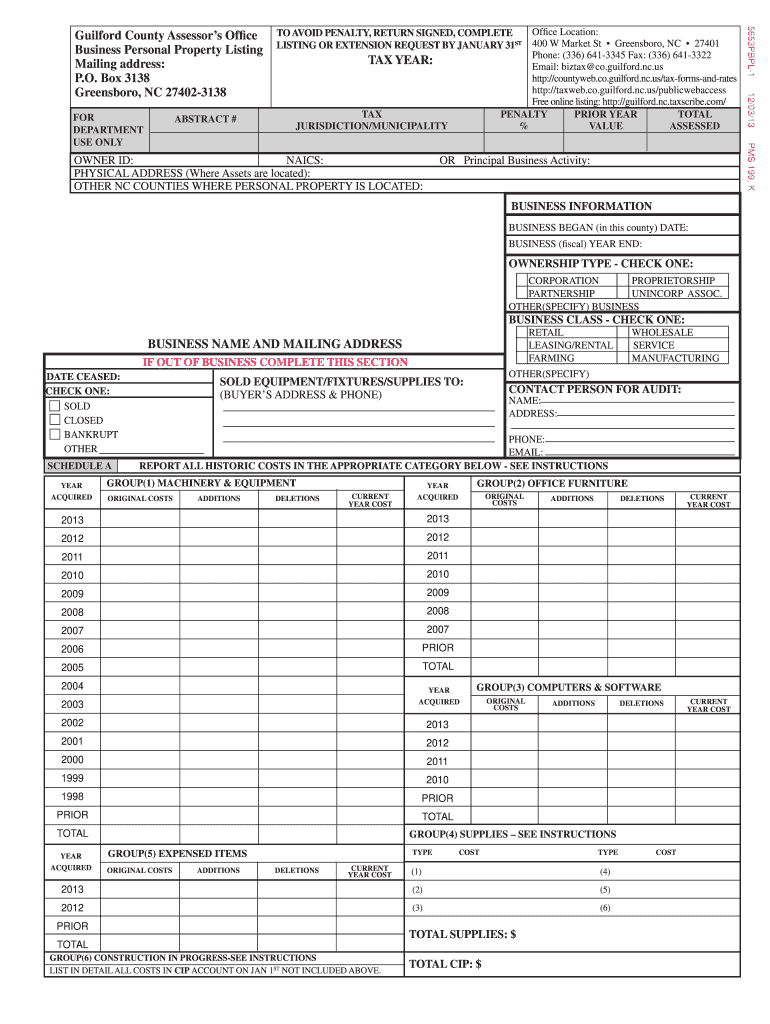

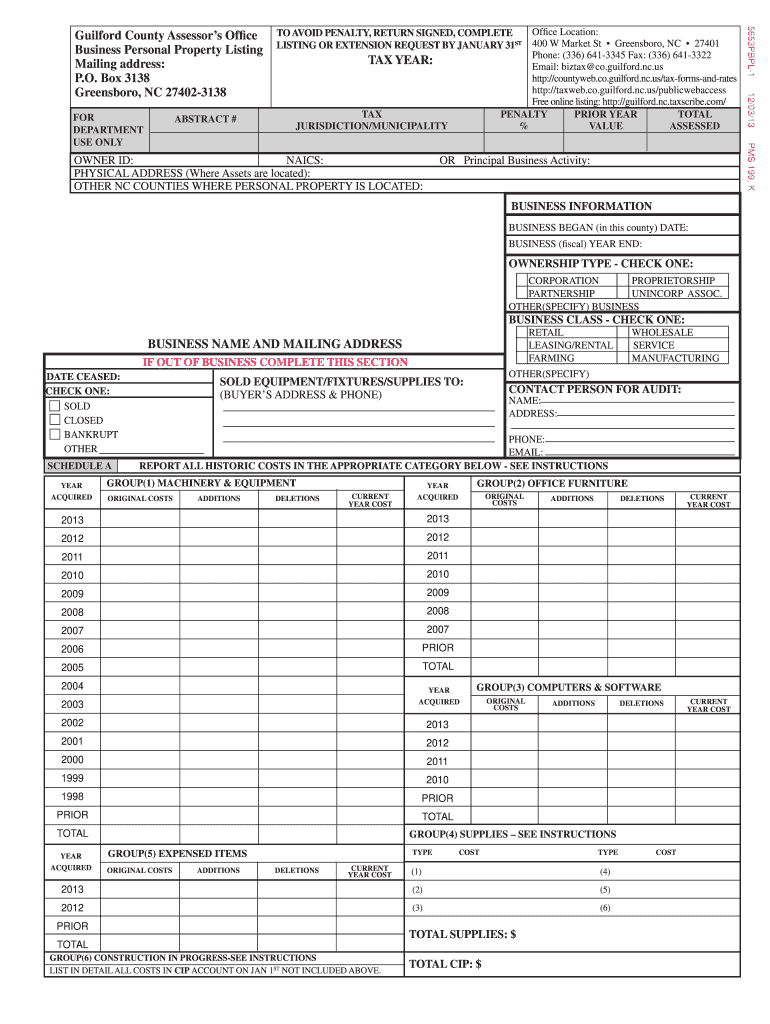

Guilford. nc.us http //countyweb. co. guilford. nc.us/tax-forms-and-rates http //taxweb. co. guilford. nc.us/publicwebaccess Free online listing http //guilford. nc.taxscribe. com/ PENALTY PRIOR YEAR VALUE ASSESSED TO AVOID PENALTY RETURN SIGNED COMPLETE LISTING OR EXTENSION REQUEST BY JANUARY 31ST 5653PBPL-1 Guilford County Assessor s Of ce Business Personal Property Listing Mailing address P. ABSTRACT TAX YEAR TAX JURISDICTION/MUNICIPALITY PMS ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NC 5653PBPL

Edit your NC 5653PBPL form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC 5653PBPL form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NC 5653PBPL online

Follow the steps below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NC 5653PBPL. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC 5653PBPL Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC 5653PBPL

How to fill out NC 5653PBPL

01

Begin by entering your name in the designated field.

02

Fill out your contact information including your address, phone number, and email.

03

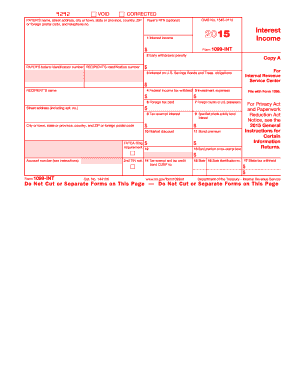

Provide your Social Security number or tax identification number as required.

04

Indicate the type of application or request you are submitting.

05

Complete any necessary sections regarding eligibility or program specifics.

06

Review the form for clarity and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate office listed in the instructions.

Who needs NC 5653PBPL?

01

Individuals applying for benefits or services related to NC 5653PBPL.

02

Applicants seeking assistance or eligibility confirmation from specific programs.

03

Citizens or residents in need of support services provided within the framework of NC 5653PBPL.

Fill

form

: Try Risk Free

People Also Ask about

How do I get property tax exemption in South Carolina?

Most property tax exemptions are found in South Carolina Code Section 12-37-220. For any real property exemptions taxation is a year in arrears, meaning to be exempt for the current year, you must be the owner of record and your effective date of disability must be on or before December 31 of the previous year.

At what age do you stop paying property taxes in South Carolina?

The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

How do I get a property tax exemption in North Carolina?

A qualifying owner must either be at least 65 years of age or be totally and permanently disabled. The owner cannot have an income amount for the previous year that exceeds the income eligibility limit for the current year, which for the 2021 tax year is $31,500. See G.S. 105-277.1 for the full text of the statute.

What is the senior property tax exemption in Guilford County?

Reduce the taxable value of your home: Homeowners who are 65 and older or 100% totally and permanently disabled can get $25,000 or up to 50% off their primary residence value, whichever is greater, if they meet certain income and ownership requirements.

How to apply for property tax exemption in South Carolina?

Where do I apply? You must apply for the Homestead Exemption at your County Auditor's office. If you are unable to go to the Auditor's office, you may authorize someone to apply for you. Contact the County Auditor's Office for details.

At what age do seniors stop paying property taxes in NC?

North Carolina defers a portion of the property taxes on the appraised value of a permanent residence owned and occupied by a North Carolina resident who has owned and occupied the property at least five years, is at least 65 years of age or is totally and permanently disabled, and whose income does not exceed $50,700.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NC 5653PBPL to be eSigned by others?

To distribute your NC 5653PBPL, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute NC 5653PBPL online?

Completing and signing NC 5653PBPL online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out NC 5653PBPL using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign NC 5653PBPL and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is NC 5653PBPL?

NC 5653PBPL is a specific form used for reporting certain tax-related information in the state of North Carolina.

Who is required to file NC 5653PBPL?

Entities or individuals who meet the criteria for the specific reporting requirements outlined by the North Carolina Department of Revenue are required to file NC 5653PBPL.

How to fill out NC 5653PBPL?

To fill out NC 5653PBPL, you will need to provide the required personal or business information, follow the instructions on the form for accurate reporting, and ensure all calculations and entries are correct before submission.

What is the purpose of NC 5653PBPL?

The purpose of NC 5653PBPL is to facilitate the reporting of specific financial information to ensure compliance with state tax regulations.

What information must be reported on NC 5653PBPL?

The information that must be reported on NC 5653PBPL includes income details, deductions, credits, and any other relevant financial data as specified in the form's instructions.

Fill out your NC 5653PBPL online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC 5653pbpl is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.