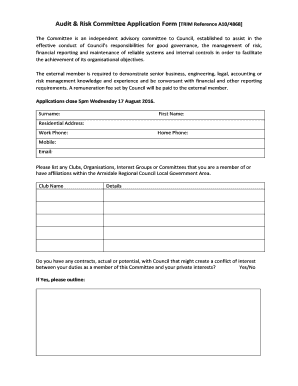

Get the free Credit and Eviction Reports Application

Show details

This document outlines the process for landlords to begin using credit and eviction reports, including required documents and compliance with the Fair Credit Reporting Act (FCRA). It also explains

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit and eviction reports

Edit your credit and eviction reports form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit and eviction reports form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit and eviction reports online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit credit and eviction reports. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit and eviction reports

How to fill out Credit and Eviction Reports Application

01

Begin by downloading the Credit and Eviction Reports Application form from the relevant website or institution.

02

Carefully read the instructions provided with the application to understand the requirements.

03

Fill in your personal information, including your full name, address, social security number, and date of birth.

04

Provide any required identification information, such as a driver's license number or other forms of ID.

05

Detail your credit history by listing any outstanding debts or loans.

06

Include information on your rental history, such as previous addresses and landlords' contact information.

07

Review your information for accuracy and completeness before submitting.

08

Submit the application via the instructed method (online, mail, or in person) along with any required fees.

Who needs Credit and Eviction Reports Application?

01

Individuals applying for rental properties who need to validate their creditworthiness.

02

Landlords and property managers who are screening potential tenants for eligibility.

03

Lenders evaluating applicants for mortgages or loans based on credit history.

04

Property investment companies that perform due diligence on potential tenants.

Fill

form

: Try Risk Free

People Also Ask about

How can I check my credit for evictions?

A credit report generally doesn't show an eviction. However, collections related to an eviction will show up on the major credit reporting agencies. If you owed money for unpaid rent, your prior landlord could get a money judgment from the court requiring you to pay back rent and damages.

How to get a credit report for a rental application?

The most common ways of getting a tenant's credit report are directly through one of the three major credit reporting bureaus (Equifax, Experian, and TransUnion) or through a tenant screening platform like Avail.

What is eviction in simple terms?

Eviction is the removal of a tenant from rental property by the landlord. In some jurisdictions it may also involve the removal of persons from premises that were foreclosed by a mortgagee (often, the prior owners who defaulted on a mortgage).

What is the best definition of actual eviction?

Actual eviction is the legal process of physically removing a person from a property they are renting or occupying. This can happen when a landlord takes legal action to remove a tenant who has violated the terms of their lease or rental agreement.

How do you use eviction notice in a sentence?

Examples from Collins dictionaries He was charged with failing to comply with a government eviction notice to leave his home. The council obtained an eviction notice. We were served with an eviction notice yesterday. She has been issued with an eviction notice because of the behaviour of her sons.

What is the minimum credit score a landlord should accept?

What is the minimum credit score to rent an apartment? Most landlords require a score between 600 and 650, but this varies depending on location and property type.

What is the most common reason for eviction?

Reasons for Eviction First, and most frequently, for not paying rent. Second, for other, non-trivial violations of lease agreements. Finally, landlords may evict tenants whose lease expired.

How to explain eviction on application?

Do not lie about a previous eviction. If you are asked about it on an application or in person, be truthful. Explain what happened that led to the eviction. If you're caught in a lie, it's almost guaranteed that a landlord won't rent to you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

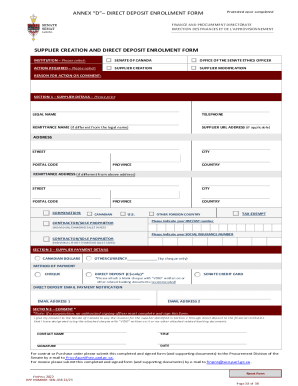

What is Credit and Eviction Reports Application?

The Credit and Eviction Reports Application is a document or system used to request or compile credit history and eviction records of individuals for the purpose of assessing their eligibility for rental agreements.

Who is required to file Credit and Eviction Reports Application?

Landlords, property management companies, and organizations that are considering renting property to an individual are typically required to file a Credit and Eviction Reports Application.

How to fill out Credit and Eviction Reports Application?

To fill out the Credit and Eviction Reports Application, one needs to provide the applicant's personal information such as name, address, date of birth, and Social Security number, along with consent to obtain the reports.

What is the purpose of Credit and Eviction Reports Application?

The purpose of the Credit and Eviction Reports Application is to help landlords and property managers evaluate a potential tenant's creditworthiness and rental history, thus reducing the risk of non-payment or eviction.

What information must be reported on Credit and Eviction Reports Application?

The information that must be reported includes the applicant's credit score, payment history, any previous evictions, outstanding debts, and other relevant financial background information.

Fill out your credit and eviction reports online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit And Eviction Reports is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.