Get the CREATE A FINANCIAL PLAN - Free World U

Show details

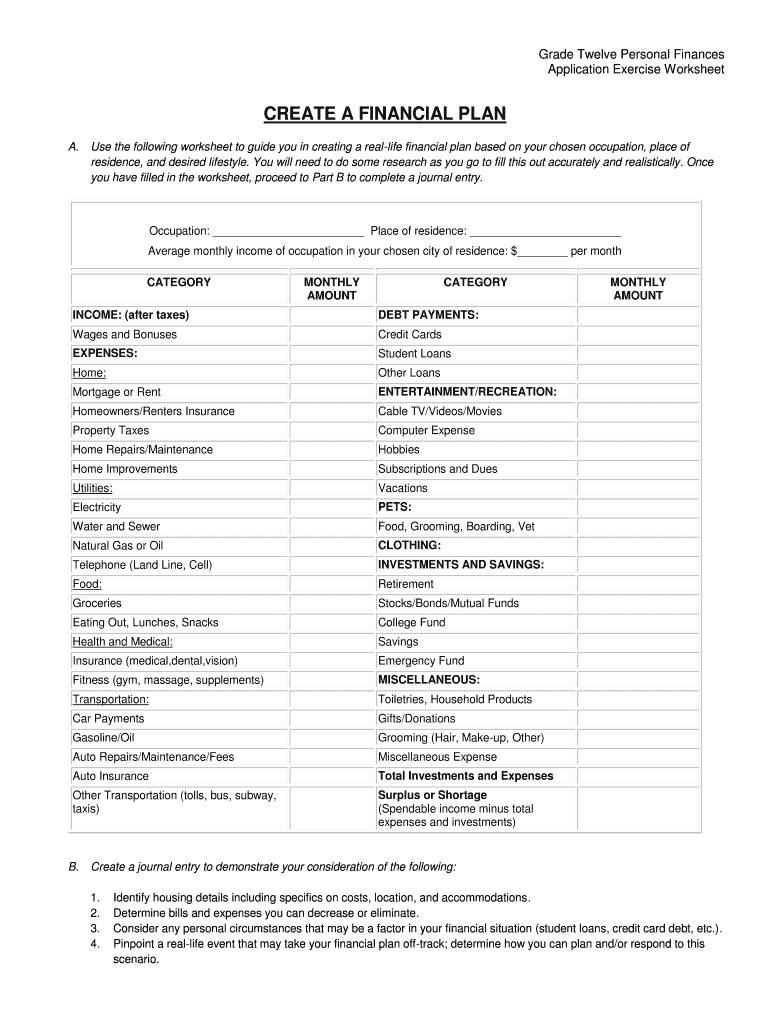

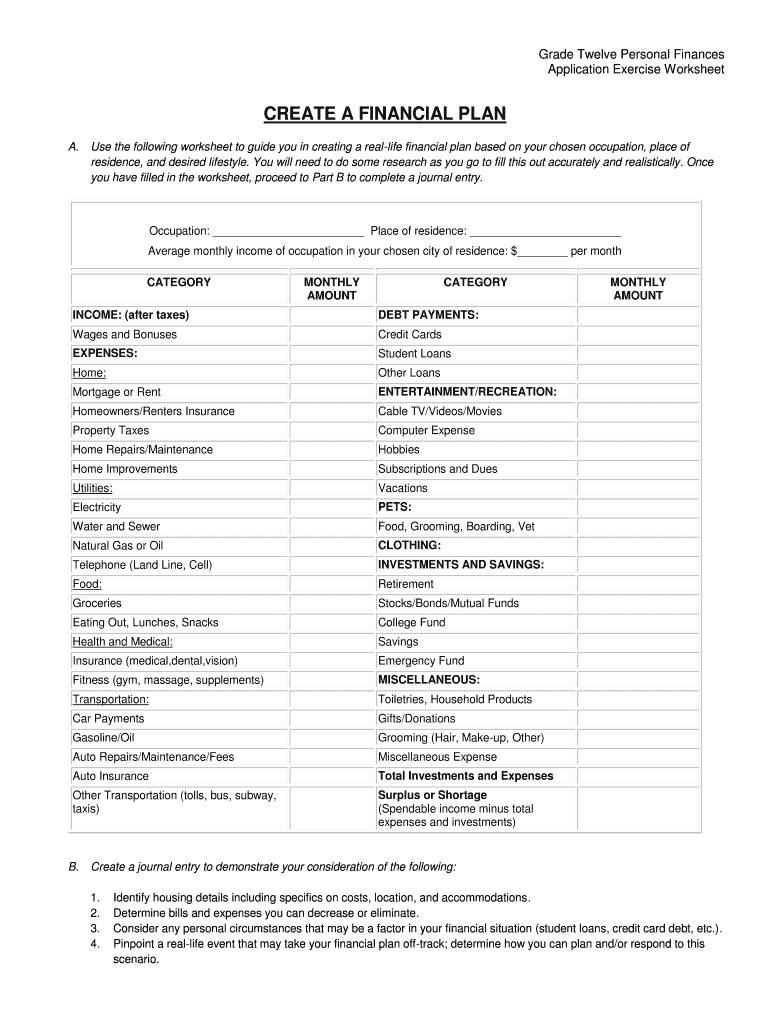

Grade Twelve Personal Finances Application Exercise Worksheet CREATE A FINANCIAL PLAN A. Use the following worksheet to guide you in creating a real life financial plan based on your chosen occupation,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign create a financial plan

Edit your create a financial plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your create a financial plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing create a financial plan online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit create a financial plan. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out create a financial plan

How to fill out and create a financial plan:

01

Start by setting clear financial goals: Determine what you want to achieve in the short term and long term. This could include saving for a specific purchase, paying off debt, or planning for retirement.

02

Assess your current financial situation: Take an inventory of your income, expenses, assets, and liabilities. Calculate your net worth and identify any areas where you need to improve or make adjustments.

03

Track your spending: Keep a record of your income and expenses to gain a better understanding of where your money is going. This will help you identify areas where you can cut back or allocate more funds towards your goals.

04

Create a budget: Based on your goals and financial situation, develop a budget that outlines your monthly income and expenses. Make sure to allocate funds towards savings, debt repayment, and necessities first before considering discretionary spending.

05

Evaluate and manage your debt: Review your outstanding debts and create a plan to pay them off strategically. Prioritize high-interest debts and explore options like debt consolidation or refinancing to save on interest payments.

06

Save and invest wisely: Set aside a portion of your income for savings and investments. Identify suitable investment options such as stocks, bonds, mutual funds, or real estate, based on your risk tolerance and financial goals.

07

Review your insurance coverage: Protect yourself and your loved ones by evaluating your insurance needs. Consider policies such as health insurance, life insurance, disability insurance, and homeowner's insurance to mitigate financial risks.

08

Plan for retirement: It's essential to save for retirement early on to ensure financial stability in your golden years. Explore retirement plans like employer-sponsored 401(k)s, individual retirement accounts (IRAs), or annuities, and contribute regularly.

09

Continuously reassess your financial plan: Regularly review and adjust your financial plan as your goals, circumstances, or market conditions change. Stay flexible and make necessary modifications to stay on track towards achieving your objectives.

Who needs to create a financial plan?

01

Individuals with financial goals: Anyone who has specific financial goals, such as saving for a down payment on a house, funding a child's education, or planning for retirement, can benefit from creating a financial plan.

02

Young adults starting their careers: Taking control of your finances early on can set a strong foundation for future financial success. Creating a financial plan can help young adults manage their income, save for the future, and avoid unnecessary debt.

03

Individuals with unstable financial situations: Those facing financial difficulties or living paycheck to paycheck can greatly benefit from a financial plan. It can help them manage their expenses, create a budget, and develop strategies to improve their financial stability.

04

Families and couples: Managing shared finances can be challenging. Creating a financial plan allows families and couples to set joint financial goals, allocate resources effectively, and work together towards achieving their dreams.

05

Individuals approaching retirement: As retirement approaches, having a solid financial plan becomes crucial. It helps individuals determine if they have enough savings to retire comfortably, make the most of their retirement funds, and plan for future healthcare expenses.

06

Business owners and entrepreneurs: Business owners need to create financial plans not only for their personal finances but also for their businesses. A well-defined financial plan can guide decision-making, budgeting, and investment strategies to ensure business growth and profitability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit create a financial plan from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your create a financial plan into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit create a financial plan in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing create a financial plan and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How can I fill out create a financial plan on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your create a financial plan. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your create a financial plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Create A Financial Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.