Get the free certificate of liability insurance - Early Learning Coalition of ...

Show details

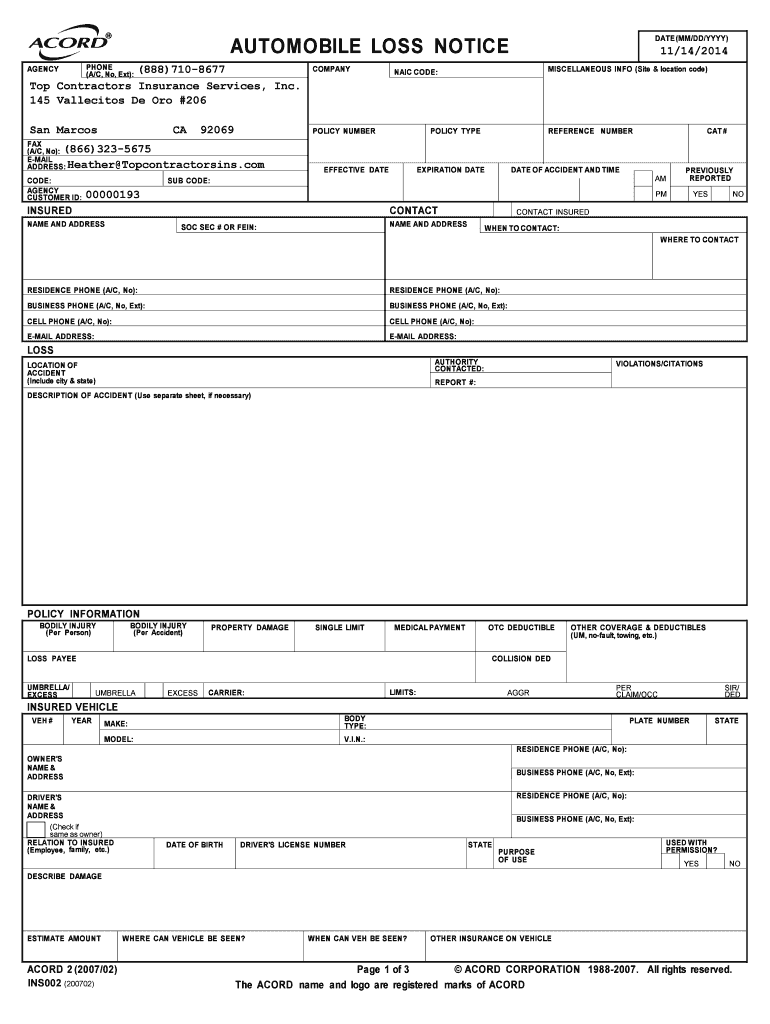

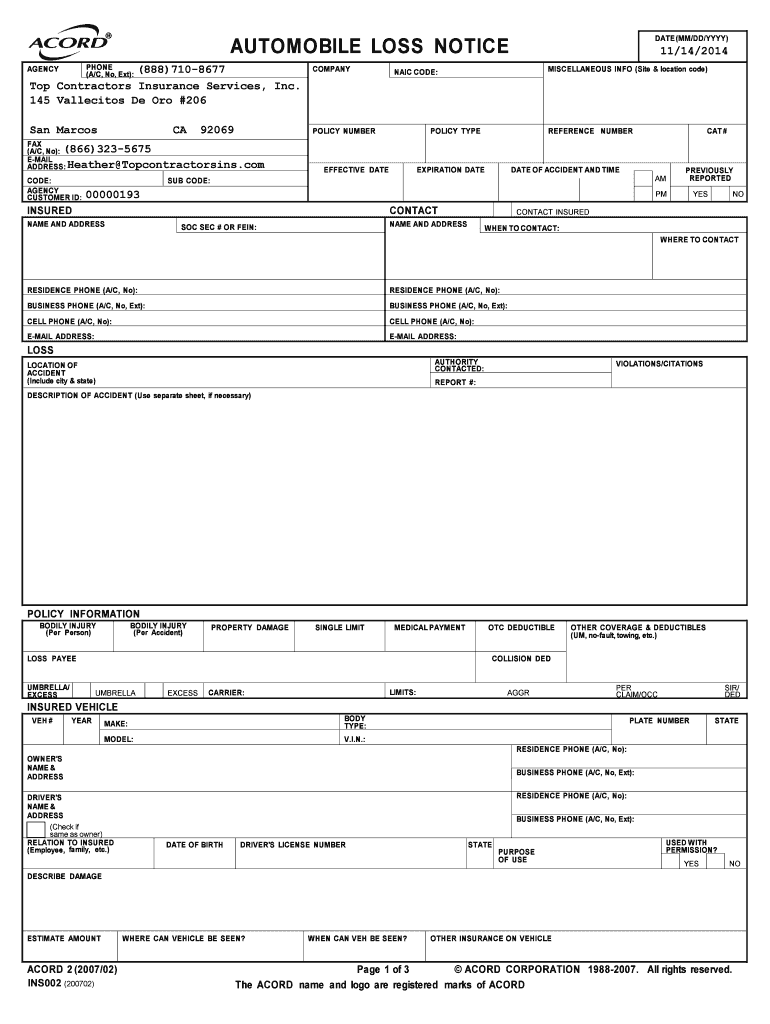

DATE (MM/DD/YYY)AUTOMOBILE LOSS NOTICE PHONE (A/C, No, Ext):(888)7108677 Top Contractors Insurance Services, Inc. 145 Vallecitos De Oro #206COMPANYSan MarcosPOLICY NUMBERAGENCYCA92069FAX (A/C, No):

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificate of liability insurance

Edit your certificate of liability insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate of liability insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing certificate of liability insurance online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit certificate of liability insurance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certificate of liability insurance

How to fill out certificate of liability insurance?

01

Start by obtaining a certificate of liability insurance form from your insurance provider. This form can usually be requested online or through your agent.

02

Begin filling out the form by providing your business information. This includes your company name, address, and contact information.

03

Next, enter the policy number of your liability insurance coverage. This number can typically be found on your insurance policy documents or by contacting your insurance provider.

04

Indicate the effective date and the expiration date of your liability insurance policy. Ensure that the dates entered on the certificate of liability insurance match the dates on your actual policy.

05

Specify the types of liability coverage you have, such as general liability, professional liability, or product liability. This information can be found on your insurance policy documents.

06

Include the limits of liability coverage. This refers to the maximum amount your insurance provider will pay in case of a claim. These limits are also stated in your insurance policy.

07

Indicate any additional insured parties. If you need to add other individuals or entities as additional insured parties, provide their names and addresses on the certificate of liability insurance form.

08

Lastly, sign and date the certificate of liability insurance. Make sure all the information provided is accurate and legible before submitting the form to the appropriate party.

Who needs certificate of liability insurance?

01

Businesses: Any business, regardless of size or industry, can benefit from having a certificate of liability insurance. This includes sole proprietors, partnerships, corporations, and limited liability companies.

02

Contractors: Construction contractors, electricians, plumbers, and other skilled trade professionals often need to provide a certificate of liability insurance before starting work on a project. This ensures that they have the necessary insurance coverage to protect the client and themselves from potential liabilities.

03

Event Organizers: Whether you're hosting a wedding, a conference, or a festival, event organizers often require liability insurance. This helps protect against any potential accidents, property damage, or injuries that may occur during the event.

04

Landlords: Property owners and property management companies typically need liability insurance to protect against any potential claims resulting from accidents or injuries that occur on their property.

05

Consultants and Freelancers: Independent consultants, freelancers, and self-employed professionals may need liability insurance to safeguard against claims of professional negligence or errors and omissions made in the course of their work.

In summary, individuals and businesses involved in various industries and activities may require a certificate of liability insurance. It is essential to consult with your insurance provider to determine your specific needs and to accurately fill out the certificate of liability insurance form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send certificate of liability insurance for eSignature?

Once your certificate of liability insurance is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I execute certificate of liability insurance online?

With pdfFiller, you may easily complete and sign certificate of liability insurance online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit certificate of liability insurance on an Android device?

The pdfFiller app for Android allows you to edit PDF files like certificate of liability insurance. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is certificate of liability insurance?

A certificate of liability insurance is a document that provides proof that an individual or business has insurance coverage to protect against potential claims or lawsuits.

Who is required to file certificate of liability insurance?

Businesses and individuals who provide services or products that may pose a risk of injury or damage to others are typically required to file a certificate of liability insurance.

How to fill out certificate of liability insurance?

To fill out a certificate of liability insurance, you will need to provide information about your insurance policy, including the policy number, coverage limits, and effective dates.

What is the purpose of certificate of liability insurance?

The purpose of a certificate of liability insurance is to demonstrate that an individual or business has insurance coverage to protect against potential claims or lawsuits.

What information must be reported on certificate of liability insurance?

Information such as the policy number, coverage limits, effective dates, and the name of the insured party must be reported on a certificate of liability insurance.

Fill out your certificate of liability insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificate Of Liability Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.