Get the free IVA Funds - Non-Retirement Redemption Form as of Oct 2012

Show details

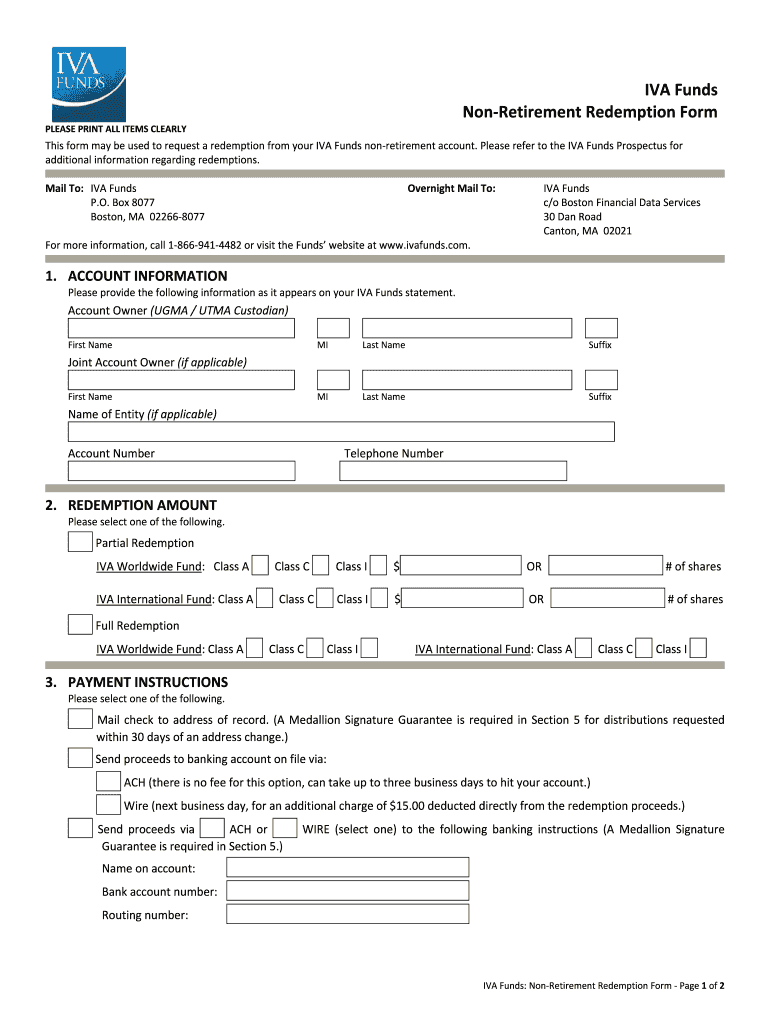

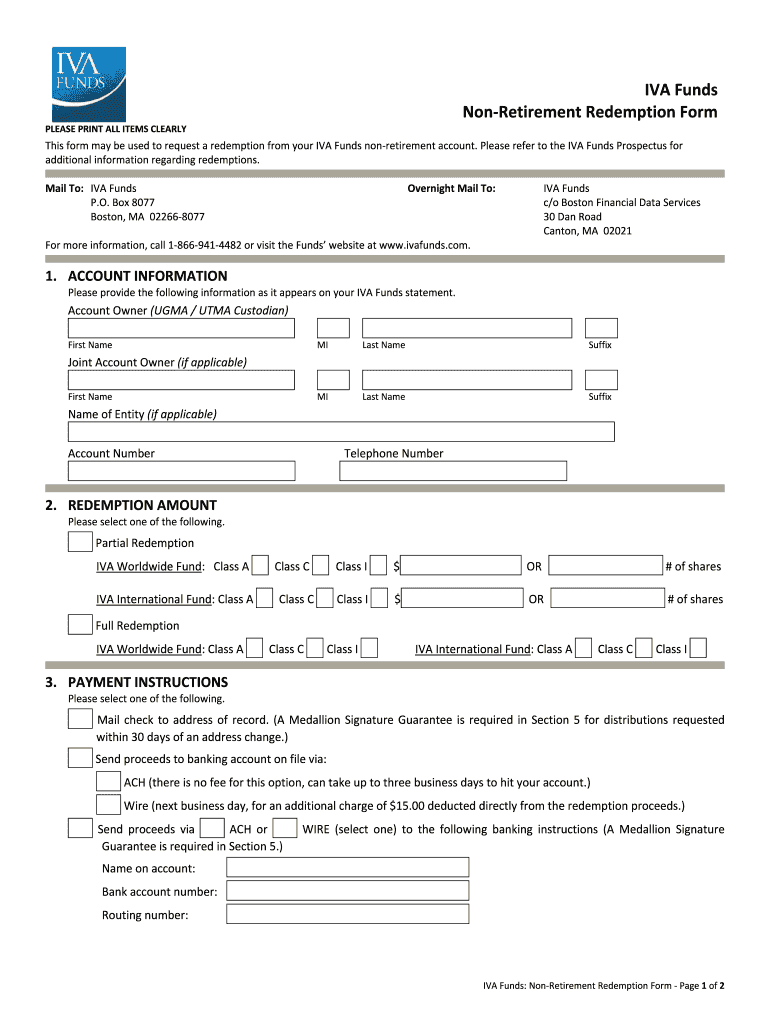

Funds NonRetirementRedemptionForm PLEASEPRINTALLITEMSCLEARLY ThisformmaybeusedtorequestaredemptionfromyourIVAFundsnonretirementaccount. PleaserefertotheIVAFundsProspectusfor additionalinformationregardingredemptions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign iva funds - non-retirement

Edit your iva funds - non-retirement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your iva funds - non-retirement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing iva funds - non-retirement online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit iva funds - non-retirement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out iva funds - non-retirement

How to fill out IVA funds - non-retirement:

01

Gather all necessary documentation: Start by gathering all your financial information, such as bank statements, investment statements, and any other relevant documents that show your non-retirement assets and holdings.

02

Determine your investment goals: Before filling out the IVA funds, it is important to establish your investment objectives. Whether you are looking for long-term growth, stable income, or a combination of both, identifying your goals will help you make informed investment decisions.

03

Research investment options: Explore the available investment options that meet your goals. Consider factors such as risk tolerance, time horizon, and asset allocation. Non-retirement investment options may include stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate investment trusts (REITs), among others.

04

Consult with a financial advisor: It is advisable to consult with a qualified financial advisor who can offer personalized advice based on your financial situation and goals. They can help you understand the potential risks, benefits, and tax implications associated with non-retirement investments.

05

Fill out the required forms: Once you have determined your investment strategy and reviewed the necessary documentation, you will need to fill out the relevant forms provided by the financial institution or investment platform. These forms typically require information such as your personal details, investment amount, desired asset allocation, and beneficiary information.

Who needs IVA funds - non-retirement:

01

Individuals seeking diversified investments: Non-retirement investment options, such as IVA funds, offer individuals the opportunity to diversify their investment portfolios. This is particularly beneficial for those who already have retirement savings and are looking to further diversify their investment holdings.

02

Investors with a longer time horizon: Non-retirement investments are often suited for individuals with a longer time horizon, as they typically involve more risk and volatility compared to retirement accounts. Such investments may be suitable for individuals who can tolerate short-term fluctuations in exchange for potential long-term growth.

03

Those looking to achieve specific financial goals: IVA funds - non-retirement can be beneficial for individuals who have specific financial goals outside of retirement planning, such as purchasing a second home, funding education expenses, or starting a business. These investment options can provide a means to grow wealth and potentially achieve these goals.

04

High-income earners: Individuals with higher incomes may find non-retirement investments useful for optimizing their tax efficiency. Non-retirement investments may provide opportunities for tax diversification, allowing high-income earners to potentially reduce their taxable income through capital gains or other investment strategies.

05

Individuals with a comprehensive financial plan: IVA funds - non-retirement can play a role within a well-rounded financial plan. By including non-retirement investments alongside retirement accounts and other financial strategies, individuals can create a comprehensive framework to address their short-term and long-term financial needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in iva funds - non-retirement without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing iva funds - non-retirement and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the iva funds - non-retirement electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your iva funds - non-retirement in seconds.

How do I fill out the iva funds - non-retirement form on my smartphone?

Use the pdfFiller mobile app to complete and sign iva funds - non-retirement on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is iva funds - non-retirement?

IVA funds - non-retirement refer to investment funds that are not meant for retirement savings.

Who is required to file iva funds - non-retirement?

Individuals who have invested in non-retirement IVA funds are required to file them each year.

How to fill out iva funds - non-retirement?

To fill out IVA funds - non-retirement, one should gather all relevant investment documents and report the necessary information to the tax authorities.

What is the purpose of iva funds - non-retirement?

The purpose of IVA funds - non-retirement is to provide individuals with investment opportunities outside of traditional retirement accounts.

What information must be reported on iva funds - non-retirement?

Information such as the total value of the investment, any dividends or capital gains earned, and any changes in the investment portfolio must be reported on IVA funds - non-retirement.

Fill out your iva funds - non-retirement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Iva Funds - Non-Retirement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.