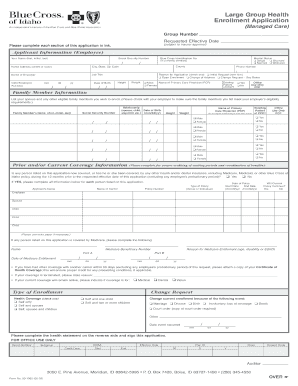

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new non-profit corporation. The form contains basic information concerning the corporation, normally including the corporate name, names of the incorporates, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

Get the free North Dakota Nonprofit Corporation Articles of Incorporation

Show details

This document is used to establish a nonprofit corporation in North Dakota by filing articles of incorporation with the Secretary of State, in accordance with North Dakota Century Code, Chapter 10-33.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign north dakota nonprofit corporation

Edit your north dakota nonprofit corporation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your north dakota nonprofit corporation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out north dakota nonprofit corporation

How to fill out North Dakota Nonprofit Corporation Articles of Incorporation

01

Title the document as 'Articles of Incorporation of [Name of Nonprofit]'.

02

Provide the name of the corporation as it will appear in the state records.

03

Include the purpose of the nonprofit organization, detailing its mission and activities.

04

List the name and address of the registered agent in North Dakota.

05

Specify the number of directors (at least three) and provide their names and addresses.

06

State the duration of the corporation (usually perpetual).

07

If applicable, mention any specific provisions for the existence of membership, if any.

08

Include a statement affirming that the organization will operate according to nonprofit regulations.

09

Sign and date the document by the incorporators.

10

Submit the completed form along with the required filing fee to the North Dakota Secretary of State.

Who needs North Dakota Nonprofit Corporation Articles of Incorporation?

01

Nonprofit organizations wishing to operate legally in North Dakota.

02

Groups that seek tax-exempt status under federal and state laws.

03

Entities planning to raise funds or apply for grants as a nonprofit.

04

Organizations looking to formalize their governance structure and operations.

Fill

form

: Try Risk Free

People Also Ask about

Are articles of incorporation the same as 501c3?

In some states, the articles of incorporation are also known as 501c3 articles of incorporation, certificates of formation, or even charter documents.

What is the difference between a non profit corporation and a 501c3?

Articles of incorporation (the “articles) is the document filed with a state to create a corporation. Most states ask for only basic information about the corporation, but some require more information than others. All states require an in-state registered agent.

What are the articles of incorporation?

IRS Tax-Exempt Status Even though it's not a corporate entity, an unincorporated association might still qualify for section 501(c)(3) tax-exempt status with the Internal Revenue Service (IRS) if its purposes fall within the IRS's exempt purposes.

Does a 501c3 have articles of incorporation?

By incorporating your entity, you are giving the minimal information needed to the state to form the entity, but the IRS doesn't care about your state. This is extremely important. You need to draft a complete Articles of Incorporation with specific legal languages, and that's what the IRS accepts.

How to get a copy of articles of organization in North Dakota?

Any company registered in North Dakota can order certified copies of its official formation documents from the North Dakota Secretary of State. Processing time is typically 1-2 business days plus mailing time.

How do I set up a 501c3 in North Dakota?

North Dakota Nonprofit Step 1: Determine Your Nonprofit Type. Step 2: Choose a Name for Your Nonprofit. Step 3: Research IRS Requirements for Tax-Exempt Status. Step 4: Select a Registered Agent. Step 5: File in FirstStop. Step 6: Obtain Employer Identification Number (EIN)

How do I create an articles of incorporation for a non profit?

Nonprofit articles of Incorporation include vital organizational and contact information. Organization's name. Address for primary office. Nonprofit's purpose. Duration of organization. Contact details of Incorporators. Contact details of board members. Additional statements. Check your state's website.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is North Dakota Nonprofit Corporation Articles of Incorporation?

The North Dakota Nonprofit Corporation Articles of Incorporation is a legal document filed with the state to establish a nonprofit corporation. It outlines the organization's purpose, structure, and governance.

Who is required to file North Dakota Nonprofit Corporation Articles of Incorporation?

Any group or individuals wishing to form a nonprofit corporation in North Dakota must file the Articles of Incorporation with the Secretary of State.

How to fill out North Dakota Nonprofit Corporation Articles of Incorporation?

To fill out the Articles of Incorporation, you need to provide basic information including the nonprofit's name, duration, registered agent, address, purpose, governing structure, and any other specifics required by state law.

What is the purpose of North Dakota Nonprofit Corporation Articles of Incorporation?

The purpose of the Articles of Incorporation is to formally establish the nonprofit corporation as a legal entity, articulate its mission, and delineate its governance structure, fulfilling state legal requirements.

What information must be reported on North Dakota Nonprofit Corporation Articles of Incorporation?

The information that must be reported includes the nonprofit's name, duration, purpose, registered agent's name and address, the names and addresses of the incorporators, and any additional provisions governing the corporation.

Fill out your north dakota nonprofit corporation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

North Dakota Nonprofit Corporation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.