Get the free Micro-Enterprise Loan Program - bhawaiiancouncilbborgb

Show details

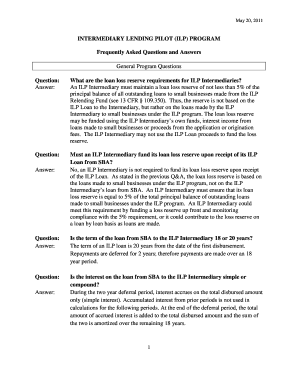

MicroEnterprise Loan Program Checklist The items listed below are required in order to process the MicroEnterprise Loan Program application. Please submit all listed documents at the time of application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign micro-enterprise loan program

Edit your micro-enterprise loan program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your micro-enterprise loan program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing micro-enterprise loan program online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit micro-enterprise loan program. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out micro-enterprise loan program

How to Fill Out Micro-Enterprise Loan Program:

Gather the necessary documents and information:

01

Personal identification (government-issued ID)

02

Proof of address (e.g., utility bill)

03

Business registration documents (if applicable)

04

Financial statements (income, expenses, assets)

05

Business plan or proposal

06

Relevant tax documents

Research and identify eligible micro-enterprise loan programs:

01

Check with local financial institutions, government agencies, or nonprofit organizations offering micro-loans.

02

Ensure the loan program aligns with your business needs and financial capabilities.

Understand the loan program requirements:

01

Review the eligibility criteria, such as business size, annual revenue, and creditworthiness.

02

Familiarize yourself with the loan terms, interest rates, repayment schedule, and any other conditions.

Complete the loan application form:

01

Provide accurate personal and business information.

02

Clearly explain the purpose of the loan and how it will benefit your micro-enterprise.

03

Attach supporting documents as required.

Prepare a business plan:

01

Outline your business objectives, strategies, and financial forecasts.

02

Include details about the products or services offered, target market, competition analysis, and marketing plans.

03

Highlight how the loan will contribute to the growth and sustainability of your micro-enterprise.

Develop a repayment plan:

01

Assess your current financial situation and determine how you will repay the loan.

02

Consider cash flow projections and potential challenges that may affect timely repayments.

03

Show a realistic plan for generating sufficient revenue to repay the loan within the agreed-upon timeframe.

Submit the application:

01

Carefully review the completed application and attached documents for accuracy and completeness.

02

Follow the specified submission process, which could be online, by mail, or in-person.

03

Keep copies of all submitted documents for your records.

Who Needs Micro-Enterprise Loan Program:

Entrepreneurs and small business owners:

01

Individuals starting a micro-enterprise or already operating a small-scale business.

02

Those seeking funds to finance working capital, purchase equipment, or invest in business expansion.

Low-income individuals or communities:

01

Micro-enterprise loans often target individuals or communities lacking access to traditional financing options.

02

They provide an opportunity for socio-economic empowerment and poverty alleviation.

Small women-owned businesses:

Micro-enterprise loan programs may prioritize supporting women entrepreneurs, acknowledging the need for gender equality and promoting female entrepreneurship.

It is important to note that specific micro-enterprise loan programs can have varying eligibility criteria and target different demographics. Consequently, it is crucial to research and identify the loan programs that best suit your business needs and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get micro-enterprise loan program?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the micro-enterprise loan program in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I execute micro-enterprise loan program online?

pdfFiller has made it simple to fill out and eSign micro-enterprise loan program. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make edits in micro-enterprise loan program without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your micro-enterprise loan program, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

What is micro-enterprise loan program?

Micro-enterprise loan program is a financial assistance program designed to provide small loans to individuals or groups who are looking to start or expand a small business.

Who is required to file micro-enterprise loan program?

Individuals or groups seeking financial assistance for small business ventures are required to file for the micro-enterprise loan program.

How to fill out micro-enterprise loan program?

To fill out the micro-enterprise loan program, applicants need to provide information about their business plan, financial projections, and personal information for credit check.

What is the purpose of micro-enterprise loan program?

The purpose of micro-enterprise loan program is to support small businesses and entrepreneurship by providing access to capital that may not be available through traditional lenders.

What information must be reported on micro-enterprise loan program?

Information such as business plan, financial statements, personal credit history, and any collateral offered for the loan must be reported on the micro-enterprise loan program.

Fill out your micro-enterprise loan program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Micro-Enterprise Loan Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.