Get the free Credit Extension to Past Due Customer with Preferred Status

Show details

This document provides a template for writing a letter to offer a preferred customer, who is past due, additional time to settle their account.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit extension to past

Edit your credit extension to past form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit extension to past form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit extension to past online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit extension to past. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

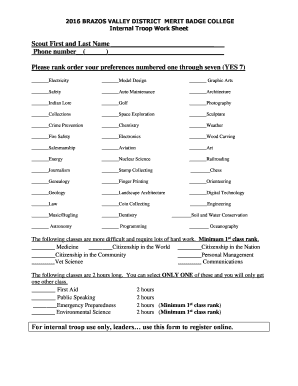

How to fill out credit extension to past

How to fill out Credit Extension to Past Due Customer with Preferred Status

01

Gather necessary customer information including account number and contact details.

02

Access the Credit Extension request form in your system.

03

Fill out the customer’s name and preferred status details in the appropriate fields.

04

Specify the amount of credit extension requested.

05

Provide a clear reason for the credit extension, ensuring it aligns with company policy.

06

Include any supporting documentation that can back up the request.

07

Review the completed form for accuracy and completeness.

08

Submit the form to the designated approval authority within the organization.

Who needs Credit Extension to Past Due Customer with Preferred Status?

01

Customers who have an outstanding balance but are considered preferred due to their loyalty or business history.

02

Businesses looking to manage cash flow issues while maintaining relationships with valued customers.

03

Finance teams needing to assess risk and cash flow implications before granting extensions.

Fill

form

: Try Risk Free

People Also Ask about

What does "extended credit" mean?

Meaning of extended credit in English money that is lent for a longer period of time than is usual or than was originally agreed: The airline asked for extended credit from three to six months.

What does it mean to extend your credit?

Also, extend someone credit. Allow a purchase on credit; also, permit someone to owe money. For example, The store is closing your charge account; they won't extend credit to you any more, or The normal procedure is to extend you credit for three months, and after that we charge interest.

What is the meaning of extension of credit?

Extension of Credit means the making of a Borrowing, the issuance of a Letter of Credit or the amendment of any Letter of Credit having the effect of extending the stated termination date thereof or increasing the maximum amount available to be drawn thereunder.

Should credit be extended to customers?

Extending customer credit can be a valuable strategy for small business growth, but it requires careful planning and management. By understanding credit risk, establishing clear policies, and implementing effective credit management practices, you can minimize risk and foster positive customer relationships.

What does it mean for credit to be extended?

Meaning of extended credit in English money that is lent for a longer period of time than is usual or than was originally agreed: The airline asked for extended credit from three to six months. Small businesses are less likely to get extended credit terms from their suppliers.

What is extending credit to customers?

When you extend credit to a customer, you allow them to obtain goods or services before they pay for them. You are trusting your customer to pay at a later date. This can be a win-win situation. Extending credit can attract new customers and can create loyalty and trust among existing ones.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Credit Extension to Past Due Customer with Preferred Status?

Credit Extension to Past Due Customer with Preferred Status refers to a financial arrangement that allows customers who have a preferred status, but are past due on payments, to receive an extension on their credit terms or payment deadlines.

Who is required to file Credit Extension to Past Due Customer with Preferred Status?

Typically, the finance or credit department of an organization is required to file the Credit Extension to Past Due Customer with Preferred Status, particularly for customers who meet the preferred status criteria.

How to fill out Credit Extension to Past Due Customer with Preferred Status?

To fill out the Credit Extension form, one must provide necessary customer information, details regarding the past due amounts, proposed new credit terms, rationale for the extension, and any relevant supporting documentation.

What is the purpose of Credit Extension to Past Due Customer with Preferred Status?

The purpose is to maintain a good relationship with valued customers, assist them in managing their financial commitments, and ensure continued business transactions, even when they face temporary setbacks.

What information must be reported on Credit Extension to Past Due Customer with Preferred Status?

The report should include customer identification details, account status, outstanding balances, requested extension terms, reason for extension, and the approval signatures from relevant authorities.

Fill out your credit extension to past online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Extension To Past is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.