Get the free GIFT INKIND

Show details

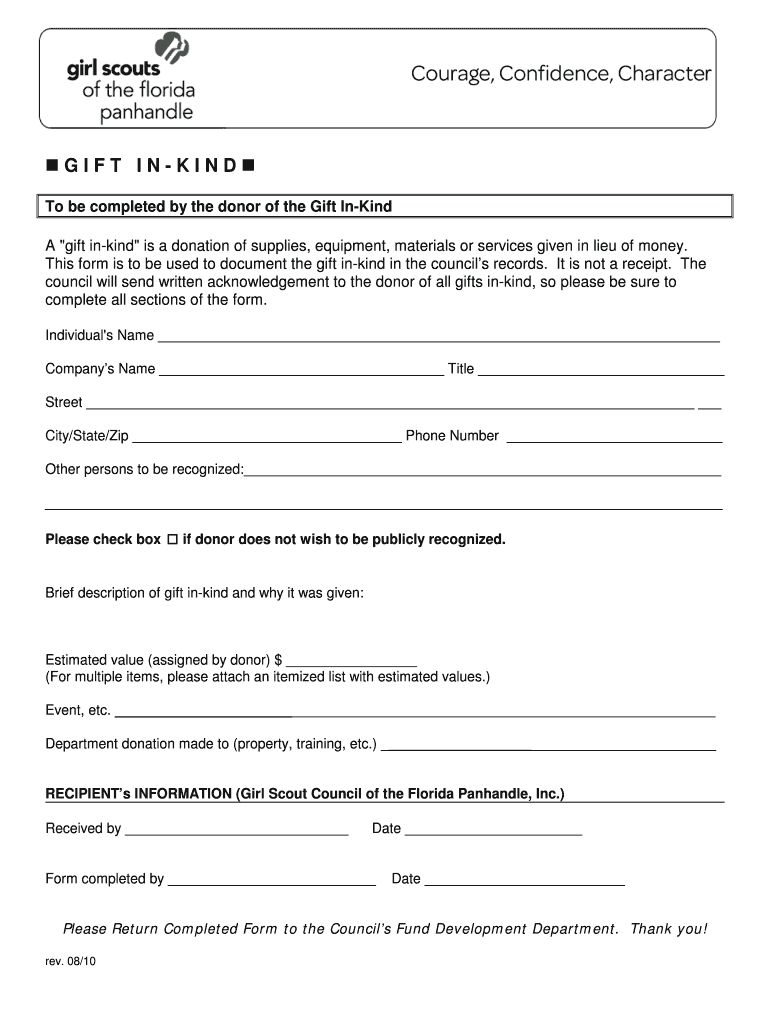

GIFT INKING To be completed by the donor of the Gift Inking A gift inking is a donation of supplies, equipment, materials or services given in lieu of money. This form is to be used to document the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift inkind

Edit your gift inkind form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift inkind form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gift inkind online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit gift inkind. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift inkind

How to fill out gift inkind:

01

Start by obtaining the necessary form for reporting your gift inkind. This form is typically available from the organization or institution you are donating to.

02

Carefully read the instructions provided on the form to understand the specific requirements and guidelines for filling it out.

03

Begin by providing your personal information, including your name, address, contact details, and any other requested information.

04

Specify the details of your gift inkind, including a description of the item or service being donated and its estimated value.

05

If applicable, provide any necessary documentation to support the value of your gift inkind, such as receipts, appraisals, or invoices. This helps validate the accuracy of your donation.

06

Complete any additional sections or questions on the form that are relevant to your gift inkind. This may include details about the purpose of the donation, any restrictions or conditions tied to it, or any preferences you have regarding how it should be used or allocated.

07

Review the completed form to ensure all information is accurate and complete. Make sure you have signed and dated the form, if required.

08

Submit the filled-out form as instructed, whether it is by mailing it to the organization, dropping it off in person, or submitting it electronically, depending on the provided options.

Who needs gift inkind:

01

Nonprofit organizations often rely on gift inkind donations to support their programs and services. These organizations need gift inkind to supplement their resources and fulfill their missions effectively.

02

Educational institutions, such as schools, colleges, and universities, may require gift inkind to enhance their programs, provide educational resources, or support student scholarships.

03

Healthcare facilities, including hospitals, clinics, and nursing homes, may benefit from gift inkind donations, such as medical equipment, supplies, or volunteer services, to enhance patient care and treatment.

04

Community organizations and initiatives, such as shelters, food banks, and disaster relief efforts, often rely on gift inkind to provide essential resources and support to those in need.

05

Cultural and arts organizations, including museums, theaters, and galleries, may seek gift inkind contributions to enrich their exhibits, performances, or events.

06

Religious institutions may require gift inkind to support their outreach programs, community initiatives, or worship services.

07

Environmental and conservation organizations may need gift inkind contributions to preserve natural resources, protect wildlife, or promote sustainable practices.

08

Government agencies or public institutions may accept gift inkind donations if they align with their objectives and policies, such as supporting public parks, libraries, or public safety initiatives.

09

Universities and research institutions may welcome gift inkind donations, such as equipment, supplies, or expertise, to further their scientific or academic pursuits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my gift inkind in Gmail?

gift inkind and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit gift inkind online?

With pdfFiller, it's easy to make changes. Open your gift inkind in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I sign the gift inkind electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your gift inkind in seconds.

What is gift inkind?

Gift inkind refers to a non-monetary donation of goods or services.

Who is required to file gift inkind?

Individuals or organizations that receive or give non-monetary gifts above a certain value may be required to file gift inkind.

How to fill out gift inkind?

Gift inkind forms can typically be filled out online or submitted through mail with detailed information about the gift.

What is the purpose of gift inkind?

The purpose of gift inkind is to track and report non-monetary donations for tax and transparency purposes.

What information must be reported on gift inkind?

Information such as the description of the gift, its estimated value, the donor's or recipient's details, and the date of the gift must be reported on gift inkind forms.

Fill out your gift inkind online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift Inkind is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.