Get the free APPLICATION FOR SBALOWDOC LOAN

Show details

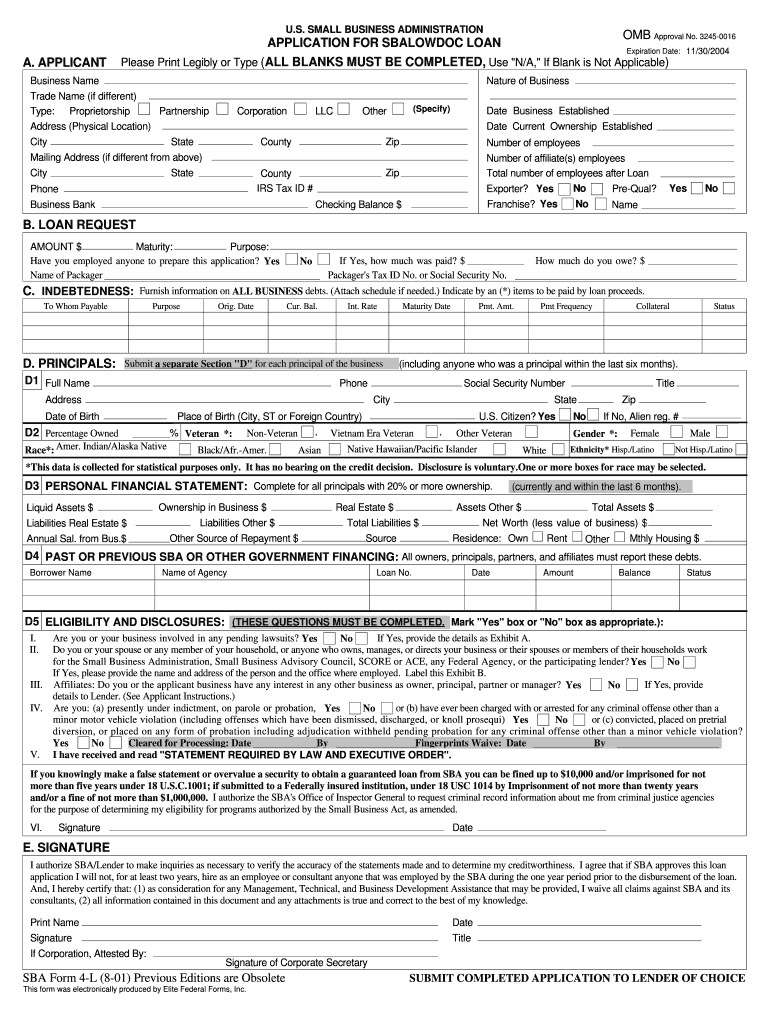

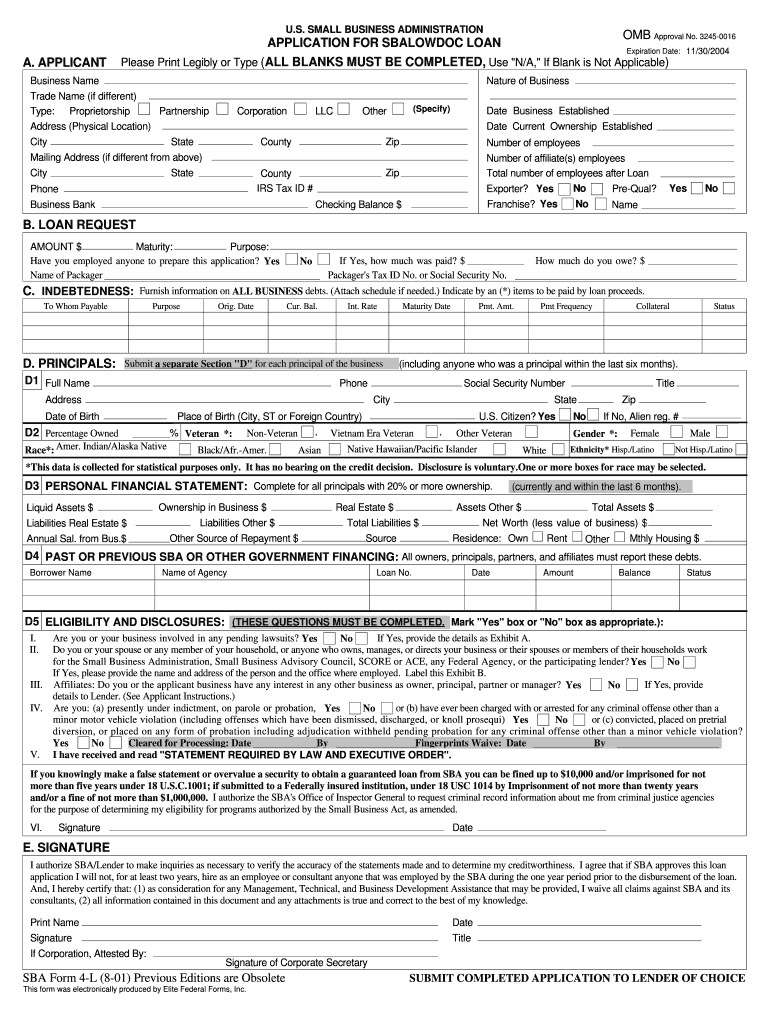

Este documento es una solicitud para un préstamo SBALowDoc de la Administración de Pequeñas Empresas de EE. UU., diseñado para ayudar a las pequeñas empresas a obtener financiamiento accesible.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for sbalowdoc loan

Edit your application for sbalowdoc loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for sbalowdoc loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for sbalowdoc loan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application for sbalowdoc loan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for sbalowdoc loan

How to fill out APPLICATION FOR SBALOWDOC LOAN

01

Start by downloading the APPLICATION FOR SBALOWDOC LOAN form from the official website.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information such as name, address, and contact details.

04

Provide details about your business, including the name, type, and address.

05

Declare the purpose of the loan and how the funds will be used.

06

Include financial information such as income, expenses, and any existing debts.

07

Gather necessary supporting documents, such as tax returns and bank statements.

08

Review the application for accuracy and completeness.

09

Submit the application along with required documents to the relevant lending institution.

Who needs APPLICATION FOR SBALOWDOC LOAN?

01

Small business owners looking for funding to support their operations or growth.

02

Entrepreneurs who need quick access to capital without extensive documentation.

03

Business owners who might not qualify for traditional loans due to lack of collateral.

Fill

form

: Try Risk Free

People Also Ask about

What is the most SBA will lend?

Get $500 to $5.5 million to fund your business Loans guaranteed by SBA range from small to large and can be used for most business purposes, including long-term fixed assets and operating capital.

What is the easiest SBA loan to get?

Thanks to the wide range of permitted loan uses, an SBA Express loan is financing that's easy to approve and is likely perfect for your startup's needs. What Is an SBA Microloan? SBA microloans, which are some of the easiest SBA loans to get approved for, range in size between $500 and $50,000.

What is the 20% rule for SBA?

All loans insured by the SBA require a personal guarantee from every owner with a 20 percent or greater equity stake in the business.

Can non-US citizens apply for an SBA loan?

Yes, a non-U.S. citizen can apply for an SBA loan. As part of the SBA loan application process, each “proprietor, general partner, officer, director, LLC managing member, and 20%+ owner” of a business applying for a loan must provide an SBA Form 912 (Statement of Personal History) to their lender.

What is the easiest SBA loan to get approved for?

Thanks to the wide range of permitted loan uses, an SBA Express loan is financing that's easy to approve and is likely perfect for your startup's needs. What Is an SBA Microloan? SBA microloans, which are some of the easiest SBA loans to get approved for, range in size between $500 and $50,000.

What is the minimum credit score to qualify for an SBA loan?

The minimum credit score for an SBA loan is 680 with a 10% down payment to purchase the asset. The SBA 504 loan, or SBA CDC loan, offers long-term, fixed-rate funding of up to $5 million for major fixed assets (i.e., real estate, equipment, etc.) that promote business growth and job creation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR SBALOWDOC LOAN?

The APPLICATION FOR SBALOWDOC LOAN is a document used to apply for a specific type of loan designed for borrowers who may not have traditional documentation, allowing for a streamlined approval process.

Who is required to file APPLICATION FOR SBALOWDOC LOAN?

Individuals or businesses seeking a loan with minimal documentation requirements typically file the APPLICATION FOR SBALOWDOC LOAN, often including self-employed individuals and those with non-traditional income sources.

How to fill out APPLICATION FOR SBALOWDOC LOAN?

To fill out the APPLICATION FOR SBALOWDOC LOAN, applicants need to provide personal information, financial details, and any relevant supporting documentation that may be requested, ensuring accuracy and completeness.

What is the purpose of APPLICATION FOR SBALOWDOC LOAN?

The purpose of the APPLICATION FOR SBALOWDOC LOAN is to facilitate access to funds for borrowers who may not have conventional documents to verify their income, enabling easier loan approval.

What information must be reported on APPLICATION FOR SBALOWDOC LOAN?

The APPLICATION FOR SBALOWDOC LOAN typically requires information such as personal identification, income details, debts, credit history, and the purpose of the loan.

Fill out your application for sbalowdoc loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Sbalowdoc Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.