Get the free Qualified Plan and 457b Plan Disclosure - Pacific Life

Show details

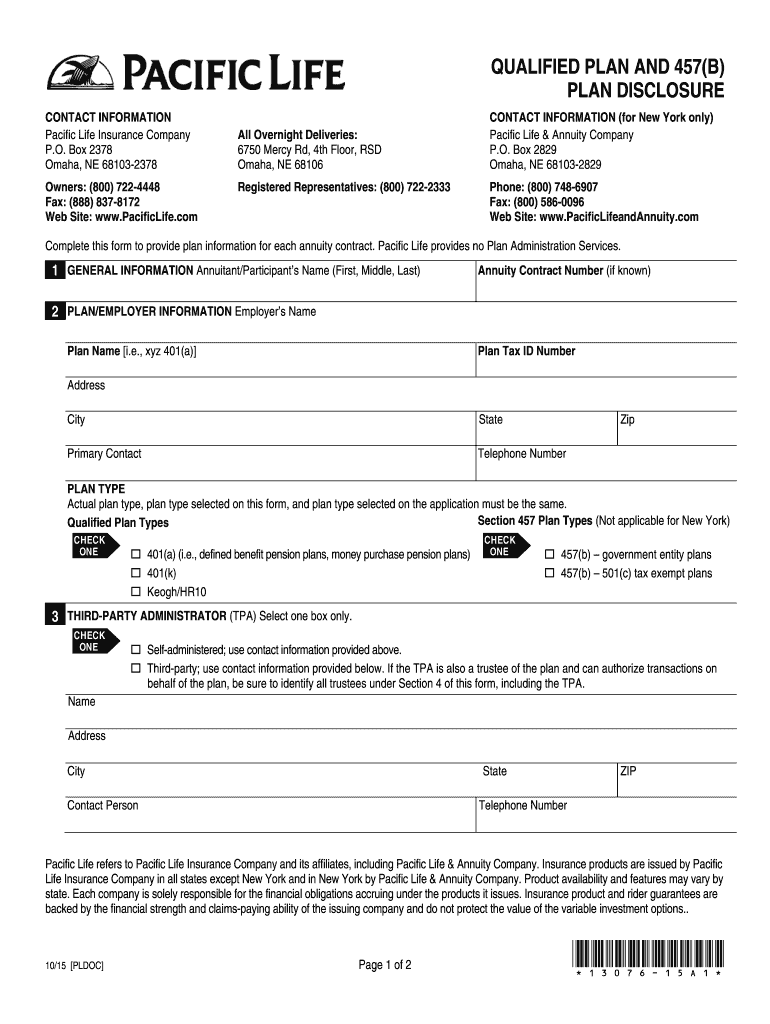

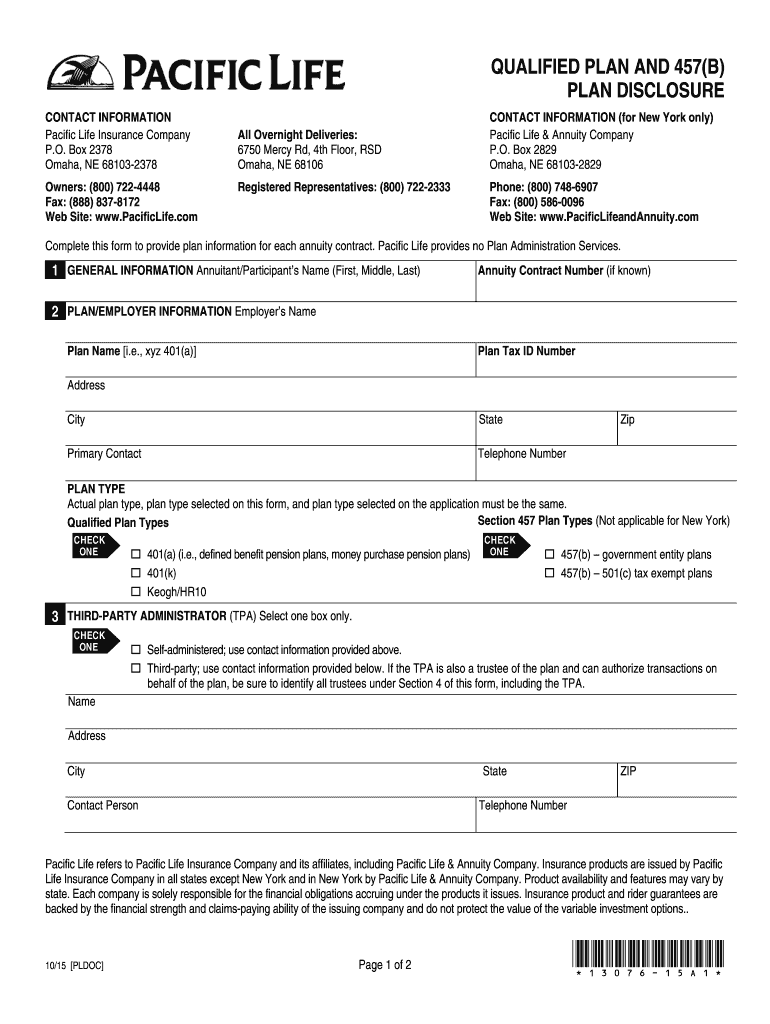

QUALIFIED PLAN AND 457 B) PLAN DISCLOSURE CONTACT INFORMATION Pacific Life Insurance Company P.O. Box 2378 Omaha, NE 681032378 Owners: (800 7224448 Fax: (888 8378172 Website: www.PacificLife.com All

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign qualified plan and 457b

Edit your qualified plan and 457b form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your qualified plan and 457b form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing qualified plan and 457b online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit qualified plan and 457b. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out qualified plan and 457b

How to Fill Out a Qualified Plan and 457b:

01

Gather necessary information: Start by collecting all the relevant documents and information needed to fill out the qualified plan and 457b forms. This may include your personal information, such as name, address, and Social Security number, as well as details about your employment, earnings, and retirement goals.

02

Understand the eligibility criteria: Before completing the forms, make sure you meet the eligibility requirements for a qualified plan and 457b. These plans are typically offered to employees of nonprofit organizations, local governments, or state governments. Ensure you meet the necessary criteria for participating in these retirement plans.

03

Review the instructions carefully: Carefully read the instructions provided with the qualified plan and 457b forms. These instructions will guide you through the process and provide specific information on how to complete each section accurately.

04

Provide accurate personal information: Begin by filling out your personal information accurately, ensuring there are no errors or typos. Double-check that your name, address, and Social Security number are correct, as any mistakes could cause delays or complications.

05

Understand the investment options: A qualified plan and 457b both offer various investment options for your retirement savings. Take the time to understand these options, such as choosing between stocks, bonds, or mutual funds. Consider your risk tolerance, financial goals, and the advice of a financial advisor when deciding how to allocate your contributions.

06

Determine contribution amounts: Decide how much you want to contribute to your qualified plan and 457b accounts. Consider factors such as your current financial situation, desired retirement income, and any employer matching contributions. Take advantage of any maximum contribution limits or catch-up contributions available to boost your retirement savings.

07

Choose beneficiary designation: It is crucial to designate a beneficiary for your qualified plan and 457b accounts. This ensures that in the event of your passing, your retirement savings will be distributed according to your wishes. Carefully select your beneficiary and provide their accurate contact information on the forms.

Who Needs a Qualified Plan and 457b:

01

Employees of nonprofit organizations: Those who work for nonprofit organizations, such as charities or educational institutions, may be eligible for a qualified plan and 457b. These plans provide employees with a tax-advantaged way to save for retirement and enjoy potential employer contributions.

02

Local government employees: Many local governments offer qualified plans and 457b options for their employees. This includes individuals working for municipalities, counties, or other local governmental entities. These plans give government employees a means to save for retirement while enjoying potential employer matchings.

03

State government employees: State governments often provide qualified plans and 457b options as part of their employee benefits package. State employees, including teachers, law enforcement personnel, and administrative staff, may be eligible for these retirement plans. They offer tax advantages and the opportunity for employer contributions.

Please note that specific eligibility criteria and availability of qualified plans and 457b may vary depending on the employer and local regulations. It is advisable to consult with your employer's human resources department or a financial advisor to determine your eligibility and understand the details of these retirement plans.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify qualified plan and 457b without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your qualified plan and 457b into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit qualified plan and 457b online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your qualified plan and 457b to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I fill out qualified plan and 457b on an Android device?

On Android, use the pdfFiller mobile app to finish your qualified plan and 457b. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is qualified plan and 457b?

A qualified plan is a retirement plan that meets certain requirements set by the IRS. A 457b plan is a type of non-qualified retirement plan specifically designed for state and local government employees.

Who is required to file qualified plan and 457b?

Employers who offer qualified plans and 457b plans are required to file these plans with the IRS.

How to fill out qualified plan and 457b?

Employers must complete the necessary forms provided by the IRS and submit them by the deadline.

What is the purpose of qualified plan and 457b?

The purpose of qualified plans and 457b plans is to provide retirement benefits to employees.

What information must be reported on qualified plan and 457b?

Employers must report information such as employee contributions, employer contributions, and plan investments.

Fill out your qualified plan and 457b online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Qualified Plan And 457b is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.