Get the free Integrated AML 2009

Show details

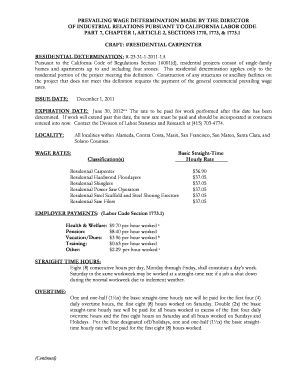

This document is an order form for requesting a license to use Integrated AML 2009 and details the terms and conditions for licensing, including fees and user limits.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign integrated aml 2009

Edit your integrated aml 2009 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your integrated aml 2009 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit integrated aml 2009 online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit integrated aml 2009. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out integrated aml 2009

How to fill out Integrated AML 2009

01

Obtain the Integrated AML 2009 form from the relevant authority or website.

02

Review the instructions provided with the form for specific guidance on filling it out.

03

Fill in the personal information section, including name, address, and contact details.

04

Provide details of any previous AML complaints or issues, if applicable.

05

Complete the sections regarding your financial activities, including income sources and transaction details.

06

Sign and date the form at the designated area to certify its accuracy.

07

Submit the completed form either electronically or by mail as directed.

Who needs Integrated AML 2009?

01

Individuals and businesses involved in financial transactions.

02

Financial institutions and service providers required to comply with AML regulations.

03

Regulatory authorities requiring data on anti-money laundering efforts.

Fill

form

: Try Risk Free

People Also Ask about

What are the new AML regulations 2025?

From 14 May 2025, the UK government will enforce new Anti-Money Laundering (AML) regulations that significantly expand compliance obligations for landlords and letting agents. These changes aim to prevent criminals from exploiting the rental market to launder illicit funds or engage in other financial crimes.

What is the AML CFT system?

Anti-Money Laundering / Countering The Financing Of Terrorism (AML/CFT) Bank Secrecy Act (BSA) is the common name for a series of laws and regulations enacted in the United States to combat money laundering and the financing of terrorism.

What is the AML money laundering Act?

Anti-Money Laundering / Countering The Financing Of Terrorism (AML/CFT) Bank Secrecy Act (BSA) is the common name for a series of laws and regulations enacted in the United States to combat money laundering and the financing of terrorism.

What is the Anti-Money Laundering Act Act?

The AML/CTF Act provides the means to help deter, detect and disrupt money laundering and terrorism financing. It also provides financial intelligence to revenue and law enforcement agencies. The AML/CTF Act implements a risk-based approach to regulation, and sets out general principles and obligations.

What is integration in Anti-Money Laundering?

Integration The final stage of money laundering is known as 'integration'. At this point, the laundered money has been absorbed into the legal financial system due to the layering process. As it is now reintegrated into the financial system, it is essentially legal tender for the criminals to use as they like.

What is the purpose of the AML Act?

The purpose of the AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing, such as securities fraud and market manipulation.

What is the Anti-Money Laundering Act summary?

What is the Anti-Money Laundering Act (AMLA)? The Anti-Money Laundering Act (AMLA), enacted as Republic Act No. 9160 in 2001, is the Philippines' primary legislation designed to prevent money laundering and financial crimes.

What is the AML Act 2009?

The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 (the Act) requires a Border Cash Report to be completed by every person, unless exempt, who moves cash into or out of New Zealand, and any person who is to receive cash from outside New Zealand sent either by the person or by another person, AND

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Integrated AML 2009?

Integrated AML 2009 is a regulatory form used for reporting anti-money laundering activities, designed to streamline the reporting process for financial institutions.

Who is required to file Integrated AML 2009?

Financial institutions, such as banks, credit unions, and other entities involved in financial services, are required to file Integrated AML 2009.

How to fill out Integrated AML 2009?

To fill out Integrated AML 2009, institutions must provide detailed information about transactions, customer identification, and suspicious activities as per the guidelines set by regulatory authorities.

What is the purpose of Integrated AML 2009?

The purpose of Integrated AML 2009 is to enhance the monitoring and reporting of suspicious financial activities to prevent money laundering and related crimes.

What information must be reported on Integrated AML 2009?

The information that must be reported includes transaction details, customer identification information, and any suspicious activities or transactions that raise red flags.

Fill out your integrated aml 2009 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Integrated Aml 2009 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.