OH Union Home Mortgage FHA Loan Submission Checklist 2015-2025 free printable template

Show details

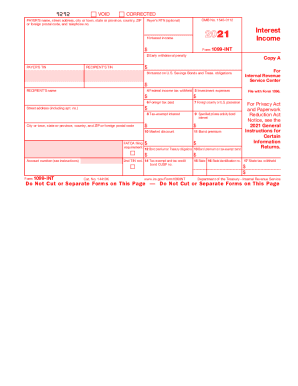

This document serves as a comprehensive checklist for submitting FHA loans, detailing necessary information, disclosures, and documentation requirements for loan processing.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH Union Home Mortgage FHA Loan

Edit your OH Union Home Mortgage FHA Loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH Union Home Mortgage FHA Loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OH Union Home Mortgage FHA Loan online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit OH Union Home Mortgage FHA Loan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out OH Union Home Mortgage FHA Loan

How to fill out OH Union Home Mortgage FHA Loan Submission

01

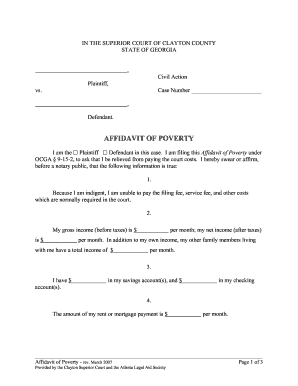

Gather all necessary personal documentation, including proof of income, employment verification, and credit history.

02

Obtain a copy of your credit report and address any discrepancies beforehand.

03

Fill out the FHA loan application form with accurate personal information.

04

Provide information about the property you intend to purchase, including the address and purchase price.

05

List all debts and monthly obligations to provide a full picture of your financial situation.

06

Include details about any assets, such as bank accounts, retirement accounts, and other investments.

07

Submit all required documentation along with the completed application form to the lender.

08

Keep in contact with your mortgage broker or loan officer for updates and to provide any additional information they may need.

Who needs OH Union Home Mortgage FHA Loan Submission?

01

Individuals or families looking to purchase their first home.

02

Homebuyers with lower credit scores who may qualify for an FHA loan.

03

Those seeking to refinance an existing FHA loan to get better terms or cash out.

04

Potential homeowners looking to take advantage of lower down payment options.

Fill

form

: Try Risk Free

People Also Ask about

What are the 5 steps of the mortgage process?

Once you know the steps to obtain a mortgage loan, it will make the process of buying a home much easier. Step 1: Apply and Pre-qualify. Step 2: Loan Processing. Step 3: Home Appraisal. Step 4: Final Approval. Step 5: Closing.

What makes a good loan processor?

A loan processor should have the skills to scrutinize the client's credit report and should be able to identify the documents that will be required to tackle their credit profile. Assess the client's assets including their savings and checking accounts, outstanding debts such as car loans, student loan repayments etc.

What does a processor do in a mortgage loan?

A mortgage processor is responsible for assembling, administering and processing your loan application paperwork before it gets approved by the loan underwriter. They play a key role in getting your mortgage loan request to the final close.

How do I know my mortgage is approved?

Once it's finished, you'll receive a formal mortgage offer from your lender. That means it's official: your application has been approved. You'll usually get this in the mail, though if you're using a broker, they'll likely give you a heads-up it's on the way.

What is the approval step in mortgage?

The first step in the mortgage loan process is to decide how much house you can afford, followed by preapproval, finding a home, choosing a mortgage lender and then submitting your mortgage application. After your application is approved, you'll be responsible for the closing costs and down payment.

Is it hard to be a mortgage processor?

This job can be stressful due to the many variables that influence the decisions to be made. Being a loan processor is not physically challenging or particularly difficult to accomplish, but it can be hard mentally as it requires a significant amount of analysis to complete.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send OH Union Home Mortgage FHA Loan to be eSigned by others?

To distribute your OH Union Home Mortgage FHA Loan, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete OH Union Home Mortgage FHA Loan online?

pdfFiller makes it easy to finish and sign OH Union Home Mortgage FHA Loan online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I complete OH Union Home Mortgage FHA Loan on an Android device?

Use the pdfFiller mobile app and complete your OH Union Home Mortgage FHA Loan and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is OH Union Home Mortgage FHA Loan Submission?

OH Union Home Mortgage FHA Loan Submission is a process through which lenders submit loan applications for FHA-insured mortgages to ensure compliance with federal guidelines.

Who is required to file OH Union Home Mortgage FHA Loan Submission?

Lenders who are seeking approval for FHA-insured loans are required to file the OH Union Home Mortgage FHA Loan Submission.

How to fill out OH Union Home Mortgage FHA Loan Submission?

To fill out the OH Union Home Mortgage FHA Loan Submission, lenders must complete the designated application forms, provide necessary borrower information, and submit them through the appropriate online platform or portal.

What is the purpose of OH Union Home Mortgage FHA Loan Submission?

The purpose of OH Union Home Mortgage FHA Loan Submission is to enable lenders to seek approval for FHA loans, ensuring that all applications meet federal standards for insurability.

What information must be reported on OH Union Home Mortgage FHA Loan Submission?

The information that must be reported includes borrower details, employment and financial history, property information, and any other relevant documentation that supports the loan application.

Fill out your OH Union Home Mortgage FHA Loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH Union Home Mortgage FHA Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.