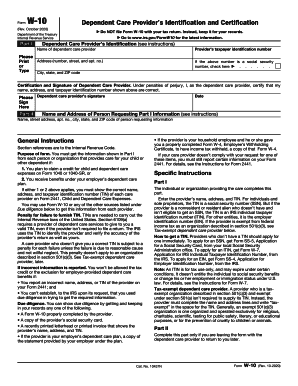

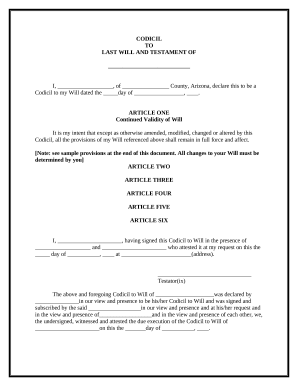

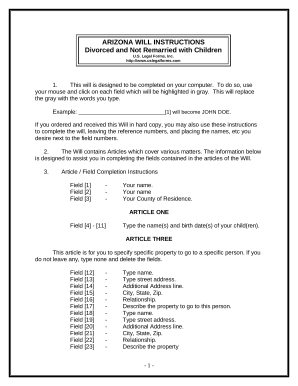

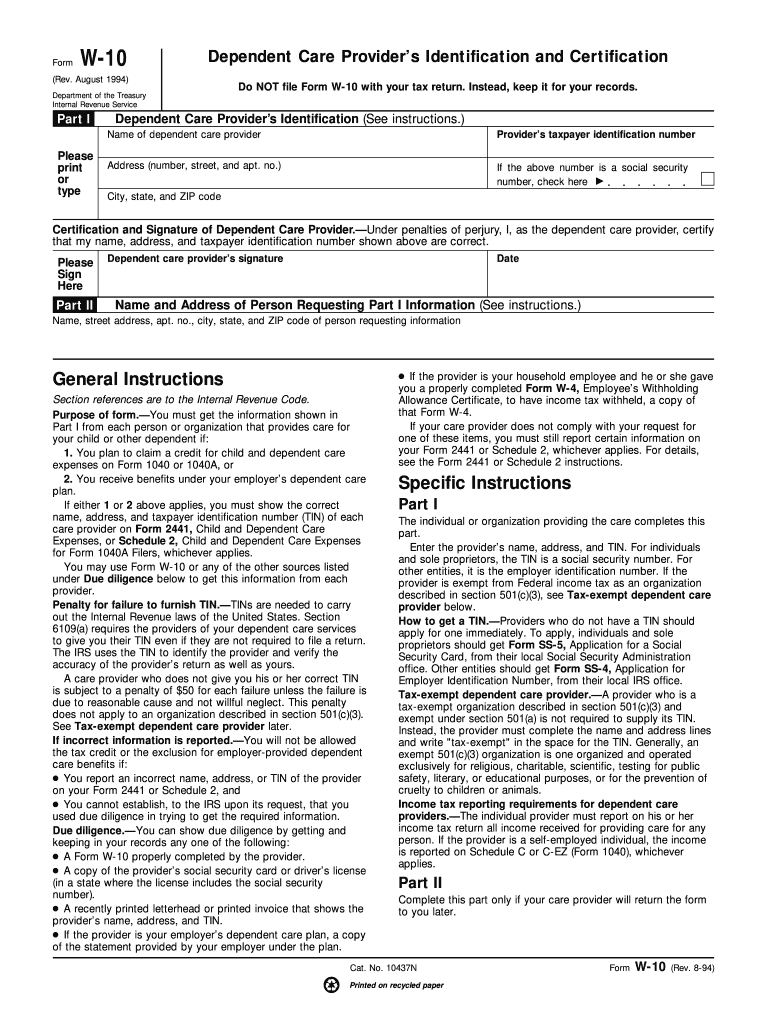

IRS W-10 1994 free printable template

Instructions and Help about IRS W-10

How to edit IRS W-10

How to fill out IRS W-10

About IRS W-10 1994 previous version

What is IRS W-10?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

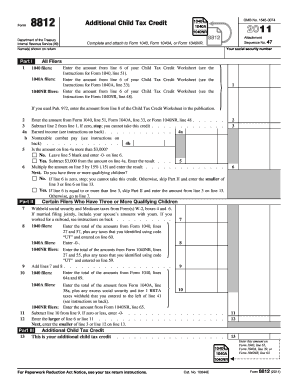

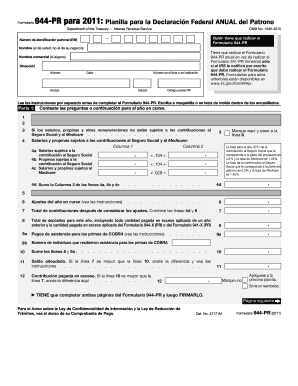

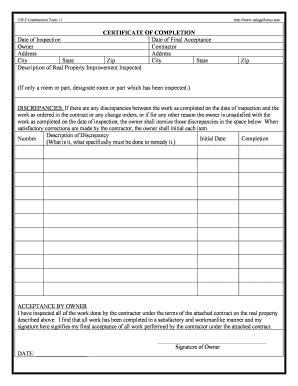

Is the form accompanied by other forms?

FAQ about IRS W-10

What should I do if I realize I've made a mistake after submitting my form w-10?

If you notice an error in your form w-10 after submission, you can correct it by filing an amended version. It’s important to note the original submission date and any reference numbers, as these will be required when making corrections. Ensure you follow the specific instructions for amendments to avoid delays in processing.

How can I verify the status of my form w-10 after filing?

To track the status of your submitted form w-10, you may use the IRS online tools or contact their customer service for updates. Be aware of common e-file rejection codes; if your form was rejected, you will need to correct the issues before resubmission.

Are there any special considerations for nonresidents filing form w-10?

Nonresidents filing form w-10 should be aware that additional documentation might be required to demonstrate tax status. They may need to provide supporting forms, such as W-8BEN, alongside their form w-10 to ensure compliance with IRS regulations for foreign individuals.

What are common errors made when submitting form w-10, and how can I avoid them?

Common errors with form w-10 include incorrect taxpayer identification numbers or mismatches with IRS records. To avoid these mistakes, double-check all entries against your official IRS documents and ensure that all names are correctly spelled and matched with corresponding identification numbers.

See what our users say