Get the free Putnam County Sales Information

Show details

This document contains detailed sales information for properties in Putnam County from September 1, 2008, to September 30, 2008, including details about owners, addresses, zoning, acreage, sale prices,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign putnam county sales information

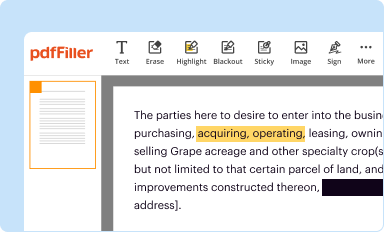

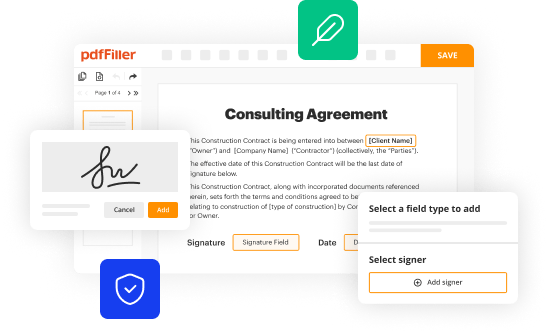

Edit your putnam county sales information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

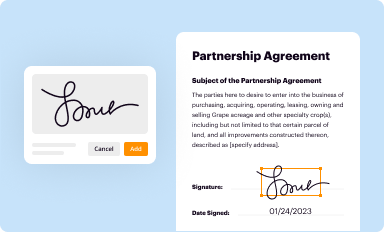

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

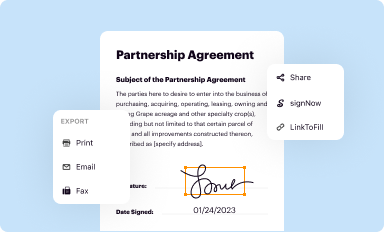

Share your form instantly

Email, fax, or share your putnam county sales information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit putnam county sales information online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit putnam county sales information. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out putnam county sales information

How to fill out Putnam County Sales Information

01

Start by downloading the Putnam County Sales Information form from the official website.

02

Fill in the date of the sale at the top of the form.

03

Enter the property address for the sale, including street, city, and zip code.

04

Provide the names of all parties involved in the transaction, including buyers and sellers.

05

Specify the sale price of the property in the appropriate section.

06

Fill out the section regarding any financing or mortgage details related to the sale.

07

If applicable, include any details about improvements made to the property before the sale.

08

Sign and date the form at the bottom to certify that the information provided is accurate.

09

Submit the completed form to the Putnam County Clerk's office as instructed.

Who needs Putnam County Sales Information?

01

Real estate agents involved in property sales in Putnam County.

02

Buyers purchasing property and needing to understand tax implications.

03

Sellers needing to report the sale of their property for tax purposes.

04

Local government officials who require the information for land use planning and assessment.

05

Title companies and lenders that need sales data for processing transactions.

Fill

form

: Try Risk Free

People Also Ask about

Is Florida sales tax 6% or 7%?

Florida's general state sales tax rate is 6% with the following exceptions: Retail sales of new mobile homes - 3% Amusement machine receipts - 4% Rental, lease, or license of commercial real property - 2%

What is the Putnam County sales tax rate?

Putnam County's is currently set at 8 3/8%, which includes the state share of the sales tax (4%), the current county share (4%), and an added MTA tax (3/8).

What is the property tax rate in Putnam County NY?

Median Putnam County effective property tax rate: 3.27%, significantly higher than the national median of 1.02%. Median annual Putnam County tax bill: $11,749, $9,349 higher than the national median property tax bill of $2,400.

What is the sales tax in Putnam County Florida?

Putnam County sales tax details The minimum combined 2025 sales tax rate for Putnam County, Florida is 7.0%. This is the total of state, county, and city sales tax rates. The Florida sales tax rate is currently 6.0%.

What is the sales tax in Tennessee?

The general state tax rate is 7%. The local tax rate varies by county and/or city. Please click on the links to the left for more information about tax rates, registration and filing.

Does Florida have 7.5 sales tax?

Florida imposes a six percent (6%) state sales tax.

What is the sales tax in Putnam County NY?

A county sales tax is a common surcharge on retail sales that is collected from residents and non-residents who make purchases in Putnam County. Putnam County's is currently set at 8 3/8%, which includes the state share of the sales tax (4%), the current county share (4%), and an added MTA tax (3/8).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Putnam County Sales Information?

Putnam County Sales Information is a form that provides details regarding property sales, including the sale price and property characteristics, used for assessment and taxation purposes.

Who is required to file Putnam County Sales Information?

Sellers of real estate properties in Putnam County are required to file Putnam County Sales Information.

How to fill out Putnam County Sales Information?

To fill out Putnam County Sales Information, provide accurate details about the property sold, including the sale price, date of sale, property description, and the names of the buyer and seller.

What is the purpose of Putnam County Sales Information?

The purpose of Putnam County Sales Information is to collect data on property sales for assessment of property values and to inform tax calculations in the county.

What information must be reported on Putnam County Sales Information?

Putnam County Sales Information must report the sale price, date of sale, legal description of the property, buyer and seller names, and any relevant property characteristics.

Fill out your putnam county sales information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Putnam County Sales Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.