Get the free Consumer Credit in Ireland

Show details

Este databook proporciona información sobre el crédito al consumo en Irlanda, cubriendo el tamaño del mercado, la segmentación del mercado y el análisis de la competencia del sector.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer credit in ireland

Edit your consumer credit in ireland form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer credit in ireland form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consumer credit in ireland online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit consumer credit in ireland. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consumer credit in ireland

How to fill out Consumer Credit in Ireland

01

Gather necessary documents: income statements, proof of identity, and any other financial information.

02

Visit the official Consumer Credit website or your chosen financial institution to access the application form.

03

Carefully read the instructions provided with the application form.

04

Complete the form with accurate details: personal information, financial background, and credit history.

05

Double-check all entries for accuracy to avoid delays in processing.

06

Submit the completed application form along with all required documents either online or in person.

07

Await confirmation and any communication from the lender regarding your application status.

Who needs Consumer Credit in Ireland?

01

Individuals looking to finance a major purchase such as a car or home.

02

People seeking to consolidate existing debts into a single loan.

03

Consumers wanting to manage personal expenses over a longer period.

04

Any adult in Ireland who is considering a loan for education or business purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is consumer credit and how does it work?

What is Consumer Credit? A consumer credit system allows consumers to borrow money or incur debt, and to defer repayment of that money over time. Having credit enables consumers to buy goods or assets without having to pay for them in cash at the time of purchase.

Which country has no credit score?

Japan: Japan does not have a standardized national credit scoring system akin to those in Western countries. Instead, financial institutions assess creditworthiness based on factors like income, employment stability, and repayment history.

Is it better to use cash or credit card in Ireland?

Visa, Mastercard, Apple pay, Google pay, Revolut accepted almost everywhere. Get euros at AAA or use your debit card in a Irish bank ATM. You need some cash for tips, incidentals, maybe parking. Small shops and local cafes prefer cash to avoid credit card fees.

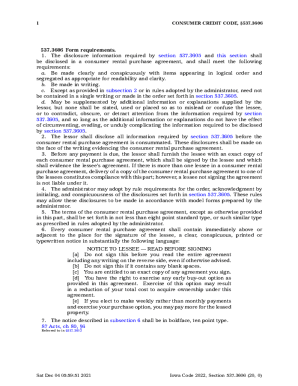

What is the Consumer Credit Act 1995 Ireland?

Definition. The Consumer Credit Act 1995 is a piece of legislation enacted in Ireland to regulate consumer credit agreements and protect consumers who borrow money or enter into credit transactions.

Does credit exist in Ireland?

The Central Credit Register (the Register) is a centralised system that collects and securely stores information about loans. It is managed by the Central Bank of Ireland under the Credit Reporting Act 2013. The Register collects information on loans of €500 or more including: Credit cards.

Is credit a thing in Ireland?

Unlike some other countries, there is no credit scoring or grading system; the CCR only provides factual information about your credit history. Here's what it includes: Personal information: Your name, address, date of birth, PPS number, and contact details.

What are the consumer laws in Ireland?

The CCPC enforces a wide range of consumer protection laws, including laws on deceptive trading practices (including unfair, misleading and aggressive), consumer credit, package travel, unfair contract terms, timeshare, consumer safety (mandatory standards), food labelling, textile labelling, unit pricing and price

What credit system does Ireland use?

The ECTS is the recommended credit system for higher education in Ireland and across the European Higher Education Area.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Consumer Credit in Ireland?

Consumer credit in Ireland refers to the borrowing of funds by individuals for personal use, which typically includes loans, credit cards, and installment plans for the purchase of goods and services.

Who is required to file Consumer Credit in Ireland?

Individuals and businesses that provide consumer credit, such as banks, credit unions, and finance companies, are required to register and file information regarding consumer credit in Ireland.

How to fill out Consumer Credit in Ireland?

To fill out consumer credit forms in Ireland, individuals need to provide personal details, information about their financial situation, and specifics about the credit being applied for, including amounts and repayment terms.

What is the purpose of Consumer Credit in Ireland?

The purpose of consumer credit in Ireland is to provide individuals with access to funds for personal expenditures, facilitating purchases that they may not be able to afford upfront and allowing for better cash flow management.

What information must be reported on Consumer Credit in Ireland?

Information that must be reported on consumer credit in Ireland includes the amount of credit granted, repayment terms, interest rates, fees, the identity of the borrower, and their credit history.

Fill out your consumer credit in ireland online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Credit In Ireland is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.