Get the free Check List for Trust and Foundations

Show details

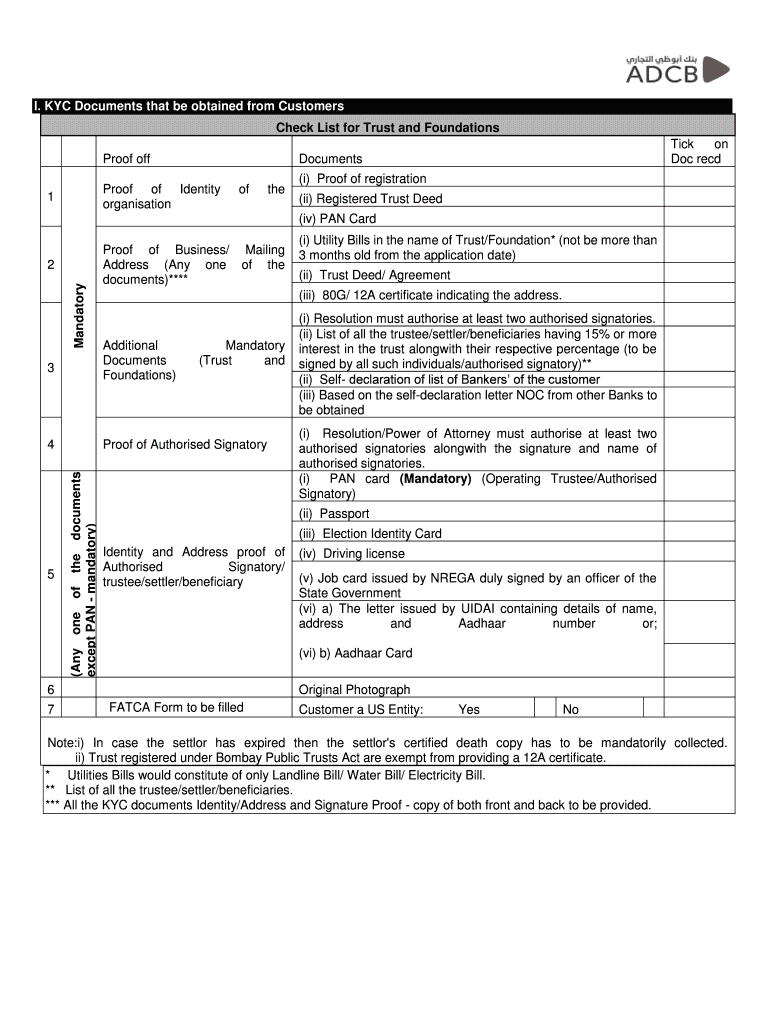

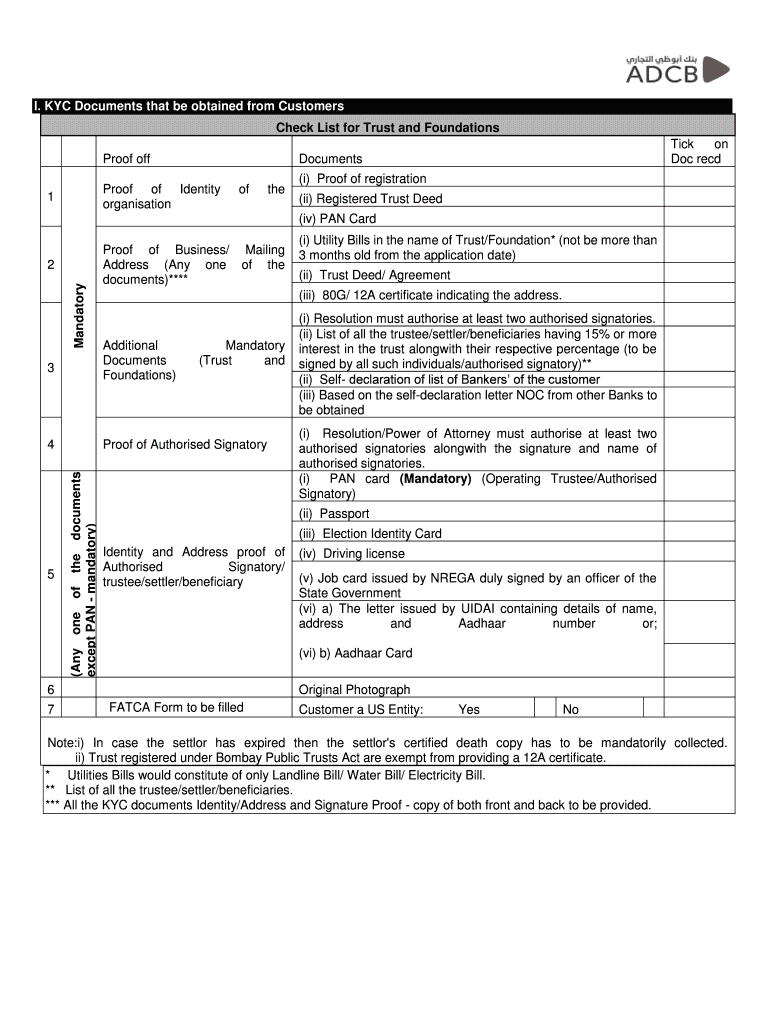

I. KYC Documents that be obtained from Customers Check List for Trust and Foundations Proof off Proof of Identity organization 1 Tick on Doc recd Documents of the (i) Proof of registration (ii) Registered

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign check list for trust

Edit your check list for trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your check list for trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit check list for trust online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit check list for trust. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out check list for trust

How to fill out a checklist for trust?

01

Gather all necessary documents: Start by compiling all relevant legal documents, financial statements, and personal information related to the trust. This may include the trust agreement, deeds, titles, insurance policies, and beneficiary information.

02

Review and update information: Carefully review the trust documents and ensure that all information is accurate and up to date. Make any necessary revisions or amendments to reflect current circumstances.

03

Identify and list trust assets: Compile a comprehensive list of all assets held by the trust, including real estate, investments, bank accounts, stocks, and any other valuable belongings.

04

Appoint successor trustees and beneficiaries: Determine who will take over as trustees in case of incapacity or death. Also, identify beneficiaries and their respective shares or interests in the trust.

05

Assess and address tax implications: Consider the potential tax consequences of the trust and consult with a tax professional to ensure compliance with applicable laws and regulations.

06

Create a plan for ongoing management: Establish a system for managing the trust, including record-keeping, accounting, and annual reviews. This will help ensure that the trust operates smoothly and in line with its intended purpose.

07

Communicate the checklist to relevant parties: Share the checklist with all involved parties, such as co-trustees, beneficiaries, and legal advisors, to ensure everyone is on the same page and understands their responsibilities.

Who needs a checklist for trust?

01

Individuals setting up a trust: When establishing a trust, it is crucial to have a checklist to guide you through the process, ensuring that all necessary steps are taken and important considerations are addressed.

02

Trustees: Trustees, who are responsible for managing and administering the trust, can benefit from a checklist to ensure they fulfill their duties properly and stay organized.

03

Beneficiaries: While beneficiaries may not be directly involved in the administrative aspects of the trust, having a checklist can help them understand the process, manage their expectations, and ensure they receive their entitled benefits.

04

Estate planning attorneys and professionals: Legal professionals involved in creating and managing trusts can use a checklist as a resource to ensure they cover all essential elements and comply with legal requirements.

05

Financial advisors and accountants: Financial advisors and accountants who work in collaboration with trusts can use a checklist to gather relevant information and ensure accurate reporting and tax compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find check list for trust?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the check list for trust in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for the check list for trust in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your check list for trust in seconds.

How do I complete check list for trust on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your check list for trust by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is check list for trust?

A check list for trust is a form used to report required information about a trust.

Who is required to file check list for trust?

The trustee or administrator of the trust is required to file the check list for trust.

How to fill out check list for trust?

The check list for trust can be filled out by providing the requested information such as trust name, taxpayer identification number, and other relevant details.

What is the purpose of check list for trust?

The purpose of the check list for trust is to ensure that all necessary information about the trust is reported to the relevant authorities.

What information must be reported on check list for trust?

Information such as trust name, taxpayer identification number, income received, and distributions made must be reported on the check list for trust.

Fill out your check list for trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Check List For Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.