Get the free California Use Tax Return

Show details

This publication provides information about California use tax and contains a simple use tax return for individuals making purchases from out-of-state businesses.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign california use tax return

Edit your california use tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california use tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit california use tax return online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit california use tax return. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

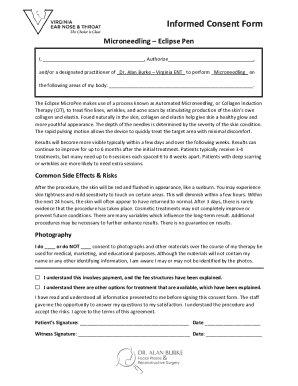

How to fill out california use tax return

How to fill out California Use Tax Return

01

Obtain the California Use Tax Return form, also known as Form BOE-401-E or Form BOE-401-A.

02

Fill in your personal information, such as your name, address, and account number if applicable.

03

Report all purchases subject to use tax that you made during the reporting period. Include items such as out-of-state purchases and online purchases.

04

Calculate the total price of the taxable items purchased.

05

Determine the applicable use tax rate for your area and calculate the total tax owed on the purchases.

06

If you have any applicable credits or exemptions, include those in the calculation.

07

Total the amounts and complete the 'Payment' section, indicating how you will pay the tax owed.

08

Review the form for accuracy and sign it.

09

Submit the completed form along with any payment by the due date, following instructions provided by the California Department of Tax and Fee Administration.

Who needs California Use Tax Return?

01

Individuals or businesses that make purchases from out-of-state sellers without paying sales tax.

02

California residents who buy items online, through catalogs, or via mail from sellers not registered to collect California sales tax.

03

Those who purchase items for storage, use, or consumption in California and are not charged sales tax at the time of purchase.

Fill

form

: Try Risk Free

People Also Ask about

Who pays sales and use tax in California?

Retailers engaged in business in California must register with the California Department of Tax and Fee Administration (CDTFA) and pay the state's sales tax, which applies to all retail sales of goods and merchandise except those sales specifically exempted by law.

Is California sales tax refunded for international tourists?

If you sell an item that will be shipped abroad before use and you ship it directly to a foreign destination or to a qualified person who will export the item, your sale may not be taxable. Please note: Foreign travelers cannot obtain refunds of sales tax paid on California purchases.

How do I know if I need to pay use tax in California?

What items are subject to use tax. Generally, if the item would have been taxable if purchased from a California retailer, it is subject to use tax. For example, purchases of clothing, appliances, toys, books, furniture, or CDs would be subject to use tax.

Do I need to pay California use tax?

What items are subject to use tax. Generally, if the item would have been taxable if purchased from a California retailer, it is subject to use tax. For example, purchases of clothing, appliances, toys, books, furniture, or CDs would be subject to use tax.

How to file use tax in California?

Filing sales tax online is generally recommended, but businesses may also submit the State, Local, and District Sales and Use Tax Return paper form (CDTFA-401-A). This form replaces the CABOE-401-A2. Taxpayers can file and pay returns online through the California Taxpayers Services Portal.

What is use tax on CA tax return?

When an out-of-state or online retailer doesn't collect the tax for an item delivered to California, the purchaser may owe "use tax," which is simply a tax on the use, storage, or consumption of personal property in California.

How to calculate sales and use tax in California?

Convert the tax rate to a decimal: Divide the tax rate by 100. For the California sales tax rate of 7.25%, this would be 7.25% / 100 = 0.0725. Calculate the tax amount: Multiply the item price by the tax rate. If an item costs $15.95, this would be 0.0725 (tax rate) x $15.95 (item price) = $1.15 in sales tax.

What is the use tax in California for online purchases?

In other words, California's online sales tax, while mostly origin-based, is technically a hybrid of origin and destination-based. Out of the four parts to the equation, three come from the home state (California state, county, and city). In California, these are combined and come out to 7.25%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is California Use Tax Return?

The California Use Tax Return is a tax form used to report and pay use tax owed on purchases made from out-of-state retailers where sales tax was not collected.

Who is required to file California Use Tax Return?

Individuals and businesses that purchase goods for use in California from outside the state without paying sales tax are required to file the California Use Tax Return.

How to fill out California Use Tax Return?

To fill out the California Use Tax Return, you need to provide details about your purchases, including the items bought, the purchase price, and calculate the use tax owed based on the current tax rate.

What is the purpose of California Use Tax Return?

The purpose of the California Use Tax Return is to ensure that all taxable purchases made from out-of-state sources are reported and taxed at the appropriate rate to maintain fairness in the sales tax system.

What information must be reported on California Use Tax Return?

The information that must be reported includes the purchaser's details, the description of purchased items, purchase dates, purchase prices, and the calculated use tax amount.

Fill out your california use tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Use Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.