Lloyds Bank 13250 2016 free printable template

Show details

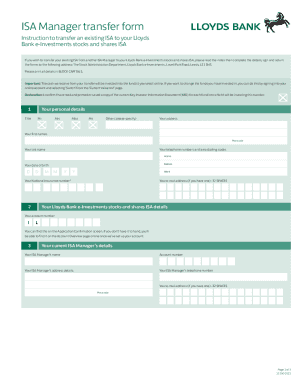

ISA manager transfer form Instruction to transfer an existing ISA to your Lloyd's Bank e Investments stocks and shares ISA If you wish to transfer your existing ISA from another ISA Manager to your

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Lloyds Bank 13250

Edit your Lloyds Bank 13250 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Lloyds Bank 13250 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Lloyds Bank 13250 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Lloyds Bank 13250. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Lloyds Bank 13250 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Lloyds Bank 13250

How to fill out Lloyds Bank 13250

01

Obtain the Lloyds Bank 13250 form from the bank's website or a local branch.

02

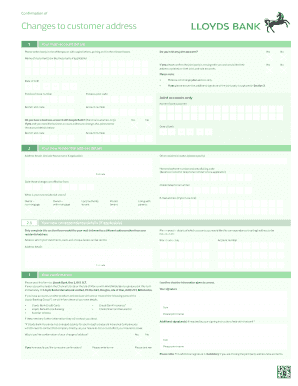

Fill in your personal details at the top of the form, including your name, address, and date of birth.

03

Provide your bank account number and sort code where required.

04

Indicate the purpose of the form clearly in the relevant section.

05

Review your information for accuracy.

06

Sign and date the form at the bottom.

07

Submit the completed form either in person at the bank or via the specified mailing address.

Who needs Lloyds Bank 13250?

01

Individuals who are opening a new account or updating their account information at Lloyds Bank.

02

Customers seeking to apply for specific banking services or products offered by Lloyds Bank.

03

Anyone who needs to provide identification or financial information for regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to transfer an ISA from one bank to another?

Transferring your ISA allows you to move your funds from one ISA to another while retaining your tax-free benefits. The main benefit of transferring your ISA is that you can potentially earn better returns elsewhere. Cash ISA transfers should take place within 15 working days.

How do I transfer my ISA from one bank to another?

How to transfer your ISA. To switch providers, contact the ISA provider you want to move to and fill out an ISA transfer form to move your account. If you withdraw the money without doing this, you will not be able to reinvest that part of your tax-free allowance again.

What happens when you transfer an ISA?

An ISA transfer means moving your savings from one ISA account to another without losing your tax-free status. You can transfer both cash ISAs and stocks and shares ISAs. Crucially, however, it does not involve you physically removing the funds from one bank or investment company and investing them with another.

Can you transfer an ISA online?

To get started, select the 'Transfer an ISA' option from your Online Banking menu. You'll need to have with you: The details of your existing ISA, including the sort code and account number. Your National Insurance number.

How long does it take to transfer from an ISA?

Just how long you have to wait for your ISA transfer depends on the type of account being transferred. Moving from one cash ISA provider to another should take no more than 15 working days. Transferring an investment (stocks and shares) ISA may take a while longer.

Does it cost to transfer an ISA?

there's no charge if you transfer your current ISA – for example, if it's a fixed-term ISA that charges for moving the money or for switching managers. you are allowed to transfer money from all of your existing ISAs, or if you're limited to only moving money in your current 'active' ISA.

How do I transfer my ISA from one provider to another?

You can transfer an ISA at any time. You can make ISA transfers to a new ISA provider and open a new ISA account for the current tax year at the same time. The part of your new ISA investment relating to the current tax year must be within the annual ISA allowance (£20,000 for the 2022/23 tax year).

What is the best way to transfer an ISA?

How to transfer your ISA. To switch providers, contact the ISA provider you want to move to and fill out an ISA transfer form to move your account. If you withdraw the money without doing this, you will not be able to reinvest that part of your tax-free allowance again.

Can I transfer money from my ISA to another bank?

You can transfer both cash ISAs and stocks and shares ISAs. Crucially, however, it does not involve you physically removing the funds from one bank or investment company and investing them with another. Instead, you need to contact your new ISA provider to help you with the transfer.

How do you transfer an ISA from one provider to another?

How do I transfer an ISA? If you're opening a new ISA, compare deals and make sure the ISA you choose allows transfers in. Check whether you'll face any charges for transferring the money and weigh up whether it's worth paying the penalty. Ask your new provider to arrange the transfer.

How many times can you transfer an ISA in a year?

The good news is that an ISA that transfers from one ISA provider to another is a fairly straightforward process, but there are a few things you need to bear in mind when transferring ISAs: You can make ISA transfers as many times as you like and this will not affect your ISA allowance in any way.

How much does it cost to transfer an ISA?

You will usually have to pay a transfer out fee which could cost up to 3% of your stocks and shares ISA balance. Look out for transaction charges which may apply when you transfer your stocks and shares ISA to a cash ISA. This charge covers the cost of selling the assets your stocks and shares ISA has invested in.

Does transferring an ISA count as opening a new one?

Transferring an ISA does not count as opening a new one. For example, if you contribute to a Stocks and Shares ISA and transfer it to a new provider in the same tax year, you can still pay into the new ISA. Without transferring, you are unable to contribute to two Stocks and Shares ISAs in the same tax year.

Can I transfer an existing ISA?

You can transfer your Individual Savings Account ( ISA ) from one provider to another at any time. You can transfer your savings to a different type of ISA or to the same type of ISA . If you want to transfer money you've invested in an ISA during the current year, you must transfer all of it.

How much can I transfer from one ISA to another?

Cash ISA transfer in rules allow you to transfer just part of a previous tax year's Cash ISA or Stocks and Shares ISA. If you transfer ISAs from previous tax years then any amount can be transferred and it does not impact your current tax year's ISA allowance.

How do I transfer my ISA to Lloyds?

Simply call us with the details of your Help to Buy: ISA to request a transfer. The transfer should be completed within 15 days. If you need to call us from abroad, you can call us on +44 0173 334 7007. Lines are open 8am – 8pm, seven days a week.

Can I transfer money from an ISA to a current account?

Money held in a cash ISA can be transferred into another cash account or into a stocks & shares ISA, and likewise, assets held in a stocks & shares ISA can be switched back into cash should you wish (this may take more preparation than transferring cash ISAs, however, so make sure to speak to your provider).

Can I transfer an ISA and open another one?

You can transfer your Individual Savings Account ( ISA ) from one provider to another at any time. You can transfer your savings to a different type of ISA or to the same type of ISA . If you want to transfer money you've invested in an ISA during the current year, you must transfer all of it.

Do I have to open a new ISA account every year?

You don't need to open a new Cash ISA every tax year. Once the end of the tax year approaches, your existing ISA will roll into the next year.

Can I do an ISA transfer online?

Most transfers can be completed online but in some cases you may need to print, sign and post your request to us. Call us on 0345 726 3646 if you are looking to transfer your existing Help to Buy: ISA to us from another provider.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in Lloyds Bank 13250 without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing Lloyds Bank 13250 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an eSignature for the Lloyds Bank 13250 in Gmail?

Create your eSignature using pdfFiller and then eSign your Lloyds Bank 13250 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out Lloyds Bank 13250 using my mobile device?

Use the pdfFiller mobile app to complete and sign Lloyds Bank 13250 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is Lloyds Bank 13250?

Lloyds Bank 13250 refers to a specific form or document used by Lloyds Banking Group for reporting or regulatory purposes.

Who is required to file Lloyds Bank 13250?

Typically, individuals or businesses who have certain account types, transactions, or regulatory obligations with Lloyds Bank are required to file the Lloyds Bank 13250.

How to fill out Lloyds Bank 13250?

To fill out the Lloyds Bank 13250, one needs to provide relevant personal or business information as required, ensuring accuracy and compliance with the instructions provided by the bank.

What is the purpose of Lloyds Bank 13250?

The purpose of Lloyds Bank 13250 is to gather information for compliance with regulatory requirements or to facilitate banking processes within Lloyds Banking Group.

What information must be reported on Lloyds Bank 13250?

The information that must be reported on Lloyds Bank 13250 generally includes personal identification details, account information, transaction details, and any other data specified by Lloyds Bank.

Fill out your Lloyds Bank 13250 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lloyds Bank 13250 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.