Get the free Residential bMortgageb Enquiry bFormb - Crystal Mortgages

Show details

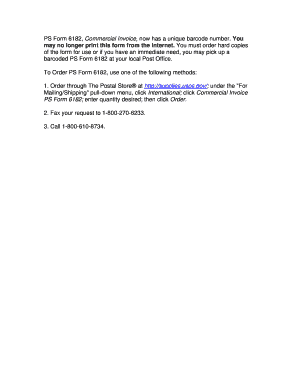

Residential Mortgage Inquiry Form e: residential underwriting togethermoney.com a: Residential Underwriting, Together, Lakeside, Cheaply, SK8 3GW MUST BE COMPLETED IN FULL OR Inquiry FORM CANNOT BE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign residential bmortgageb enquiry bformb

Edit your residential bmortgageb enquiry bformb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your residential bmortgageb enquiry bformb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit residential bmortgageb enquiry bformb online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit residential bmortgageb enquiry bformb. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out residential bmortgageb enquiry bformb

How to fill out a residential mortgage enquiry form:

01

Start by providing your personal details, including your full name, contact information, and current address. This information helps the lender identify you and contact you regarding your mortgage application.

02

Next, specify the purpose of your mortgage enquiry. Are you looking to purchase a new property, refinance an existing mortgage, or seek information about other mortgage options? Clearly state your intentions to ensure the lender can assist you effectively.

03

Indicate the type of property you are interested in. Specify whether it is a single-family home, condominium, townhouse, or any other type of residential property. This information helps the lender assess your eligibility for specific mortgage programs and determine the loan terms that may be available to you.

04

Provide details about your financial situation. This typically includes your employment status, income, and any other sources of income, such as rental properties or investments. You may also need to share information about your debts, such as credit cards, loans, or other financial obligations. These details help the lender assess your ability to make mortgage payments and determine your borrowing capacity.

05

If you have a specific property in mind, provide the property details, including the address, purchase price, and estimated down payment. This information allows the lender to evaluate the property's value and calculate the loan-to-value ratio, which is an essential factor in mortgage approval.

06

Disclose any additional information that might be relevant to your mortgage application. This could include details about co-borrowers, such as a spouse or partner, or any specific requirements you may have regarding your mortgage terms.

Who needs a residential mortgage enquiry form?

01

Individuals who are planning to purchase a new home and require a mortgage to finance the purchase.

02

Homeowners looking to refinance their existing mortgage to potentially secure lower interest rates, access equity, or change the terms of their loan.

03

People seeking information about various mortgage options, such as fixed-rate mortgages, adjustable-rate mortgages, or government-backed loans.

By filling out a residential mortgage enquiry form, individuals can provide lenders with the necessary information to assess their eligibility for a mortgage loan and determine the terms and conditions that may apply. This form is essential for anyone looking to navigate the mortgage application process effectively and obtain financing for their residential property.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find residential bmortgageb enquiry bformb?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the residential bmortgageb enquiry bformb. Open it immediately and start altering it with sophisticated capabilities.

How do I edit residential bmortgageb enquiry bformb online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your residential bmortgageb enquiry bformb to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I sign the residential bmortgageb enquiry bformb electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your residential bmortgageb enquiry bformb in seconds.

What is residential mortgage enquiry form?

The residential mortgage enquiry form is a document used to gather information about a borrower's mortgage application.

Who is required to file residential mortgage enquiry form?

Lenders, mortgage brokers, and financial institutions are required to file the residential mortgage enquiry form.

How to fill out residential mortgage enquiry form?

The form can be filled out electronically or in paper format, and requires information such as borrower details, loan amount, property address, and employment information.

What is the purpose of residential mortgage enquiry form?

The purpose of the form is to collect important information about a borrower's mortgage application for regulatory and compliance purposes.

What information must be reported on residential mortgage enquiry form?

Information such as borrower's personal details, loan amount, property address, employment information, and other relevant data must be reported on the form.

Fill out your residential bmortgageb enquiry bformb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Residential Bmortgageb Enquiry Bformb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.