Get the free Monthly Cash Flow Plan - MB Foundation

Show details

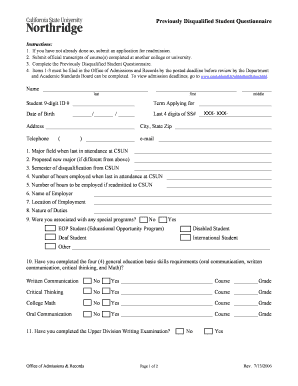

Monthly Cash Flow Plan. Now. Goal. Monthly Income. . . Salary #1 (Gross×. . . Salary #2 ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign monthly cash flow plan

Edit your monthly cash flow plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your monthly cash flow plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing monthly cash flow plan online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit monthly cash flow plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out monthly cash flow plan

How to fill out a monthly cash flow plan:

01

Start by gathering all of your financial information, including income sources, expenses, debts, and savings. This includes any pay stubs, bank statements, utility bills, loan statements, and credit card statements.

02

List all of your sources of income for the month, such as your salary, rental income, or any additional income from freelance work or investments. Be sure to include the exact amounts and any deductibles or taxes.

03

Next, list all of your fixed monthly expenses, such as rent or mortgage payments, insurance premiums, car payments, and utilities. These are typically the costs that remain the same each month.

04

Identify any variable expenses, such as groceries, dining out, entertainment, clothing, and transportation. These expenses may fluctuate from month to month, so estimate an average cost based on past spending habits.

05

Don't forget to include any debt payments, such as credit card bills, student loans, or personal loans. These are important to track in order to stay on top of any outstanding balances and plan your cash flow accordingly.

06

Subtract your total expenses from your total income to determine your monthly cash flow. A positive cash flow means you have more income than expenses, while a negative cash flow indicates that you are spending more than you earn.

07

Analyze your cash flow plan to identify areas where you can make adjustments or cut back on expenses. Look for opportunities to increase savings or pay off debt faster, as well as areas where you may be overspending.

08

Keep a record of your monthly cash flow plans and review them regularly to monitor your progress and make any necessary changes. This will help you stay accountable and achieve your financial goals.

Who needs a monthly cash flow plan:

01

Individuals and families who are looking to gain a better understanding of their financial situation and manage their money more effectively.

02

People who want to save for future goals, such as buying a house, starting a family, or retiring comfortably.

03

Individuals who are looking to pay off debt and improve their financial well-being.

04

Business owners who want to track their cash flow and ensure that their company's finances are in order.

05

Anyone who wants to have a clear overview of their income and expenses, and make informed decisions about their spending habits.

Remember, a monthly cash flow plan can be beneficial for anyone who wants to take control of their finances and work towards achieving their financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find monthly cash flow plan?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the monthly cash flow plan. Open it immediately and start altering it with sophisticated capabilities.

Can I edit monthly cash flow plan on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign monthly cash flow plan right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Can I edit monthly cash flow plan on an Android device?

With the pdfFiller Android app, you can edit, sign, and share monthly cash flow plan on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is monthly cash flow plan?

Monthly cash flow plan is a financial document that outlines the expected income and expenses for a specific month.

Who is required to file monthly cash flow plan?

Monthly cash flow plan is typically required to be filed by individuals, businesses, or organizations who want to track and manage their finances.

How to fill out monthly cash flow plan?

To fill out a monthly cash flow plan, one needs to list all sources of income, estimate expenses, and calculate the difference to see if there is a surplus or deficit.

What is the purpose of monthly cash flow plan?

The purpose of a monthly cash flow plan is to help individuals or businesses understand their cash inflows and outflows, and to make informed financial decisions.

What information must be reported on monthly cash flow plan?

Information such as income sources, expenses, savings goals, and any outstanding debts must be reported on a monthly cash flow plan.

Fill out your monthly cash flow plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Monthly Cash Flow Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.