Get the free Credit Report Pull Authoriz ation Form - bDebtHelperbbcomb

Show details

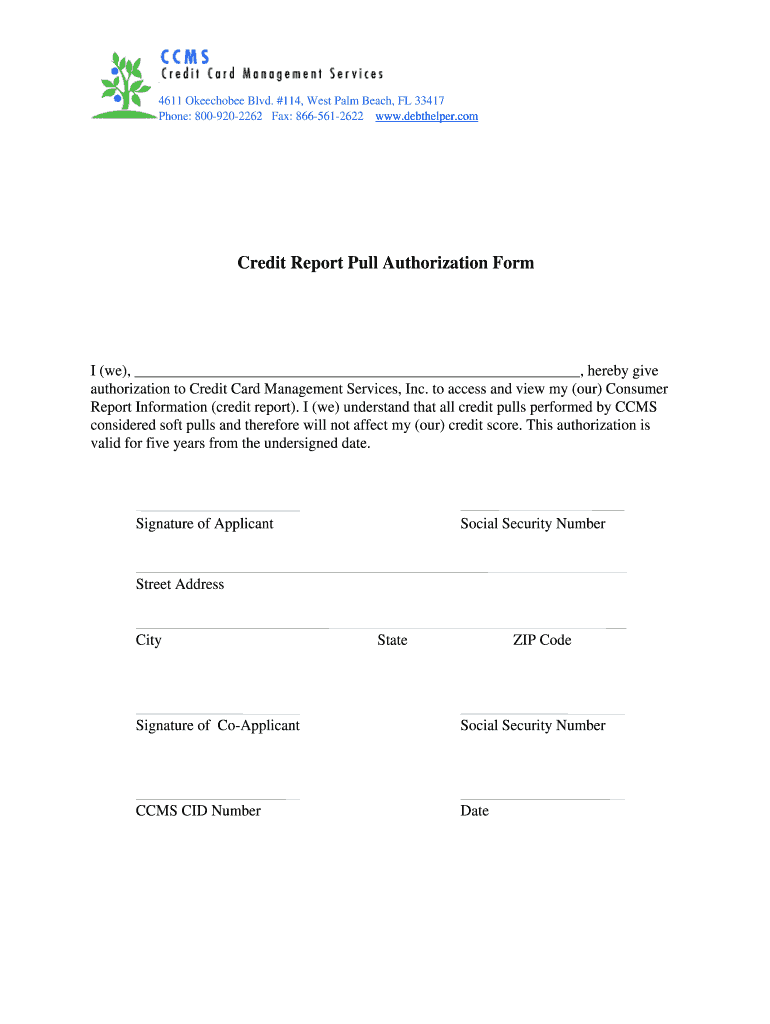

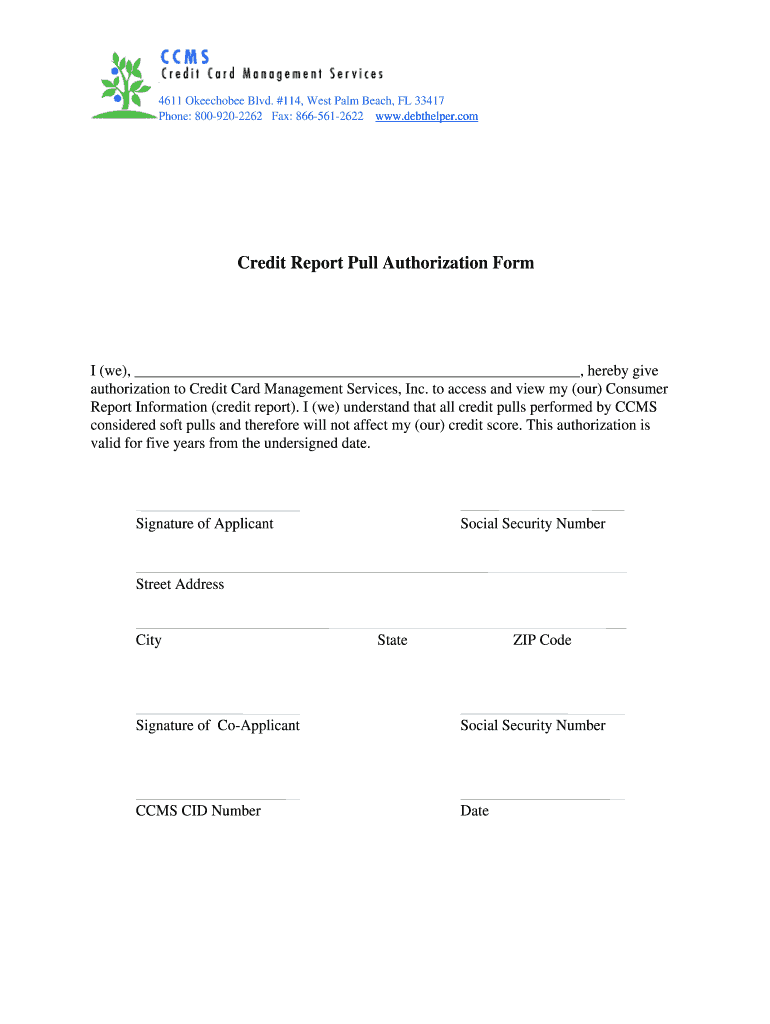

4611 Okeechobee Blvd. #114, West Palm Beach, FL 33417 Phone: 8009202262 Fax: 8665612622 www.debthelper.com Credit Report Pull Authorization Form I (we×, hereby give authorization to Credit Card Management

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit report pull authoriz

Edit your credit report pull authoriz form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit report pull authoriz form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit report pull authoriz online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit report pull authoriz. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit report pull authoriz

How to fill out credit report pull authorization:

01

Start by entering your personal information: Provide your full name, current address, social security number, date of birth, and any other requested details. Make sure to double-check the accuracy of the information before proceeding.

02

Specify the purpose of the credit report: Indicate the reason why you are requesting the credit report. Common purposes include loan applications, employment background checks, or rental applications.

03

Provide authorization for the credit report: Read carefully through the terms and conditions of the authorization form. By signing it, you are granting permission for the credit reporting agency to release your credit report to the designated individual or organization. Sign and date the form accordingly.

04

Review and verify the information: Take a final look at all the information you have provided in the authorization form. Ensure that there are no errors or missing details. This step is crucial to ensure an accurate and complete credit report.

05

Submit the form: Once you have filled out all the required fields, submit the credit report pull authorization form to the appropriate party. This might involve mailing it, submitting it online, or handing it in person, depending on the specific instructions provided.

Who needs credit report pull authorization:

01

Loan applicants: When applying for any type of loan, such as a mortgage, car loan, or personal loan, financial institutions and lenders may require a credit report pull authorization. This allows them to assess your creditworthiness and determine the terms of the loan.

02

Employers or potential employers: Some employers may request a credit report as part of their background check process. This is especially common for positions that involve handling sensitive financial information or require a high level of trust.

03

Landlords or property managers: Rental applications often require a credit report to evaluate the prospective tenant's ability to pay rent and manage their finances responsibly. Landlords or property managers may request a credit report pull authorization to review the applicant's credit history.

04

Insurance companies: When applying for certain types of insurance, such as homeowner's insurance or auto insurance, insurance companies may request access to your credit report. They use this information to determine the risk level associated with insuring you and calculating premiums.

05

Utility companies: Some utility companies, especially those that offer services on credit, may request a credit report pull authorization to assess your ability to pay for the services rendered. This is common for utilities such as phone, internet, cable, or electricity providers.

It is important to note that the specific requirements for credit report pull authorization may vary depending on the country, state, or organization involved. Always carefully read and follow the instructions provided on the authorization form to ensure compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit report pull authoriz in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your credit report pull authoriz and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit credit report pull authoriz straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit credit report pull authoriz.

How do I complete credit report pull authoriz on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your credit report pull authoriz. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is credit report pull authoriz?

Credit report pull authorization is a document that allows a third party to obtain a copy of an individual's credit report from a credit reporting agency.

Who is required to file credit report pull authoriz?

Any individual or organization that wants to access someone's credit report for a specific purpose may be required to file a credit report pull authorization.

How to fill out credit report pull authoriz?

To fill out a credit report pull authorization, one must provide their personal information, specify the reason for requesting the credit report, and sign the authorization form.

What is the purpose of credit report pull authoriz?

The purpose of a credit report pull authorization is to give permission to a third party to pull an individual's credit report, usually for the purpose of making a lending or credit decision.

What information must be reported on credit report pull authoriz?

The credit report pull authorization must include the individual's name, address, social security number, the reason for requesting the credit report, and the duration for which the authorization is valid.

Fill out your credit report pull authoriz online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Report Pull Authoriz is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.