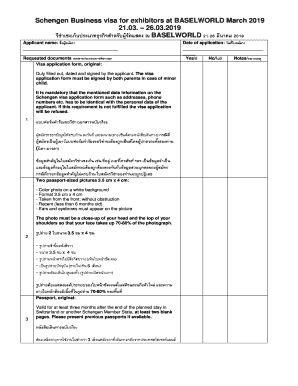

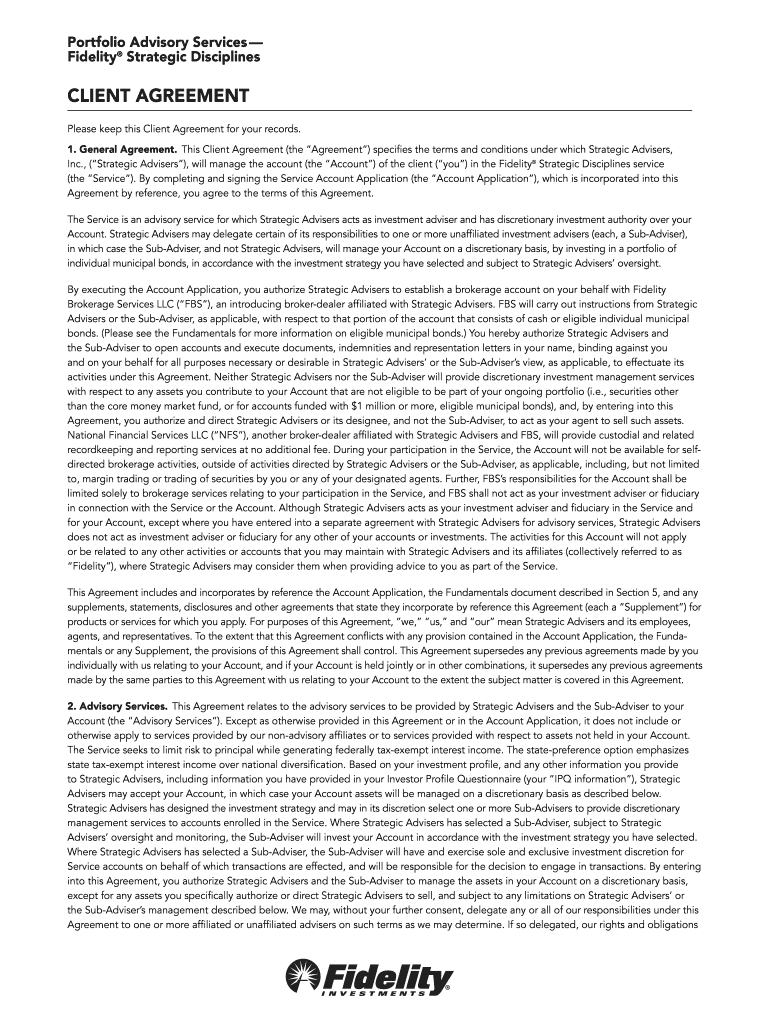

Get the free Portfolio Advisory Services — Fidelity® Strategic Disciplines CLIENT AGREEMENT

Show details

This document outlines the terms and conditions for Fidelity's Strategic Advisers, Inc. to manage clients' accounts as part of the Fidelity® Strategic Disciplines service, including services, fees,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign portfolio advisory services fidelity

Edit your portfolio advisory services fidelity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your portfolio advisory services fidelity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit portfolio advisory services fidelity online

To use the professional PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit portfolio advisory services fidelity. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out portfolio advisory services fidelity

How to fill out Portfolio Advisory Services — Fidelity® Strategic Disciplines CLIENT AGREEMENT

01

Begin by reading the introduction and instructions thoroughly.

02

Fill out the personal information section with your name, address, and contact details.

03

Provide your financial information, including income, assets, and investment experience.

04

Review the investment goals and risk tolerance questionnaire, filling it out truthfully.

05

Read through the terms and conditions of the agreement carefully.

06

Provide your signature and the date at the end of the agreement to confirm your acceptance.

Who needs Portfolio Advisory Services — Fidelity® Strategic Disciplines CLIENT AGREEMENT?

01

Individuals seeking professional investment management.

02

Clients looking to align their investment strategy with their financial goals.

03

Those wanting a structured approach to portfolio management with Fidelity.

04

Investors who prefer to delegate investment decisions to a professional advisor.

Fill

form

: Try Risk Free

People Also Ask about

What are the advisory fees for Fidelity Wealth Management?

Wealth Management fees reflect the range of advisory fees applicable to accounts managed through FSD (0.20%–0.70%) and FWS Wealth Management (0.50%–1.50%). Private Wealth Management fees are based on a $2 million or more investment level, where fees start at 0.47% for FSD accounts and 1.04% for FWS accounts.

What is Fidelity's strategy?

At Fidelity, we believe: • Asset allocation is the single most important factor in assessing the long-term risk- and-return characteristics of a diversified portfolio. Efficient portfolio diversification can be one way to lower a portfolio's risk while maintaining its expected return.

What are fidelity strategic disciplines?

through Fidelity® Strategic Disciplines. We manage your account around a specific investment objective, such as growth from large-cap stocks or income from municipal bonds.

What are the divisions of Fidelity?

Fidelity has three fund divisions: Equity (headquartered in Boston, Massachusetts), High-Income (headquartered in Boston) and Fixed-Income (headquartered in Merrimack, New Hampshire).

Is Strategic Advisors owned by Fidelity?

Investment advisory services provided through Strategic Advisers LLC, a registered investment adviser, for a fee. Brokerage services provided through Fidelity Brokerage Services LLC, Member NYSE, SIPC. Both are Fidelity Investments companies.

What are the fees for strategic disciplines in Fidelity?

3. Gross advisory fee applicable to accounts managed through Fidelity® Strategic Disciplines ranges from 0.20% to 0.49% and gross advisory fee applicable to accounts managed through Fidelity® Wealth Services ranges from 0.50%–1.04%, in each case based on a minimum investment of $2 million.

How much money do you need to have a fidelity advisor?

Fidelity® Wealth Services (FWS) offers three service levels: Fidelity Advisory Services Team, Fidelity Wealth Management, and Fidelity Private Wealth Management. Each level has its own fees, features, and eligibility requirements. Minimum investment to enroll is $50,000.

What does Fidelity specialize in?

We provide financial planning, advice, and educational resources to help investors — including young and first-time investors — make their goals a reality.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Portfolio Advisory Services — Fidelity® Strategic Disciplines CLIENT AGREEMENT?

The Portfolio Advisory Services — Fidelity® Strategic Disciplines CLIENT AGREEMENT is a legal document that outlines the terms and conditions under which Fidelity provides investment advisory services to clients, including the strategies and disciplines used in portfolio management.

Who is required to file Portfolio Advisory Services — Fidelity® Strategic Disciplines CLIENT AGREEMENT?

Clients who wish to utilize the Portfolio Advisory Services offered by Fidelity and engage in strategic discipline investment management are required to file this CLIENT AGREEMENT.

How to fill out Portfolio Advisory Services — Fidelity® Strategic Disciplines CLIENT AGREEMENT?

To fill out the Portfolio Advisory Services — Fidelity® Strategic Disciplines CLIENT AGREEMENT, clients need to provide personal information, investment objectives, risk tolerance, and other required details as specified in the form itself.

What is the purpose of Portfolio Advisory Services — Fidelity® Strategic Disciplines CLIENT AGREEMENT?

The purpose of the CLIENT AGREEMENT is to establish a formal understanding between Fidelity and the client regarding the advisory services being provided, including roles, responsibilities, fees, and investment strategies.

What information must be reported on Portfolio Advisory Services — Fidelity® Strategic Disciplines CLIENT AGREEMENT?

The CLIENT AGREEMENT must include information such as the client’s personal identification details, financial situation, investment goals, risk tolerance levels, and any previous investment experience.

Fill out your portfolio advisory services fidelity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Portfolio Advisory Services Fidelity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.