CA FTB 540 2005 free printable template

Show details

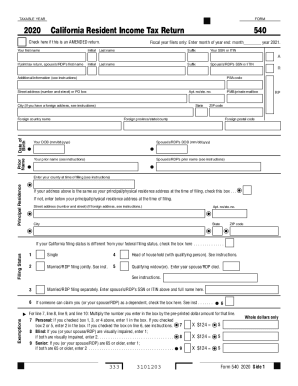

Print and Reset Form For Privacy Act Notice, get form FT 1131. FORM California Resident Income Tax Return 2005 540 C1 Side 1 Fiscal year filers only: Enter month of year-end: month year 2006. Your

pdfFiller is not affiliated with any government organization

Instructions and Help about CA FTB 540

How to edit CA FTB 540

How to fill out CA FTB 540

Instructions and Help about CA FTB 540

How to edit CA FTB 540

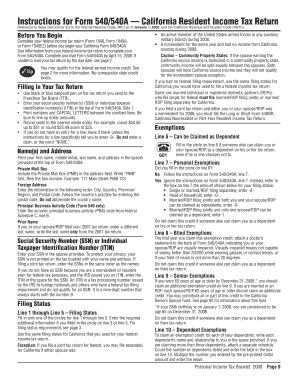

To edit the CA FTB 540 tax form, start by downloading the form from the California Franchise Tax Board's official website. Once you have a copy, use a reliable PDF editor, such as pdfFiller, to make changes. Ensure each section is complete and correct, and check that your edits comply with the required tax regulations for accuracy.

How to fill out CA FTB 540

Filling out the CA FTB 540 requires several steps. First, gather all essential documentation, including W-2 forms, 1099 forms, and any receipts for deductible expenses. Follow these steps to accurately complete the form:

01

Enter your personal information, including your name and Social Security Number.

02

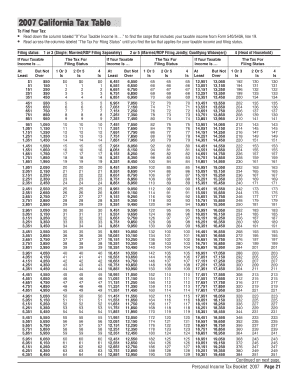

Calculate your total income and report it in the appropriate sections.

03

List all deductions you are eligible for, ensuring to attach necessary documentation.

04

Calculate your tax based on the income and deductions presented.

05

Review all entries for accuracy before submitting.

About CA FTB previous version

What is CA FTB 540?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CA FTB previous version

What is CA FTB 540?

CA FTB 540 is the California Resident Income Tax Return form used by residents of California for reporting income and calculating their state income tax obligations. This form is essential for those who earn income within the state and need to file their taxes annually.

What is the purpose of this form?

The primary purpose of CA FTB 540 is to collect income tax from California residents. The form allows individuals to report their income, claim deductions, and calculate the total tax liability owed to the state. Proper completion of the form helps ensure compliance with California's tax laws.

Who needs the form?

Individuals who are residents of California and have earned income during the tax year need to complete the CA FTB 540. This includes wage earners, self-employed individuals, and those with investment income. If your income exceeds certain thresholds, filing this form becomes mandatory.

When am I exempt from filling out this form?

Exemptions from filling out the CA FTB 540 typically occur for certain low-income individuals and specific categories such as dependents. If your income falls below the minimum filing threshold set by the California Franchise Tax Board or if you qualify under certain exceptions, you may not be required to file.

Components of the form

The CA FTB 540 consists of several key components, including sections for personal information, income reporting, deduction claims, tax computation, and signature verification. Each section must be carefully completed to ensure accurate reporting and compliance with tax laws.

What are the penalties for not issuing the form?

Failing to file the CA FTB 540 can lead to penalties imposed by the California Franchise Tax Board. Penalties may include late filing fees based on the amount of tax owed, interest on unpaid taxes, and possible legal action. It is crucial to file on time to avoid these consequences.

What information do you need when you file the form?

When filing CA FTB 540, you need various forms of information, including your social security number, income details, and receipts for any deductible expenses. Other relevant documents, such as W-2s and 1099s, are essential for accurate income reporting. Collecting this information beforehand will simplify the filing process.

Is the form accompanied by other forms?

CA FTB 540 may need to be submitted alongside other forms depending on individual circumstances. For instance, if you are claiming specific deductions or credits, you may need to include supporting schedules or forms. Review the instructions provided with CA FTB 540 for any required supplementary forms.

Where do I send the form?

The completed CA FTB 540 should be mailed to the address specified in the form’s instructions. This address may vary based on whether you are enclosing a payment or filing without a payment. Always check the latest instructions to ensure you send it to the correct location.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Helps me annotate my documents for my clients , making them easier to read.

AT LEAST I'M THINKING I'M GETTING BETTER

See what our users say