Get the free Credit and Collections - iurpa

Show details

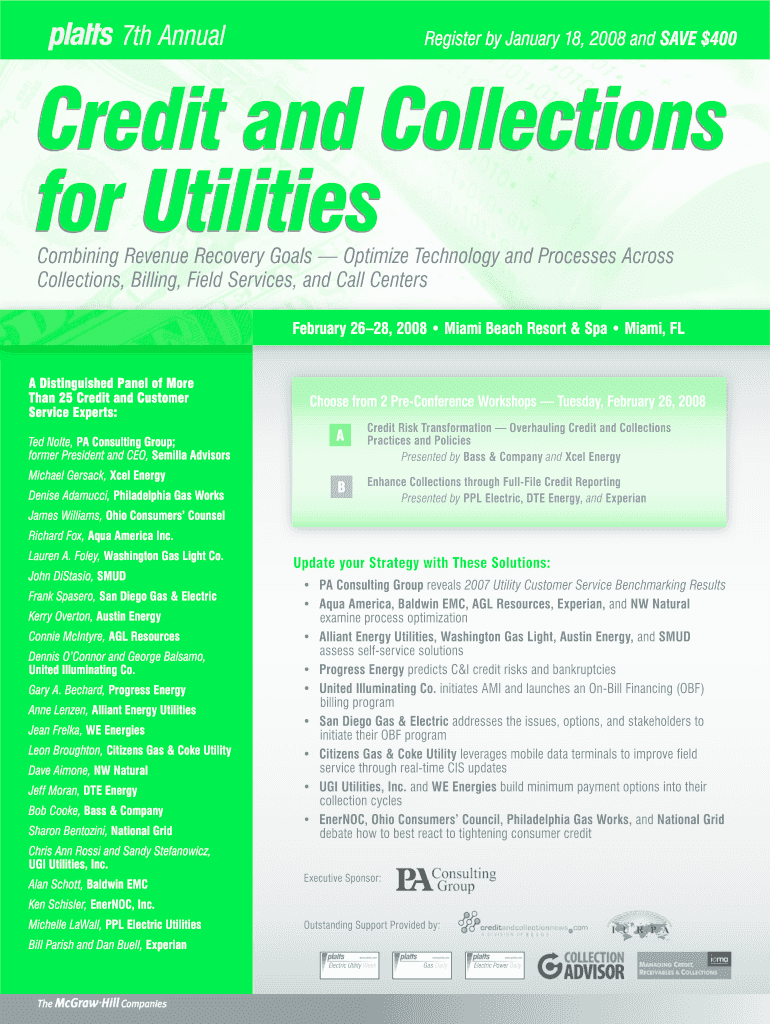

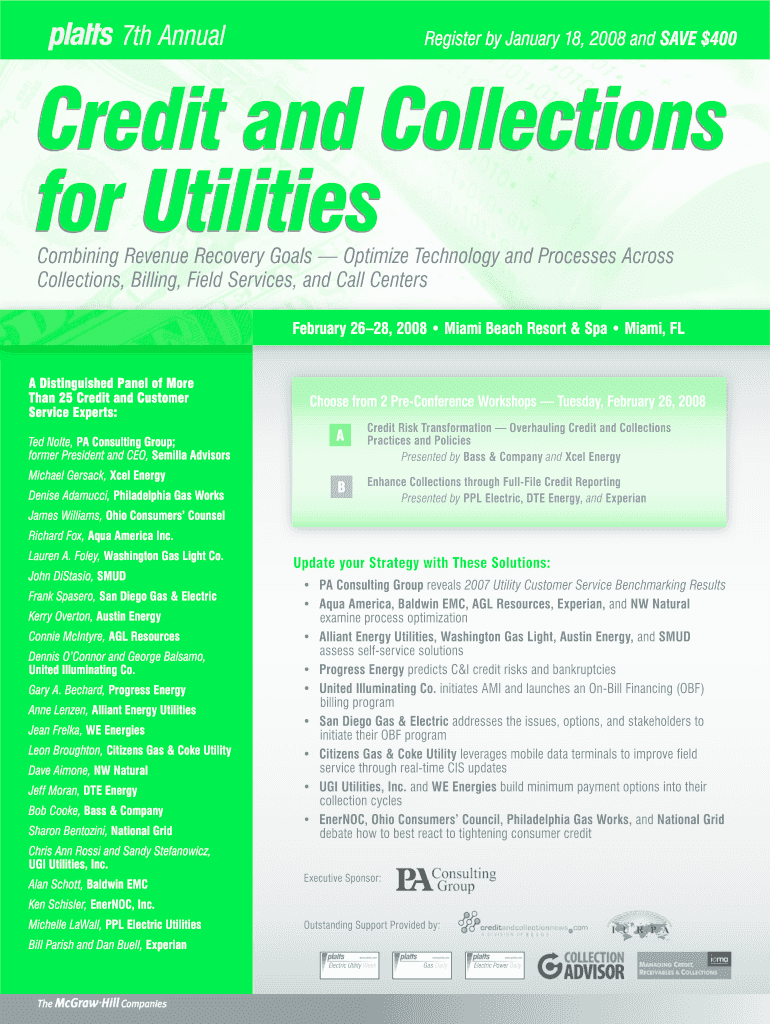

7th Annual Register by January 18, 2008, and SAVE $400 Credit and Collections for Utilities Combining Revenue Recovery Goals Optimize Technology and Processes Across Collections, Billing, Field Services,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit and collections

Edit your credit and collections form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit and collections form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit and collections online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit credit and collections. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit and collections

How to fill out credit and collections:

01

Gather all relevant financial information: Start by collecting all the necessary financial documents, such as invoices, receipts, and statements. This will help you have a clear overview of the outstanding debts and the customers who owe you money.

02

Review and update customer information: Check the accuracy of the customer information in your credit and collections system. Make sure you have their correct contact details, billing address, and payment terms. Update any outdated information to avoid communication issues later.

03

Set clear credit and payment policies: Establish clear guidelines for offering credit to customers and determine acceptable payment terms. Clearly communicate these policies to all customers to avoid any misunderstandings or disputes.

04

Monitor credit limits: Assign credit limits to each customer based on their payment history, creditworthiness, and any previous collections issues. Regularly review these credit limits and adjust them as necessary to mitigate the risk of non-payment.

05

Implement a collections strategy: Develop a systematic approach for collecting outstanding debts. This can include sending reminders, issuing late payment notices, and engaging in phone or email communication with customers. Ensure you have a process in place for escalating collection efforts if initial attempts are unsuccessful.

06

Keep accurate and up-to-date records: Maintain detailed records of all credit and collections activities. This includes the dates and methods of communication, any payment agreements or arrangements, and any notes or comments regarding customer interactions. This documentation will be essential for tracking progress and resolving disputes.

07

Review and analyze performance: Regularly evaluate the effectiveness of your credit and collections procedures. Monitor key metrics such as average collection period, bad debt ratio, and accounts receivable turnover. Identify areas for improvement and make necessary adjustments to optimize your credit and collections processes.

Who needs credit and collections?

01

Businesses: Credit and collections are crucial for businesses that offer credit terms to their customers. It helps them manage cash flow, minimize bad debts, and maintain a positive financial position.

02

Financial institutions: Banks and lending institutions heavily rely on credit and collections to assess the creditworthiness and repayment capabilities of their borrowers. It ensures the institution's financial stability and minimizes the risk of default.

03

Service providers: Companies in sectors like telecommunications, utilities, and healthcare often extend credit to customers for service payments. Credit and collections help these service providers recover outstanding debts, ensuring the sustainability of their operations.

04

Government agencies: Government entities that provide subsidies or grants often require credit and collections to manage repayments and obligations. This helps them ensure accountability and proper utilization of public funds.

05

Non-profit organizations: Even non-profit organizations may need credit and collections systems to manage outstanding donations, grants, or membership dues. By efficiently tracking and collecting these funds, they can fulfill their mission and provide valuable services.

In summary, filling out credit and collections requires a systematic approach with attention to detail. It caters to various entities ranging from businesses and financial institutions to service providers, government agencies, and non-profit organizations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit and collections?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific credit and collections and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I fill out credit and collections using my mobile device?

Use the pdfFiller mobile app to fill out and sign credit and collections on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I fill out credit and collections on an Android device?

Use the pdfFiller mobile app to complete your credit and collections on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is credit and collections?

Credit and collections is the process of managing accounts receivable, including assessing credit risk, collecting outstanding debts, and optimizing cash flow.

Who is required to file credit and collections?

Businesses, financial institutions, and individuals who extend credit to customers and clients are required to file credit and collections.

How to fill out credit and collections?

To fill out credit and collections, you need to gather information on outstanding debts, assess credit risk, and report this information to the appropriate authorities.

What is the purpose of credit and collections?

The purpose of credit and collections is to manage accounts receivable, minimize credit risk, and optimize cash flow.

What information must be reported on credit and collections?

Information such as outstanding debts, credit risk assessments, and payment history must be reported on credit and collections.

Fill out your credit and collections online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit And Collections is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.