Get the free pdffiller

Show details

Current Financial Statement SBA form 770 10. The Home Subordination Worksheet should be completed by the Lender and returned with the requested information. 11. THE SBA LOAN MUST BE CURRENT PRIOR TO CONSIDERATION OF ANY ACTION. The Small Business Administration will consider a subordination action for the refinance of any liens it is subordinate to for reduction of interest rate with NORMAL CLOSING COSTS. SBA will NOT move downward in lien positi...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for lien subordination form

Edit your sba subordination agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba subordination form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sba application for lien subordination online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sba lien subordination form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sba eidl subordination form

How to fill out SBA application for lien?

Gather necessary information:

01

Prepare all the required documents such as the loan information, borrower information, and lien details.

02

Make sure you have the necessary supporting documents, including any contracts, agreements, or legal paperwork related to the lien.

Access the SBA application portal:

01

Visit the Small Business Administration (SBA) website and navigate to the appropriate section for applying for a lien.

02

Create an account or log in to your existing account if you already have one.

Complete the application:

01

Enter the loan information, including the loan number, amount, and purpose.

02

Provide accurate borrower information, including name, contact details, and business information if applicable.

03

Fill in the details about the lien being applied, such as the collateral involved, lienholder information, and any additional relevant details.

Upload supporting documents:

01

Follow the instructions provided to upload the necessary supporting documents.

02

Ensure that all documents are clear, legible, and in the required format (e.g., PDF, JPEG).

Review and submit the application:

01

Carefully review all the information provided to ensure accuracy and completeness.

02

Make any necessary adjustments or corrections before submitting the application.

03

Once you are confident in the accuracy of the application, submit it through the SBA portal.

Who needs SBA application for lien?

Borrowers seeking loans with collateral:

If you have obtained a loan from a financial institution that requires collateral, such as real estate, equipment, or other assets, you may need to submit an SBA application for a lien.

Lenders or lienholders:

01

Lenders or lienholders who have a financial interest in the collateral provided by a borrower may also require the borrower to complete an SBA application for a lien.

02

This application helps establish the lienholder's legal claim or security interest in the collateral.

Businesses or individuals involved in legal disputes:

If you are involved in a legal dispute related to a loan or collateral, an SBA application for a lien may be necessary to document and protect the parties' interests.

Anyone seeking SBA loan forgiveness or loan modification:

In certain circumstances, borrowers who are requesting SBA loan forgiveness or loan modification may be required to fill out an SBA application for a lien to provide additional information or update existing lien details.

Please note that specific requirements and processes may vary, so it is recommended to consult the SBA website or contact the appropriate authorities for detailed and up-to-date instructions on filling out the SBA application for a lien.

Fill

can an sba loan be subordinated

: Try Risk Free

People Also Ask about sba subordination worksheet

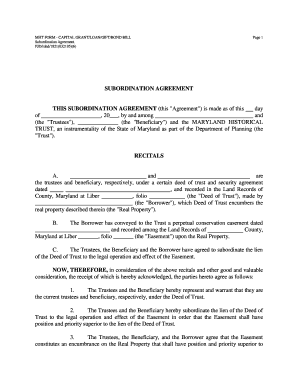

What is a subordinate lien agreement?

A lien subordination agreement is a contract between the lender and the borrower. It gives the lender priority over other creditors if the borrower's business goes bankrupt. The agreement can be made with any lending institution, including banks, credit unions, or even individuals who lend money to businesses.

What is the reason for lien subordination?

A subordination clause serves to protect the lender if a homeowner defaults. If this happens, the lender then has the legal standing to repossess the home and cover their loan's outstanding balance first. If other subordinate mortgages are involved, the secondary liens will take a backseat in this process.

What does application for lien subordination mean?

Lien Subordination occurs when the Department of Revenue allows its lien to take a lower priority than someone else's lien. Lien Subordination is made at the discretion of the Department of Revenue.

What does subordination of lien mean?

A mortgage subordination refers to the order the outstanding liens on your property get repaid if you stop making your mortgage payments. For example, your first home loan (primary mortgage) is repaid first, with any remaining funds paying off additional liens, including second mortgages, HELOCs and home equity loans.

Can SBA loans be subordinated?

If approved, SBA will email an executed Subordination Agreement to the Borrower or Lender at the address provided. The Borrower or Lender will then return its signed Lien Subordination Agreement back to SBA, with the Lender retaining a copy for its loan file.

What is SBA Form 147?

Use this form to document key loan information such as the loan number, the interest rate, the lender, and the borrower.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sba lien subordination form directly from Gmail?

sba subordination request and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I modify sba loan subordination without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your pdffiller form into a dynamic fillable form that you can manage and eSign from anywhere.

Can I sign the pdffiller form electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your pdffiller form in seconds.

What is sba application for lien?

The SBA application for lien is a document used to secure a lien against a borrower's assets by the Small Business Administration when providing a loan. It ensures that the SBA has a legal claim to the borrower's assets in case of default.

Who is required to file sba application for lien?

Any borrower seeking a loan backed by the Small Business Administration is required to file an SBA application for lien to secure the loan with collateral.

How to fill out sba application for lien?

To fill out the SBA application for lien, borrowers must provide relevant business information, details on the assets being used as collateral, and complete any required sections of the application form accurately.

What is the purpose of sba application for lien?

The purpose of the SBA application for lien is to protect the interests of the SBA by ensuring that they can reclaim some funds by claiming the borrower's collateral in the event that the borrower defaults on the loan.

What information must be reported on sba application for lien?

The SBA application for lien must report information such as the borrower's business name, details of the assets or collateral offered, loan amount, and any other necessary identifying information as required by the SBA.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.