Get the free letter from irs kansas city mo 64999

Show details

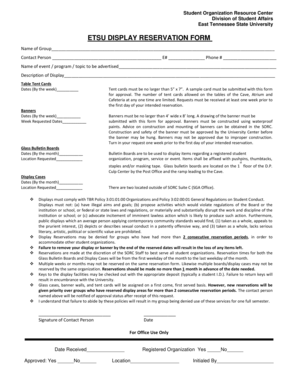

IRS Department of the Treasury Internal Revenue Service Notice CP21A Tax year Notice date March 2 2009 Social Security number 999-99-9999 To contact us Phone 1-999-999-9999 Your Caller ID Page 1 of 2 Kansas City MO 64999-0010 01899954671 JAMES HINDS 22 BOULDER STREET HANSON CT 00000-7253 Changes to your 2004 Form 1040 Amount due 24. Additional information Visit www.irs.gov/cp21a. For tax forms instructions and publications visit www.irs.gov or ca...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign letter from irs kansas city mo 64999 address form

Edit your sample letter from irs kansas city mo 64999 address form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs letter from kansas city form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sample letter from irs kansas city mo 64999 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit letter from irs kansas city form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out internal revenue service center austin tx 73301 0010 form

How to fill out kcsc kansas city mo:

01

Obtain the necessary form from the city of Kansas City's website or local government office.

02

Carefully read all instructions provided on the form to ensure you understand the requirements.

03

Begin by filling out your personal information, such as your name, address, and contact details. Make sure to provide accurate information.

04

Follow the specified sections and provide the requested details accordingly. This may include information about the property or business in question.

05

Pay attention to any specific requirements, such as attaching supporting documents or providing additional information.

06

Review your completed form to ensure all the necessary fields are filled out accurately and completely.

07

Sign and date the form as required.

08

Submit your completed form either online or by mail, following the specified instructions.

Who needs kcsc kansas city mo:

01

Individuals or businesses who wish to engage in certain activities within Kansas City may need to fill out the kcsc (Kansas City, MO, Special Committee) form.

02

This form may be required for various purposes, such as obtaining permits for constructing or modifying a building, holding special events, or operating a business in certain locations.

03

The specific situations and activities that require the kcsc form may vary, and it is advisable to consult the local government or relevant authorities to determine if this form is needed for your particular case.

Fill

letter from irs kansas city mo 64999 0010

: Try Risk Free

People Also Ask about irs kansas city mo phone number

Where do I file Form 709?

Addresses for Forms Beginning with the Number 7 Form Name (For a copy of a Form, Instruction, or Publication)Address to Mail Form to IRS:Original Return - Form 709 United States Gift (and Generation-Skipping Transfer) Tax ReturnDepartment of the Treasury Internal Revenue Service Center Kansas City, MO 6499917 more rows • Nov 29, 2022

Why would I get a letter from the IRS from Kansas City Missouri?

The IRS sends notices and letters for the following reasons: You have a balance due. You are due a larger or smaller refund. We have a question about your tax return.

Why would I get a letter from the Department of Treasury Kansas City?

The Bureau of the Fiscal Service in the Department of the Treasury collects overdue (delinquent) nontax debt for other federal agencies. If you owe money to a federal agency and you did not pay it on time, you have a delinquent debt. You will receive a letter first from the agency to whom you owe the debt.

Why would the IRS send me a letter from Kansas City?

The IRS sends notices and letters for the following reasons: You have a balance due. You are due a larger or smaller refund. We have a question about your tax return.

What does IRS Kansas City do?

This office provides information about federal tax laws, including types of income, charitable contributions, student loan interest, and more. Also accepts IRS payments, can establish payment arrangements, and answers questions about IRS letters or notices.

What IRS notices come from Kansas City?

IRS sending letters to over 9 million people who did not claim various tax benefits. KANSAS CITY, Mo. — Starting this week, the Internal Revenue Service is sending letters to more than 9 million people who qualified for various key tax benefits but did not claim them by filing a 2021 federal income tax return.

How can I tell if a letter from the IRS is real?

Letter Identification Real IRS letters have either a notice number (CP) or letter number (LTR) on either the top or bottom right-hand corner of the letter. If there's no notice number or letter, it's likely that the letter is fraudulent. It's recommended you call the IRS at 800-829-1040.

What is the address for Department of Treasury Internal Revenue?

300 N. Los Angeles St. Monday through Friday, 8:30am to 4:30pm. To navigate, press the arrow keys.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit letter from irs kansas online?

The editing procedure is simple with pdfFiller. Open your letter from irs kansas in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an eSignature for the letter from irs kansas in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your letter from irs kansas and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Can I edit letter from irs kansas on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign letter from irs kansas right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is letter from irs kansas?

A letter from the IRS in Kansas typically refers to correspondence issued by the Internal Revenue Service to taxpayers in the state of Kansas regarding tax matters, which could include notifications, requests for information, or updates on tax status.

Who is required to file letter from irs kansas?

Generally, individuals or businesses that have received a specific notice or request from the IRS regarding tax issues are required to respond or file accordingly. The requirements can vary based on the type of correspondence received.

How to fill out letter from irs kansas?

To fill out a letter from the IRS in Kansas, carefully read the instructions provided in the letter, complete any requested information accurately, and include any necessary documentation or additional forms as required by the IRS.

What is the purpose of letter from irs kansas?

The purpose of a letter from the IRS in Kansas can vary, but it generally aims to inform taxpayers of important tax-related information, such as due amounts, audits, or requirements for documentation, or to notify tax changes or actions taken on their account.

What information must be reported on letter from irs kansas?

The information that must be reported in a letter from the IRS can include taxpayer identification details, financial information relevant to the inquiries, responses to questions posed by the IRS, and any documentation supporting claims or adjustments requested by the taxpayer.

Fill out your letter from irs kansas online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Letter From Irs Kansas is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.