What is Payment Agreement?

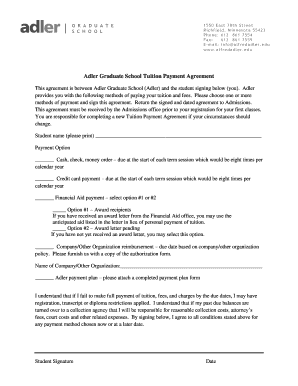

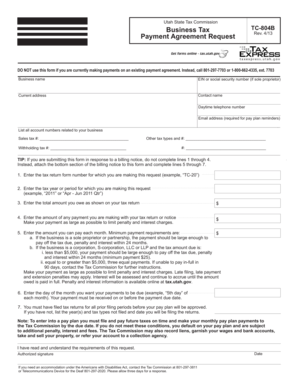

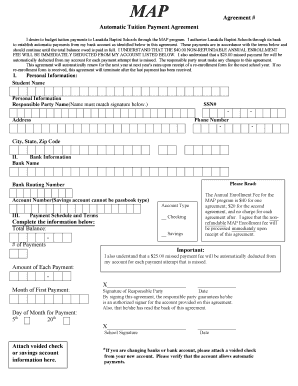

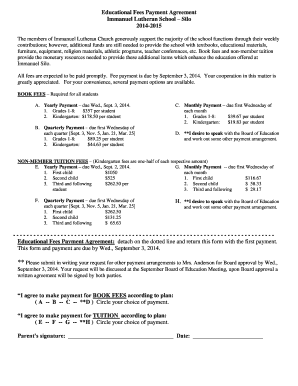

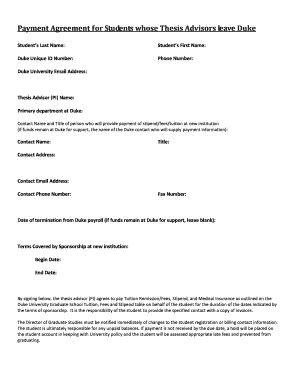

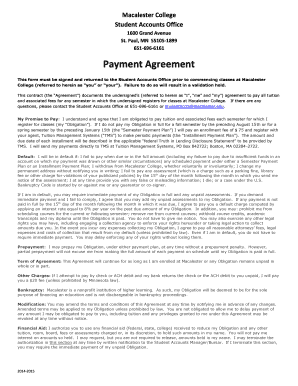

A Payment Agreement is a legally binding contract between two parties that outlines the terms and conditions for the payment of a specific amount of money or the transfer of assets. It provides clarity and protection for both parties involved, ensuring that all payments are made as agreed upon.

What are the types of Payment Agreement?

There are several types of Payment Agreements depending on the nature of the transaction:

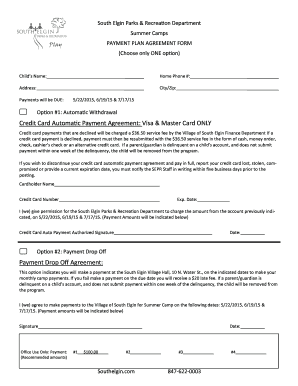

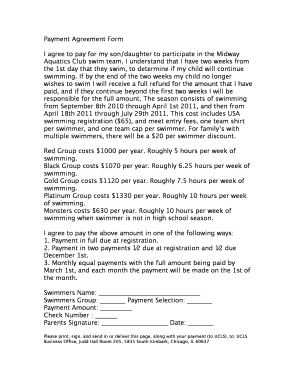

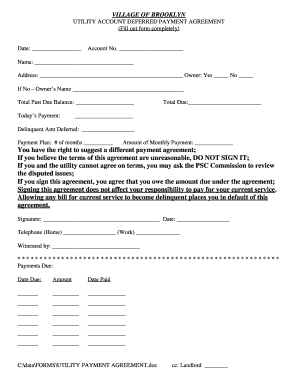

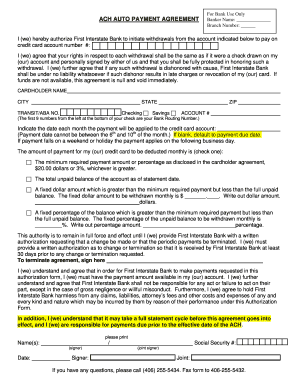

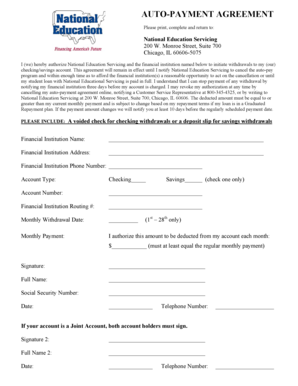

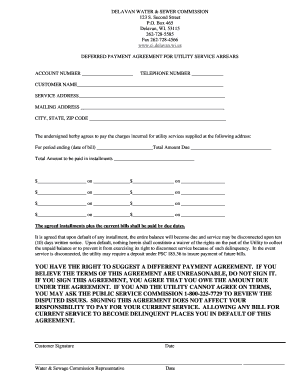

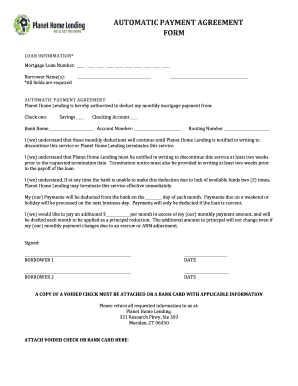

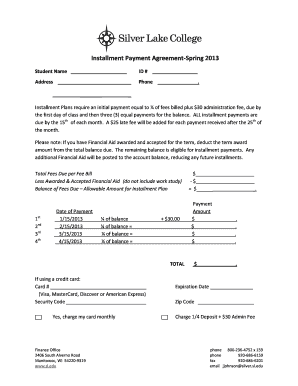

Installment Payment Agreement: This type of agreement allows the payer to make payments over a specified period of time in regular installments.

Lease Payment Agreement: A lease payment agreement is used when leasing or renting a property or equipment, outlining the payment terms and conditions.

Promissory Note: A promissory note is a written promise to repay a specified amount of money by a certain date or according to a specific payment schedule.

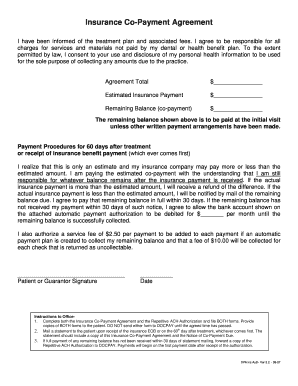

Service Agreement: A service agreement is used when engaging in a service-based business transaction, specifying the payment terms and conditions.

Sales Agreement: A sales agreement outlines the terms and conditions for the sale of goods or services, including payment details.

How to complete Payment Agreement

Completing a Payment Agreement requires careful attention to detail. Here are the steps to follow:

01

Gather all necessary information: Collect all relevant details about the parties involved, payment terms, and any additional conditions.

02

Include essential clauses: Include clauses that specify the payment amount, due dates, late payment penalties, and any other agreed-upon terms.

03

Review and negotiate: Carefully review the agreement and negotiate any terms that do not align with the parties' expectations.

04

Get legal advice if needed: If the Payment Agreement involves significant financial or legal matters, it is advisable to seek legal advice to ensure compliance and protect your interests.

05

Sign and keep copies: Once all parties agree to the terms, sign the agreement and make copies for each party's records.

With pdfFiller, completing and managing Payment Agreements becomes hassle-free. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently and securely.