SC DoR FS-102 2015 free printable template

Show details

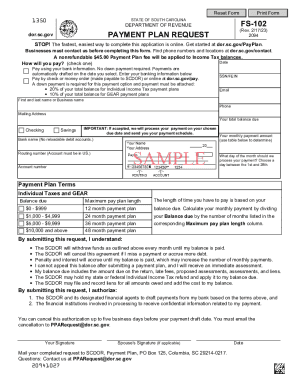

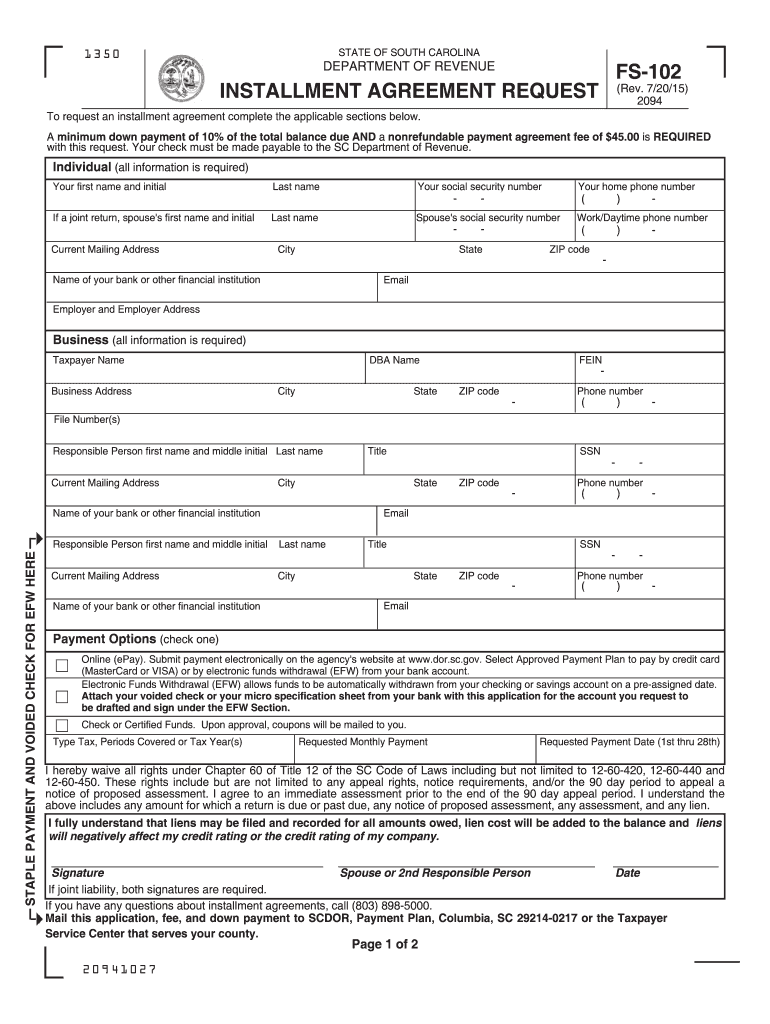

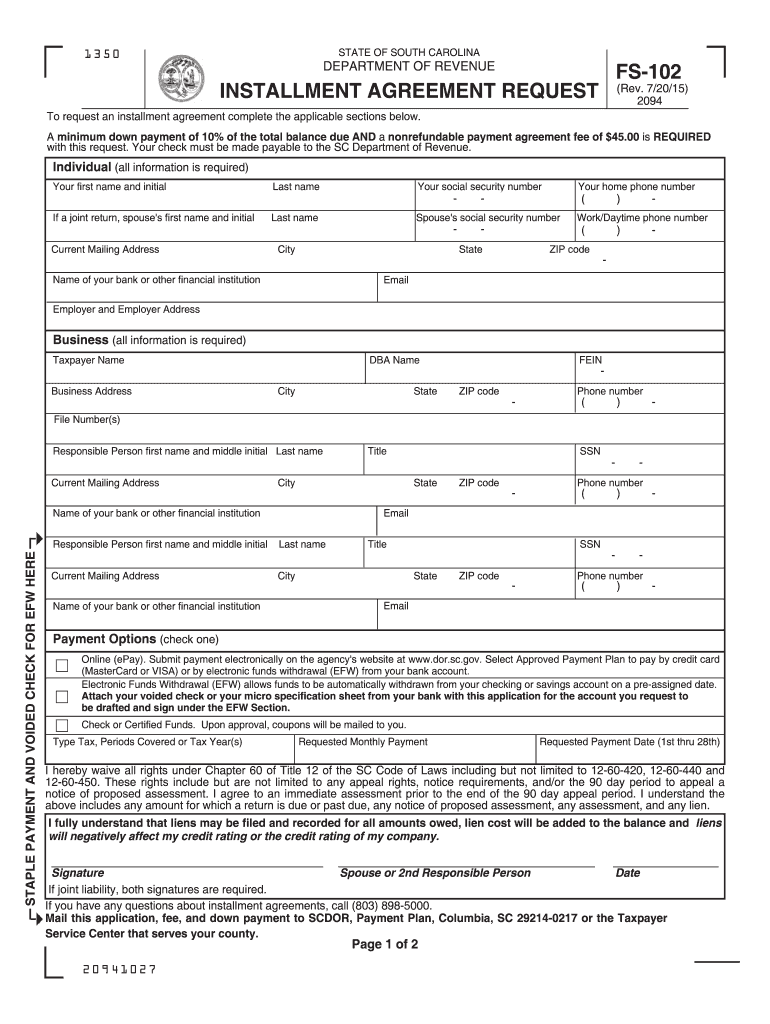

STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE FS-102 INSTALLMENT AGREEMENT REQUEST Rev. 7/20/15 To request an installment agreement complete the applicable sections below. A minimum down payment of 10 of the total balance due AND a nonrefundable payment agreement fee of 45. 00 is REQUIRED with this request. Your check must be made payable to the SC Department of Revenue. Individual all information is required Your first name and initial Last name Your social security number Your home phone...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your fs 102 2015 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fs 102 2015 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fs 102 2015 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fs 102 2015 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

SC DoR FS-102 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out fs 102 2015 form

How to fill out fs 102 2015 form:

01

Gather all necessary information and documents, such as identification, financial records, and any other required paperwork.

02

Carefully read the instructions provided with the form to ensure you understand the requirements and procedures for completion.

03

Begin by filling out the top section of the form, including your personal information, such as name, address, and contact details.

04

Proceed to the next sections, providing the required information as indicated. Make sure to double-check for accuracy and completeness.

05

If applicable, include any additional supporting documentation or attachments that may be required.

06

Sign and date the form as indicated in the designated area. Some forms may require witness signatures or other specific instructions for signing.

07

Review the completed form for any errors or missing information before submitting it.

08

Keep a copy of the completed form and any supporting documentation for your records.

Who needs fs 102 2015 form:

01

Individuals or entities who are required to report financial information to the relevant authorities.

02

This form may be required for various purposes, such as tax filings, financial statements, or regulatory compliance.

03

Specific requirements for needing the fs 102 2015 form may vary depending on jurisdiction and applicable regulations.

Instructions and Help about fs 102 2015 form

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is fs 102 form?

FS 102 form is a tax form used to report financial information related to foreign corporations or businesses.

Who is required to file fs 102 form?

Any individual or entity that has a financial interest in or signature authority over foreign bank accounts or other financial accounts is required to file FS 102 form.

How to fill out fs 102 form?

To fill out FS 102 form, you need to provide information about your foreign financial accounts, including the account numbers, names and addresses of the foreign financial institutions, and the maximum value of the account during the reporting year.

What is the purpose of fs 102 form?

The purpose of FS 102 form is to report foreign financial accounts to the Internal Revenue Service (IRS) and to help prevent tax evasion and money laundering.

What information must be reported on fs 102 form?

On FS 102 form, you must report the details of your foreign financial accounts, such as the account numbers, names and addresses of the foreign financial institutions, and the maximum value of the account during the reporting year.

When is the deadline to file fs 102 form in 2023?

The deadline to file FS 102 form in 2023 is April 17th.

What is the penalty for the late filing of fs 102 form?

The penalty for late filing of FS 102 form can be up to $10,000 per account, depending on the circumstances.

How can I edit fs 102 2015 form from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your fs 102 2015 form into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send fs 102 2015 form for eSignature?

When you're ready to share your fs 102 2015 form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit fs 102 2015 form in Chrome?

Install the pdfFiller Google Chrome Extension to edit fs 102 2015 form and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Fill out your fs 102 2015 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.