SC DoR FS-102 2021 free printable template

Show details

Reset Form

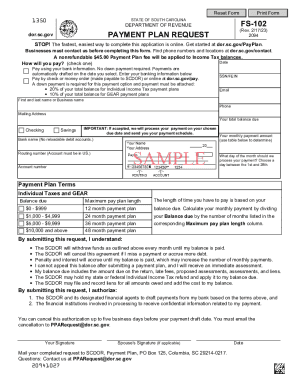

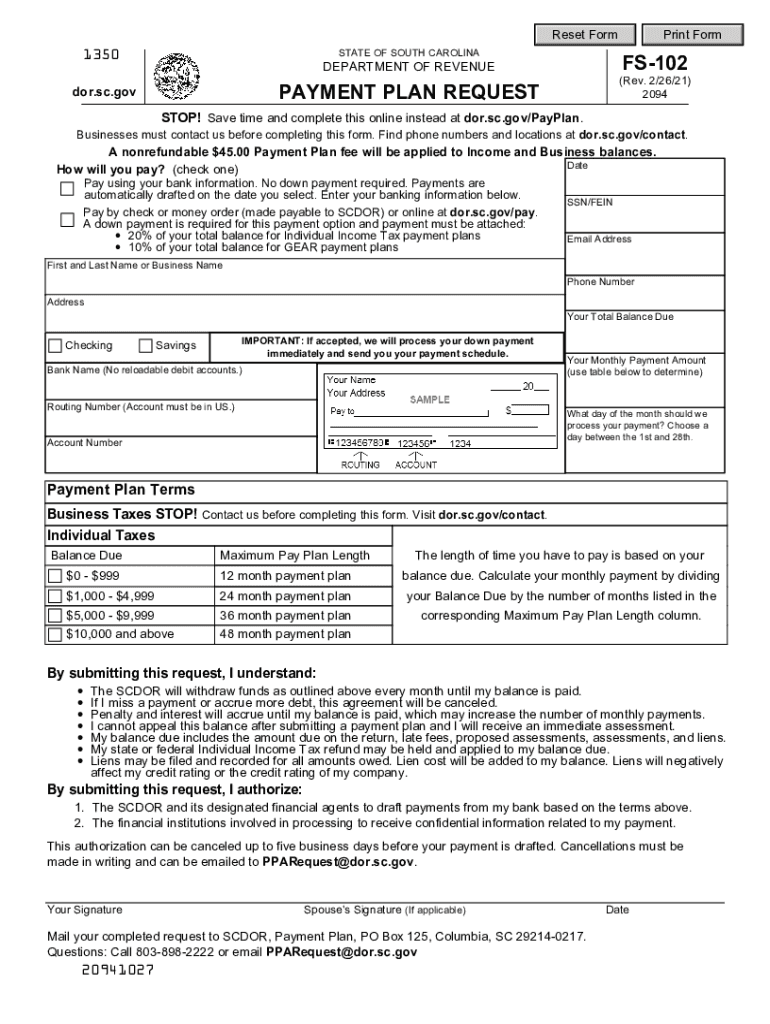

STATE OF SOUTH CAROLINA1350FS102DEPARTMENT OF REVENUE(Rev. 2/26/21)

2094PAYMENT PLAN Requestor.SC.covering Form STOP! Save time and complete this online instead at dor.sc.gov/PayPlan. Businesses

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC DoR FS-102

Edit your SC DoR FS-102 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR FS-102 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SC DoR FS-102 online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SC DoR FS-102. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR FS-102 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC DoR FS-102

How to fill out SC DoR FS-102

01

Obtain the SC DoR FS-102 form from the South Carolina Department of Revenue website or your local tax office.

02

Fill out your personal information in the designated fields, including your name, address, and taxpayer identification number.

03

Complete the section detailing your income sources and amounts for the applicable tax year.

04

Include any deductions or credits you are claiming as per the guidelines provided on the form.

05

Review the completed form for accuracy and ensure all required fields are filled out.

06

Sign and date the form where indicated.

07

Submit the form through the specified method (online, by mail, etc.) as per the instructions provided.

Who needs SC DoR FS-102?

01

Individuals residing in South Carolina who are filing their tax returns.

02

Businesses operating within South Carolina that need to report their tax obligations.

03

Tax professionals assisting clients in submitting their tax information to the South Carolina Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

Does SC have a payment plan for taxes?

You can set up a Payment Plan Agreement based on the following parameters: Determine your Balance Owed by adding ALL of your South Carolina Individual Income Tax or GEAR debts together.

How do I get a SC state tax ID number?

It's possible to find a paper application, and fill out the questionnaire by hand; after that, you'll need to send it in via traditional mail or fax. You could also talk to a representative over the phone, assuming you call in during normal working hours.

What are two types of the South Carolina state income tax forms?

Form NameForm NumberForm NameComposite Return AffidavitForm NumberI-338Form NameRecapture of South Carolina Housing Tax CreditForm NumberSC SCH TC 63RForm NameDeferred Income Taxes for South CarolinaForm NumberSC SCH TD-1Form NameIndividual Declaration of Estimated TaxForm NumberSC1040ES7 more rows

What is South Carolina financial institution tax?

Summary. All banks engaged in business in South Carolina are required to register and pay the 4.5% due on South Carolina net income. Banks are required to make Estimated Tax payments. Banks are not subject to a License Fee.

How do I get a SC tax ID number?

You can register for one online, or by completing an SS-4 and mailing it in. The IRS requires a business to have an FEIN if the business: Already has employees. Intends on hiring employees.

How much does it cost to get a tax ID number in South Carolina?

Applying for an EIN for your South Carolina LLC is completely free. The IRS doesn't charge any service fees for the EIN online application.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify SC DoR FS-102 without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including SC DoR FS-102, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Where do I find SC DoR FS-102?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the SC DoR FS-102. Open it immediately and start altering it with sophisticated capabilities.

How do I complete SC DoR FS-102 online?

Easy online SC DoR FS-102 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

What is SC DoR FS-102?

SC DoR FS-102 is a form used by the South Carolina Department of Revenue for specific reporting requirements related to certain tax filings.

Who is required to file SC DoR FS-102?

Entities or individuals that have specific tax obligations or are required to report certain information related to their financial activities in South Carolina must file SC DoR FS-102.

How to fill out SC DoR FS-102?

To fill out SC DoR FS-102, provide accurate financial information as requested on the form, ensuring all sections are completed and any necessary documentation is attached.

What is the purpose of SC DoR FS-102?

The purpose of SC DoR FS-102 is to collect necessary financial data from taxpayers to ensure compliance with state tax laws and to facilitate the accurate processing of tax obligations.

What information must be reported on SC DoR FS-102?

The information required on SC DoR FS-102 typically includes details about income, deductions, exemptions, and other relevant financial data specific to the taxpayer's situation.

Fill out your SC DoR FS-102 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR FS-102 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.