SC DoR FS-102 2012 free printable template

Show details

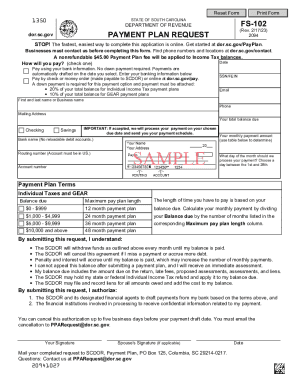

STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE FS-102 INSTALLMENT AGREEMENT REQUEST Rev. 11/29/12 Instructions If you would like to make scheduled payments on your outstanding liability complete this form. A nonrefundable payment agreement fee of 45. 00 will be charged and added to your liability. If you have an open sales license please contact the Taxpayer Service Center that serves your county to discuss your account. If your company qualifies for the Job Development Credit you will be...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC DoR FS-102

Edit your SC DoR FS-102 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR FS-102 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SC DoR FS-102 online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SC DoR FS-102. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR FS-102 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC DoR FS-102

How to fill out SC DoR FS-102

01

Obtain the SC DoR FS-102 form from the official website or your local Department of Revenue office.

02

Read the instructions carefully to understand the information required.

03

Fill in your personal details such as name, address, and contact information at the top of the form.

04

Provide the specific details regarding your financial situation as requested on the form.

05

Attach any necessary documentation that supports the information provided.

06

Review the completed form for accuracy and ensure all required fields are filled out.

07

Sign and date the form at the designated area.

08

Submit the form to the Department of Revenue through the indicated method (mail, in-person, or online).

Who needs SC DoR FS-102?

01

Individuals or entities who are applying for financial assistance, tax relief, or related programs administered by the state.

02

Taxpayers who need to report financial information to the Department of Revenue.

03

Businesses seeking to apply for specific financial programs or exemptions.

Fill

form

: Try Risk Free

People Also Ask about

What is SC1040 form?

If you file as a full-year resident, file the SC1040. Report all your income as though you were a resident for the entire year. You will be allowed a credit for taxes paid on income taxed by South Carolina and another state. Complete the SC1040TC and attach a copy of the other state's Income Tax return.

Who files SC1040?

A nonresident individual receiving South Carolina income from wages, rental property, businesses, or other investments in South Carolina, must file an SC1040 South Carolina Individual Income Tax Return and Schedule NR Nonresident Schedule.

What is the $800 tax rebate in SC?

Rebates are based on your 2021 tax liability, up to a cap. The rebate cap – the maximum rebate amount a taxpayer can receive – is $800. If your tax liability is less than $800, your rebate will be the same amount as your tax liability. If your tax liability is over the $800 cap, you will receive a rebate for $800.

What is a 1040 form used for?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What is the drip trickle irrigation credit for SC?

The credit is for 25% of expenses made in a tax year. File a separate SCH TC-1 for each measure. Claim the credit only one time for each of the three measures. The credit is limited to a maximum of $2,500 in a tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my SC DoR FS-102 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your SC DoR FS-102 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I edit SC DoR FS-102 on an iOS device?

Create, edit, and share SC DoR FS-102 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I edit SC DoR FS-102 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like SC DoR FS-102. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is SC DoR FS-102?

SC DoR FS-102 is a form used in South Carolina to report certain financial transactions and compliance information by specific individuals or organizations.

Who is required to file SC DoR FS-102?

Individuals or entities involved in certain financial transactions or operations in South Carolina may be required to file SC DoR FS-102, particularly those that fall under specific regulatory requirements.

How to fill out SC DoR FS-102?

To fill out SC DoR FS-102, gather the necessary financial information, follow the instructions provided with the form carefully, complete all required sections accurately, and ensure submission before the deadline.

What is the purpose of SC DoR FS-102?

The purpose of SC DoR FS-102 is to ensure transparency and compliance with financial regulations, allowing the state to monitor financial activities and enforce laws.

What information must be reported on SC DoR FS-102?

The information that must be reported on SC DoR FS-102 includes details about financial transactions, entity information, compliance status, and any other data required by South Carolina's regulatory authorities.

Fill out your SC DoR FS-102 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR FS-102 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.