SC DoR FS-102 2019 free printable template

Show details

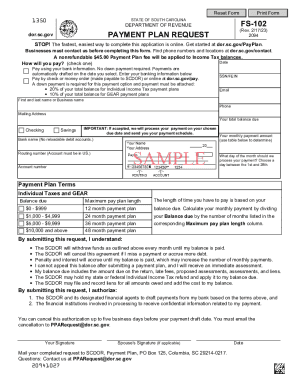

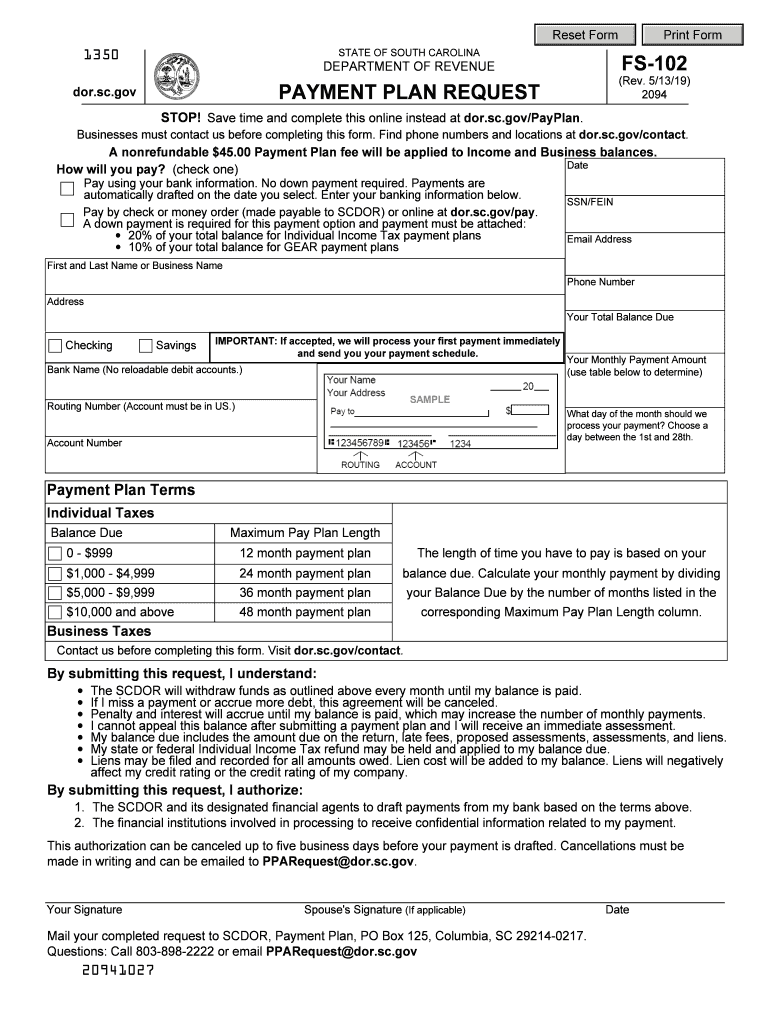

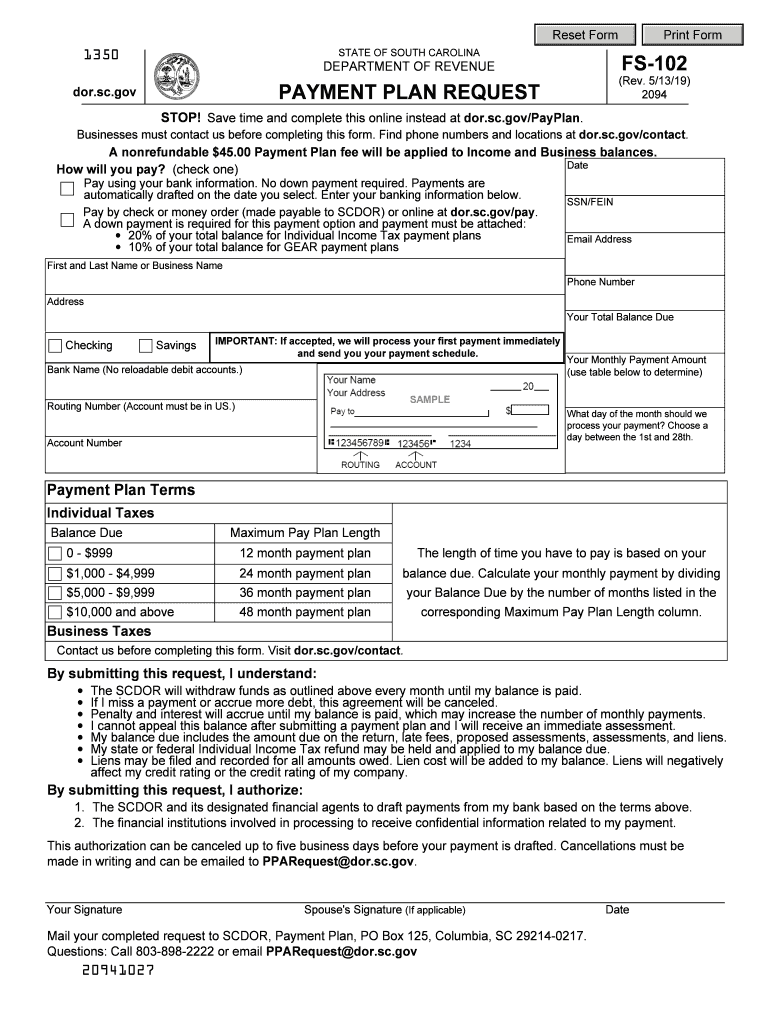

Reset Form STATE OF SOUTH CAROLINA FS-102 DEPARTMENT OF REVENUE PAYMENT PLAN REQUEST dor. sc.gov Print Form Rev. 7/30/18 To request a payment plan apply online at dor. sc*gov/payplan or complete all applicable sections. A nonrefundable payment plan fee of 45 will be applied to your balance. Date Name and Address SSN/FEIN Email Address Phone Number Checking Savings IMPORTANT If accepted we will process your first payment immediately. Balance Due You will then be notified of your subsequent...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC DoR FS-102

Edit your SC DoR FS-102 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR FS-102 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC DoR FS-102 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit SC DoR FS-102. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR FS-102 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC DoR FS-102

How to fill out SC DoR FS-102

01

Begin by downloading the SC DoR FS-102 form from the official website.

02

Enter your personal information in the designated fields, including your full name, address, and contact details.

03

Provide information about your vehicle, including the make, model, year, and VIN (Vehicle Identification Number).

04

Fill out the details regarding the reason for the application, such as new registration, renewal, or transfer.

05

Attach any required supporting documents, such as proof of ownership or identity.

06

Review the form for complete and accurate information before submission.

07

Submit the completed form either online, if available, or by mailing it to the appropriate department.

Who needs SC DoR FS-102?

01

Individuals or businesses seeking to register a vehicle in South Carolina.

02

Those who need to transfer vehicle ownership.

03

Applicants needing to update their vehicle registration information.

04

Anyone applying for a renewal of their vehicle registration.

Instructions and Help about SC DoR FS-102

Fill

form

: Try Risk Free

People Also Ask about

Does SC have a payment plan for taxes?

You can set up a Payment Plan Agreement based on the following parameters: Determine your Balance Owed by adding ALL of your South Carolina Individual Income Tax or GEAR debts together.

How do I get a SC state tax ID number?

It's possible to find a paper application, and fill out the questionnaire by hand; after that, you'll need to send it in via traditional mail or fax. You could also talk to a representative over the phone, assuming you call in during normal working hours.

What are two types of the South Carolina state income tax forms?

Form NameForm NumberForm NameComposite Return AffidavitForm NumberI-338Form NameRecapture of South Carolina Housing Tax CreditForm NumberSC SCH TC 63RForm NameDeferred Income Taxes for South CarolinaForm NumberSC SCH TD-1Form NameIndividual Declaration of Estimated TaxForm NumberSC1040ES7 more rows

What is South Carolina financial institution tax?

Summary. All banks engaged in business in South Carolina are required to register and pay the 4.5% due on South Carolina net income. Banks are required to make Estimated Tax payments. Banks are not subject to a License Fee.

How do I get a SC tax ID number?

You can register for one online, or by completing an SS-4 and mailing it in. The IRS requires a business to have an FEIN if the business: Already has employees. Intends on hiring employees.

How much does it cost to get a tax ID number in South Carolina?

Applying for an EIN for your South Carolina LLC is completely free. The IRS doesn't charge any service fees for the EIN online application.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send SC DoR FS-102 to be eSigned by others?

Once your SC DoR FS-102 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit SC DoR FS-102 in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your SC DoR FS-102, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out SC DoR FS-102 using my mobile device?

Use the pdfFiller mobile app to complete and sign SC DoR FS-102 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is SC DoR FS-102?

SC DoR FS-102 is a form used in South Carolina for the disclosure of certain financial information by specific entities during the reporting process.

Who is required to file SC DoR FS-102?

Entities that fall under specific regulatory requirements in South Carolina, such as corporations, partnerships, or other business entities involved in certain transactions, are required to file SC DoR FS-102.

How to fill out SC DoR FS-102?

To fill out SC DoR FS-102, businesses must provide the necessary financial information, ensuring accuracy and completeness, and then submit it to the appropriate state department as per the guidelines provided.

What is the purpose of SC DoR FS-102?

The purpose of SC DoR FS-102 is to collect and report financial data that aids regulatory oversight and ensures compliance with state financial regulations.

What information must be reported on SC DoR FS-102?

The form requires reporting of financial metrics, transaction details, ownership information, and any specifics related to the business's financial activities that are relevant to compliance.

Fill out your SC DoR FS-102 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR FS-102 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.