SC DoR FS-102 2022 free printable template

Show details

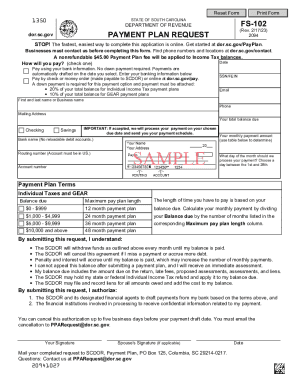

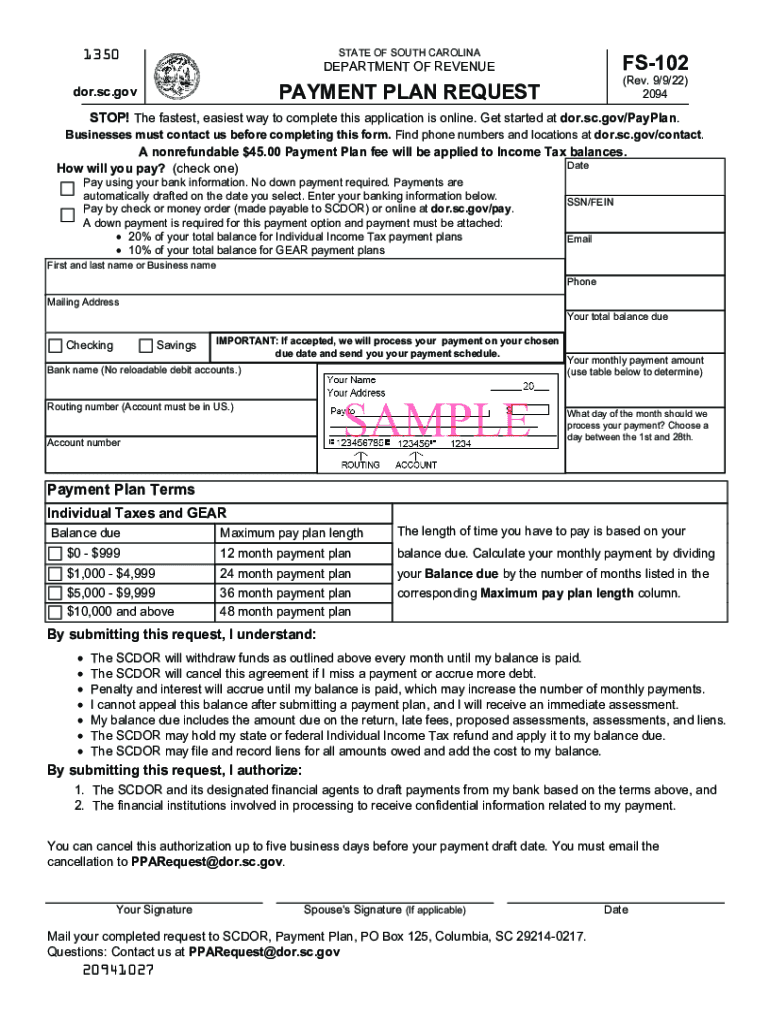

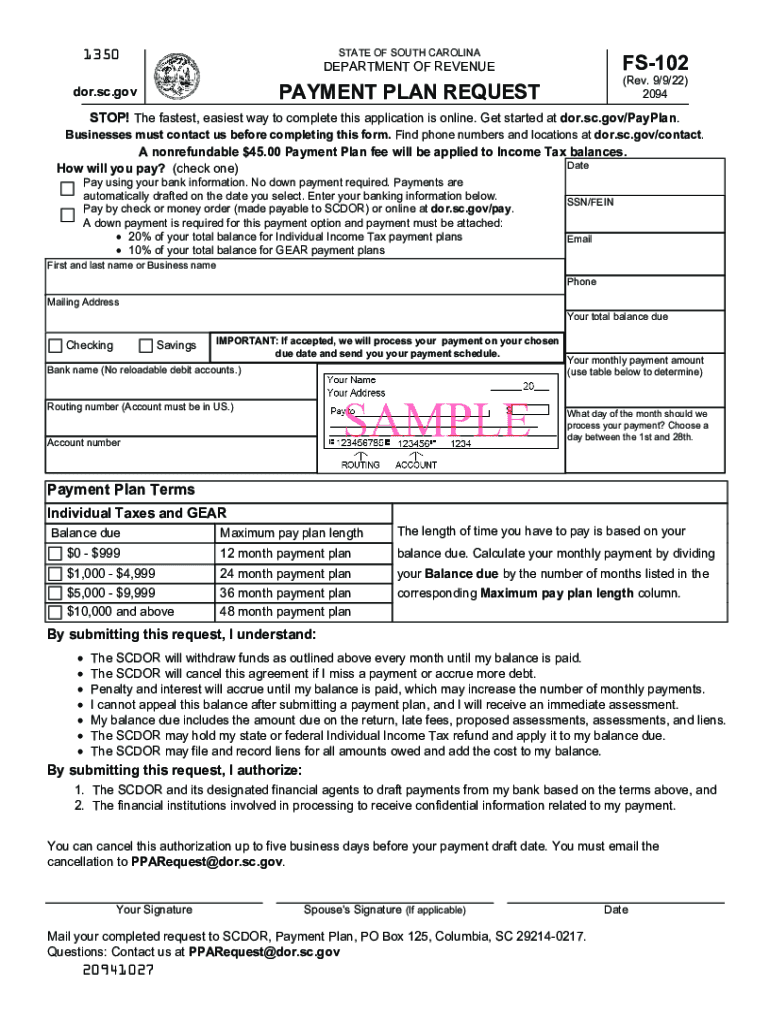

STATE OF SOUTH CAROLINA FS-102 DEPARTMENT OF REVENUE Rev. 9/9/22 PAYMENT PLAN REQUEST dor. sc.gov STOP The fastest easiest way to complete this application is online. Get started at dor. sc*gov/PayPlan* Businesses must contact us before completing this form* Find phone numbers and locations at dor. sc*gov/contact. A nonrefundable 45. 00 Payment Plan fee will be applied to Income Tax balances. Date How will you pay check one Pay using your bank information* No down payment required* Payments...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC DoR FS-102

Edit your SC DoR FS-102 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR FS-102 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SC DoR FS-102 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SC DoR FS-102. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR FS-102 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC DoR FS-102

How to fill out SC DoR FS-102

01

Start by downloading the SC DoR FS-102 form from the official website.

02

Fill out the top section with your personal information including your name, address, and contact details.

03

In the next section, provide details regarding the transaction or statutory purpose the form is for.

04

Complete any required financial information related to the request.

05

Review the form for accuracy and completeness to avoid delays.

06

Sign and date the form where indicated.

07

Submit the completed form according to the instructions provided.

Who needs SC DoR FS-102?

01

Individuals or businesses that need to request a specific service from the South Carolina Department of Revenue.

02

Taxpayers looking to clarify their tax obligations or request exemptions.

03

Anyone involved in a transaction that requires documentation for compliance with state regulations.

Instructions and Help about SC DoR FS-102

Fill

form

: Try Risk Free

People Also Ask about

Does SC have a payment plan for taxes?

You can set up a Payment Plan Agreement based on the following parameters: Determine your Balance Owed by adding ALL of your South Carolina Individual Income Tax or GEAR debts together.

How do I get a SC state tax ID number?

It's possible to find a paper application, and fill out the questionnaire by hand; after that, you'll need to send it in via traditional mail or fax. You could also talk to a representative over the phone, assuming you call in during normal working hours.

What are two types of the South Carolina state income tax forms?

Form NameForm NumberForm NameComposite Return AffidavitForm NumberI-338Form NameRecapture of South Carolina Housing Tax CreditForm NumberSC SCH TC 63RForm NameDeferred Income Taxes for South CarolinaForm NumberSC SCH TD-1Form NameIndividual Declaration of Estimated TaxForm NumberSC1040ES7 more rows

What is South Carolina financial institution tax?

Summary. All banks engaged in business in South Carolina are required to register and pay the 4.5% due on South Carolina net income. Banks are required to make Estimated Tax payments. Banks are not subject to a License Fee.

How do I get a SC tax ID number?

You can register for one online, or by completing an SS-4 and mailing it in. The IRS requires a business to have an FEIN if the business: Already has employees. Intends on hiring employees.

How much does it cost to get a tax ID number in South Carolina?

Applying for an EIN for your South Carolina LLC is completely free. The IRS doesn't charge any service fees for the EIN online application.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my SC DoR FS-102 in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your SC DoR FS-102 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send SC DoR FS-102 to be eSigned by others?

When your SC DoR FS-102 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for the SC DoR FS-102 in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your SC DoR FS-102 in seconds.

What is SC DoR FS-102?

SC DoR FS-102 is a form used in South Carolina to report various financial activities and transactions as required by the Department of Revenue.

Who is required to file SC DoR FS-102?

Any individual or entity engaged in taxable activities within South Carolina that meets the reporting criteria is required to file SC DoR FS-102.

How to fill out SC DoR FS-102?

To fill out SC DoR FS-102, individuals or entities must provide accurate financial data, follow the instructions on the form, and ensure all required fields are completed before submission.

What is the purpose of SC DoR FS-102?

The purpose of SC DoR FS-102 is to collect essential financial information from taxpayers in South Carolina for the assessment and collection of state taxes.

What information must be reported on SC DoR FS-102?

The information required on SC DoR FS-102 includes details of income, expenses, tax liabilities, and any other relevant financial data as specified by the form's instructions.

Fill out your SC DoR FS-102 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR FS-102 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.