SC DoR FS-102 2022 free printable template

Show details

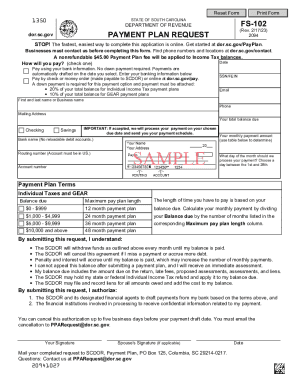

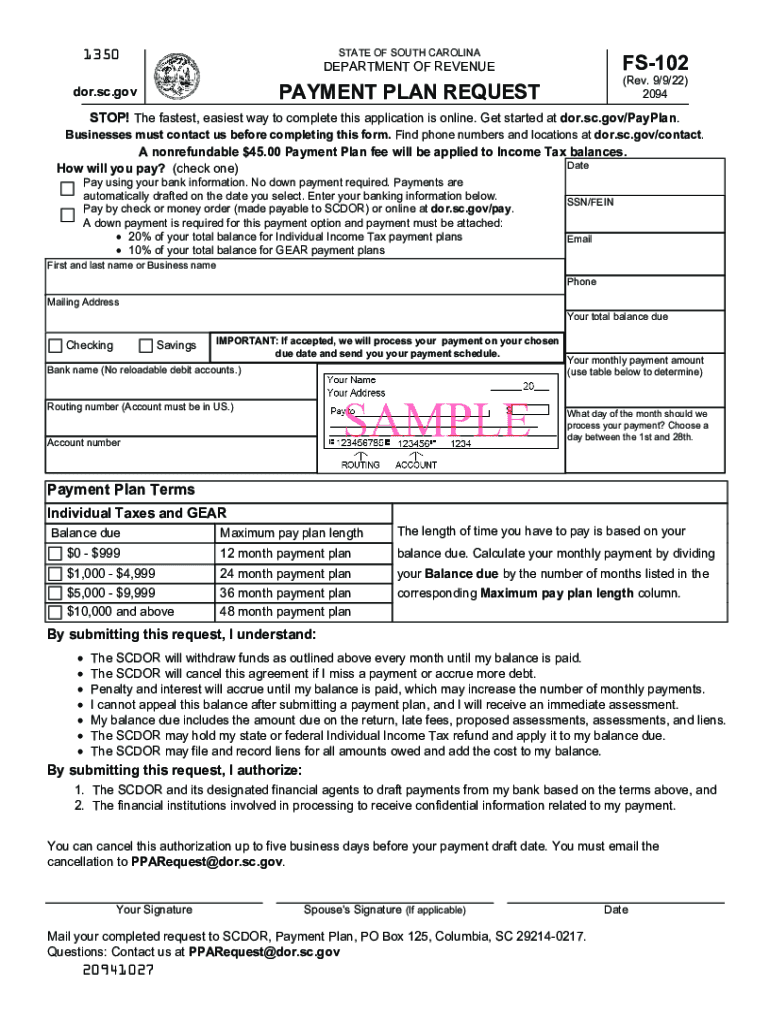

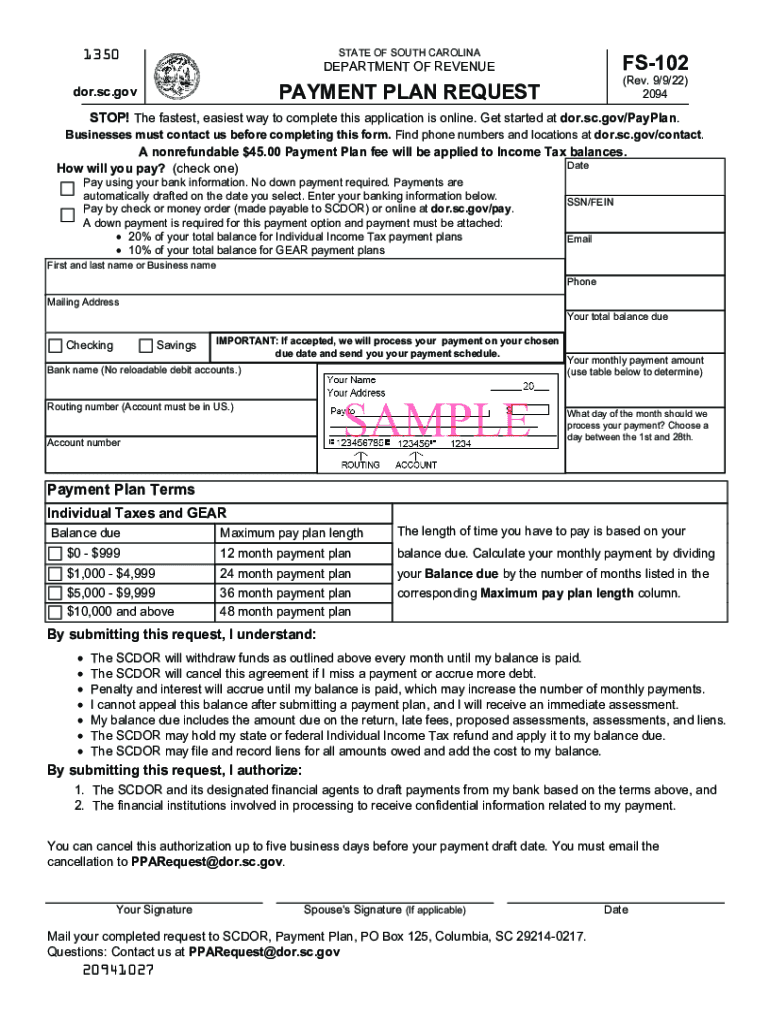

STATE OF SOUTH CAROLINA FS-102 DEPARTMENT OF REVENUE Rev. 9/9/22 PAYMENT PLAN REQUEST dor. sc.gov STOP The fastest easiest way to complete this application is online. Get started at dor. sc*gov/PayPlan* Businesses must contact us before completing this form* Find phone numbers and locations at dor. sc*gov/contact. A nonrefundable 45. 00 Payment Plan fee will be applied to Income Tax balances. Date How will you pay check one Pay using your bank information* No down payment required* Payments...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your south carolina fs 2022 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your south carolina fs 2022 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit south carolina fs online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fs147 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

SC DoR FS-102 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out south carolina fs 2022

How to fill out South Carolina FS:

01

Start by obtaining a copy of the South Carolina FS form from the appropriate source.

02

Carefully read through the instructions provided with the form to understand the requirements and gather all necessary information.

03

Begin filling out the form by providing your personal details such as your name, address, social security number, and contact information.

04

Follow the prompts on the form to provide information about your income, including any wages, self-employment earnings, rental income, or other sources of income.

05

Report any deductions or expenses that may apply to you, such as business expenses or educational expenses.

06

If you have any dependents, provide their information as required on the form.

07

Review your completed form for any errors or missing information.

08

Sign and date the form before submitting it as directed by the instructions.

Who needs South Carolina FS:

01

Individuals or families who meet the eligibility criteria for any state assistance programs in South Carolina that require the completion of the FS form.

02

Those who need to determine their eligibility for the Supplemental Nutrition Assistance Program (SNAP) or other food assistance programs in the state.

03

Residents of South Carolina who require financial assistance for purchasing food or meeting their basic needs and fulfill the income and other requirements.

Video instructions and help with filling out and completing south carolina fs

Instructions and Help about fs 147 form form

Fill scdor payment : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What information must be reported on south carolina fs?

South Carolina requires all businesses to file an annual report with the South Carolina Secretary of State. The annual report must include the name and address of the business, the name and address of the registered agent, and the type of business entity. It must also include the names of the officers, directors, or persons in charge of the business, the principal place of business, and the type of business activity conducted.

What is the penalty for the late filing of south carolina fs?

The penalty for the late filing of a South Carolina FS (franchise tax return) is $50 per month or fraction thereof, up to a maximum of $500.

What is south carolina fs?

There is no specific term or acronym called "South Carolina FS" that is widely recognized. It could possibly refer to a variety of things related to South Carolina, such as South Carolina's financial services industry, South Carolina Forestry Commission, or any other organization, place, or concept related to South Carolina that uses the letters "FS" in its name or abbreviation. More context would be needed to provide a more specific answer.

Who is required to file south carolina fs?

The individuals or businesses that are required to file South Carolina state tax returns, known as SC1040, are:

1. South Carolina residents who have a federal filing requirement.

2. Non-residents who have income from South Carolina sources and are required to file a federal tax return.

3. Part-year residents who have income from South Carolina sources during the period they were a resident of the state.

4. Estates or trusts with income derived from South Carolina sources.

5. Non-resident spouses of military service members stationed in South Carolina who have income from South Carolina sources.

6. Partnerships, including limited liability companies taxed as partnerships, that have income derived from South Carolina sources or have South Carolina nonresident partners.

7. S corporations, including limited liability companies taxed as S corporations, that have income derived from South Carolina sources or have South Carolina nonresident shareholders.

8. Nonprofit organizations that have unrelated business taxable income from South Carolina.

It is advisable to consult with a certified tax professional or refer to the South Carolina Department of Revenue for more comprehensive and up-to-date information regarding filing requirements.

How to fill out south carolina fs?

To fill out the South Carolina FS (Financial Statement), follow these steps:

1. Download the South Carolina FS form from the official South Carolina court website or obtain a copy from the court clerk.

2. Begin by entering the case number and court information at the top of the form.

3. Fill in your personal information, including your name, address, telephone number, and email address.

4. Provide information about your attorney, if applicable.

5. Specify whether you are the petitioner or respondent.

6. Enter your spouse's information, including their name, address, telephone number, and email address.

7. Indicate whether you have any children and provide their names and ages.

8. List any pending related cases.

9. Complete the income section by detailing your gross income, deductions, and net income for each source.

10. Fill out the expenses section by listing your monthly expenses, including housing costs, child support, insurance, debts, and other pertinent expenses.

11. Provide information about your assets, such as real estate, bank accounts, vehicles, retirement accounts, and other valuable possessions.

12. Disclose any debts or liabilities you have, including loans, credit card balances, medical bills, and other outstanding obligations.

13. Sign and date the form, and make sure your spouse also signs if applicable.

14. Make several copies of the completed form for your records, as well as for the court and your attorney (if applicable).

15. File the original form with the court clerk according to the specific filing instructions provided by the court.

It is advisable to consult with an attorney or seek legal advice to ensure that you accurately and adequately complete the South Carolina FS form.

What is the purpose of south carolina fs?

South Carolina FS refers to the South Carolina Freedom of Information Act (FOIA). The purpose of South Carolina FS is to promote transparency and accountability in government by granting individuals the right to access public records and meetings of state and local government entities. The law ensures that South Carolina residents can exercise their rights to obtain information about their government, fostering openness, and informing citizens about the activities and decisions of public officials.

How do I modify my south carolina fs in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your fs147 form along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send south carolina installment to be eSigned by others?

When your sc 102 form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for the sc installment agreement in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your fs 102 form in seconds.

Fill out your south carolina fs 2022 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

South Carolina Installment is not the form you're looking for?Search for another form here.

Keywords relevant to form fs 102

Related to sc fs 102

If you believe that this page should be taken down, please follow our DMCA take down process

here

.