Irs Payment Plan Balance

What is irs payment plan balance?

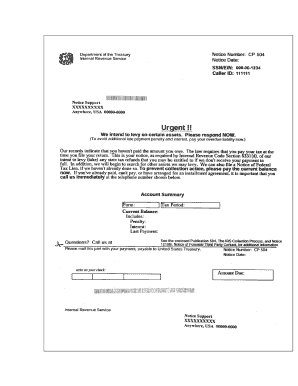

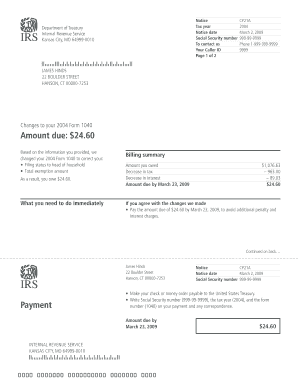

An IRS payment plan balance refers to the amount of money that an individual or business owes to the Internal Revenue Service (IRS) as part of an agreed-upon payment plan. When a taxpayer cannot pay their taxes in full, they can arrange a payment plan with the IRS to make monthly payments over time. The payment plan balance is the remaining amount owed after each monthly payment is made.

What are the types of irs payment plan balance?

There are generally two types of IRS payment plan balances: 1. Installment Agreement: This is the most common type of payment plan, where the taxpayer agrees to make regular monthly payments until the balance is paid off. 2. Offer in Compromise: In certain situations, the taxpayer may be eligible to settle their tax debt for less than the full amount owed. This requires a formal proposal to the IRS, which will be considered based on the taxpayer's ability to pay.

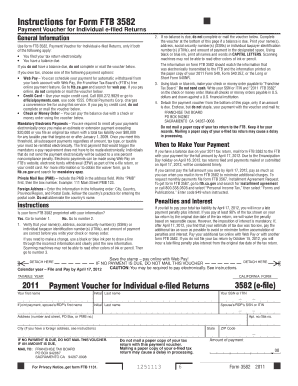

How to complete irs payment plan balance

Completing an IRS payment plan balance involves the following steps: 1. Determine eligibility: Check if you meet the IRS criteria for a payment plan and decide which type of plan suits your situation. 2. Fill out necessary forms: Fill out the appropriate form, such as Form 9465 for an installment agreement or Form 656 for an offer in compromise. 3. Submit the forms: Send the completed forms to the IRS along with any required documentation. 4. Await IRS response: Wait for the IRS to review your application and either approve or reject your proposed payment plan. 5. Make regular payments: If approved, make monthly payments as agreed upon in the payment plan until the balance is paid off.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.